These charts from India’s budget run counter to popular perception

Budget discussions revolve around taxes, prices, policy announcements, and whether the broad direction is towards growth and job creation. There’s usually enough in the budget speech to get a sense of all these. Dig a little deeper into the voluminous documents, and you will bump into numbers that shine light on the little corners of the economy. Here are four such nuggets from Budget 2014.

Budget discussions revolve around taxes, prices, policy announcements, and whether the broad direction is towards growth and job creation. There’s usually enough in the budget speech to get a sense of all these. Dig a little deeper into the voluminous documents, and you will bump into numbers that shine light on the little corners of the economy. Here are four such nuggets from Budget 2014.

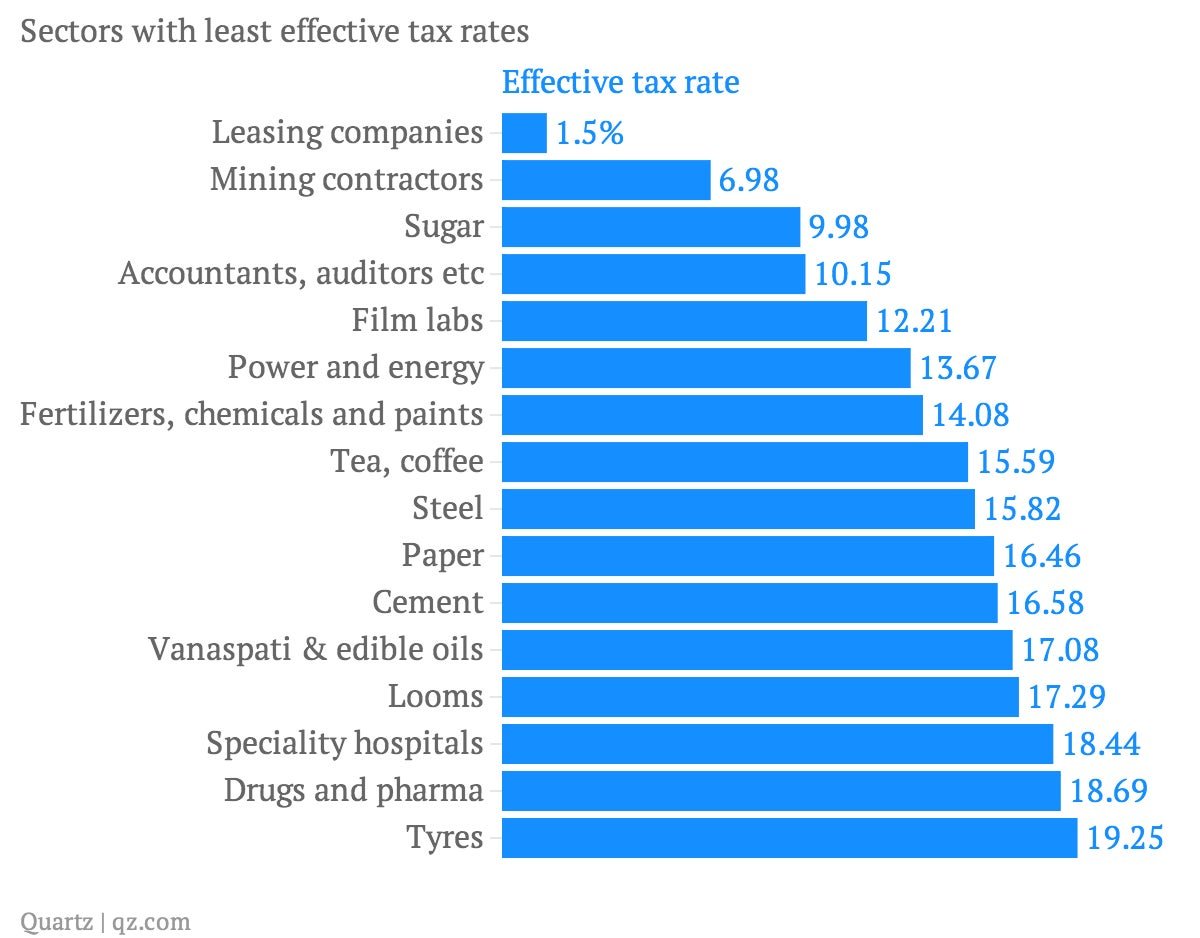

Indian industry gets a huge discount on tax rates

In some things, the Indian tax regime can actually be generous to a fault to companies. The corporate profit tax rate for 2012-13 was 32.5%. But because of a raft of tax breaks available to them, they end up paying much less. Data for 2012-13 from 618,806 companies across sectors shows the effective tax rate for a number of sectors was less than even 20%.

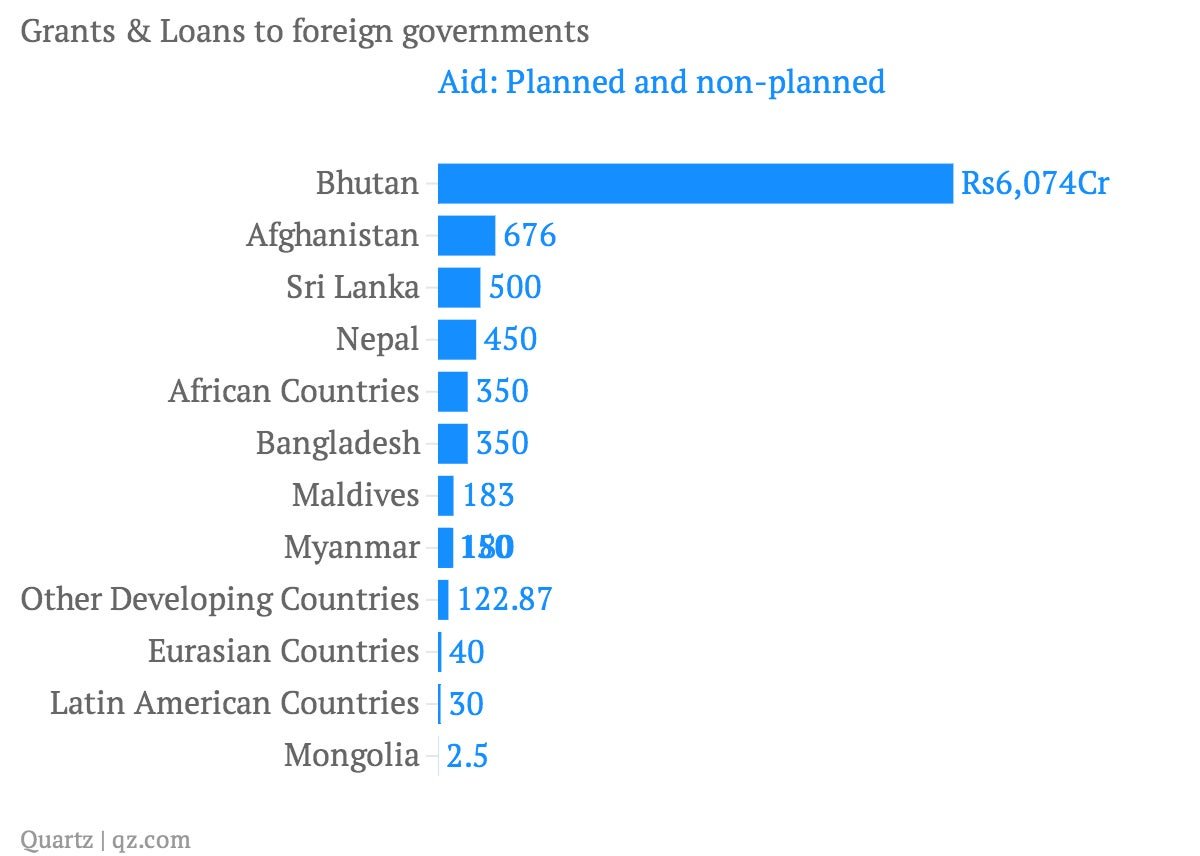

India is a big borrower, but also a lender

India might have borrowed beyond its means, but that does not stop it from lending money, especially to its neighbours, for strategic reasons. In 2014-15, India expects to give grants and loans amounting to Rs9,478 crore to foreign governments. Of this, Rs6,074 crore will go to Bhutan, a country that is of strategic interest to India for sourcing hydel power. It is also geographically located between India and China and acts as a buffer. After he became prime minister, Bhutan was the first country Narendra Modi visited.

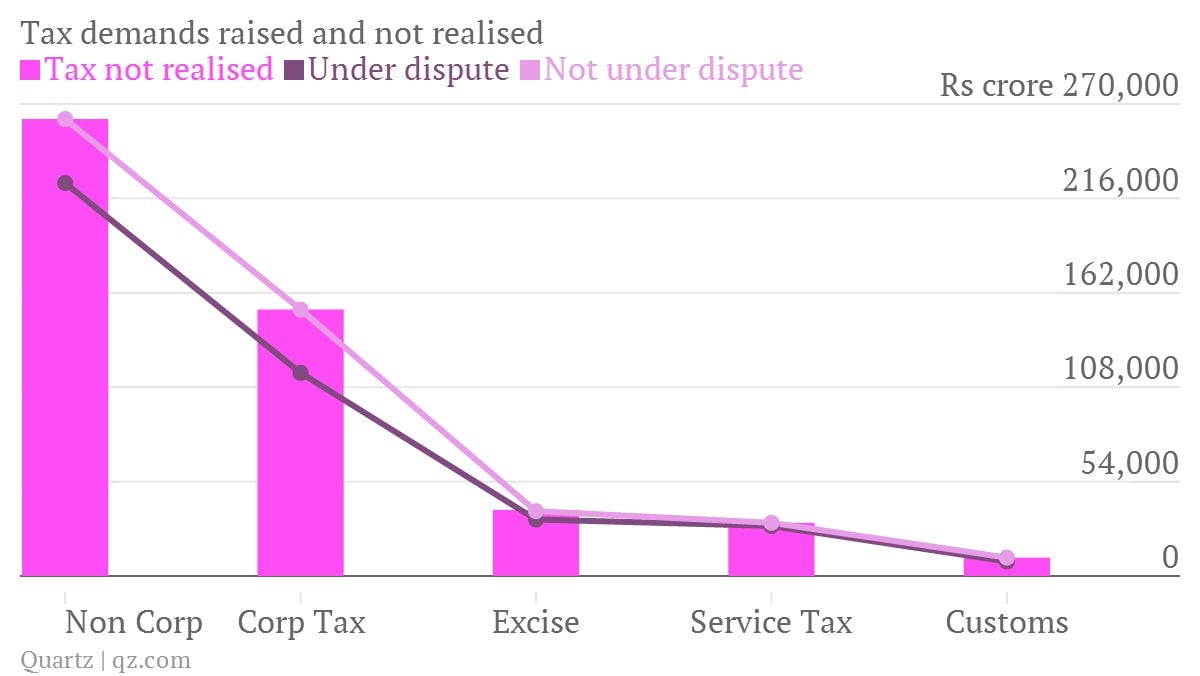

Taxmen are not as aggressive as their reputation suggests

For all the headlines and complaints India’s taxmen get for being aggressive, the government is yet to realise a huge amount of tax. And a good part of it is not even under dispute.

The government is getting bigger

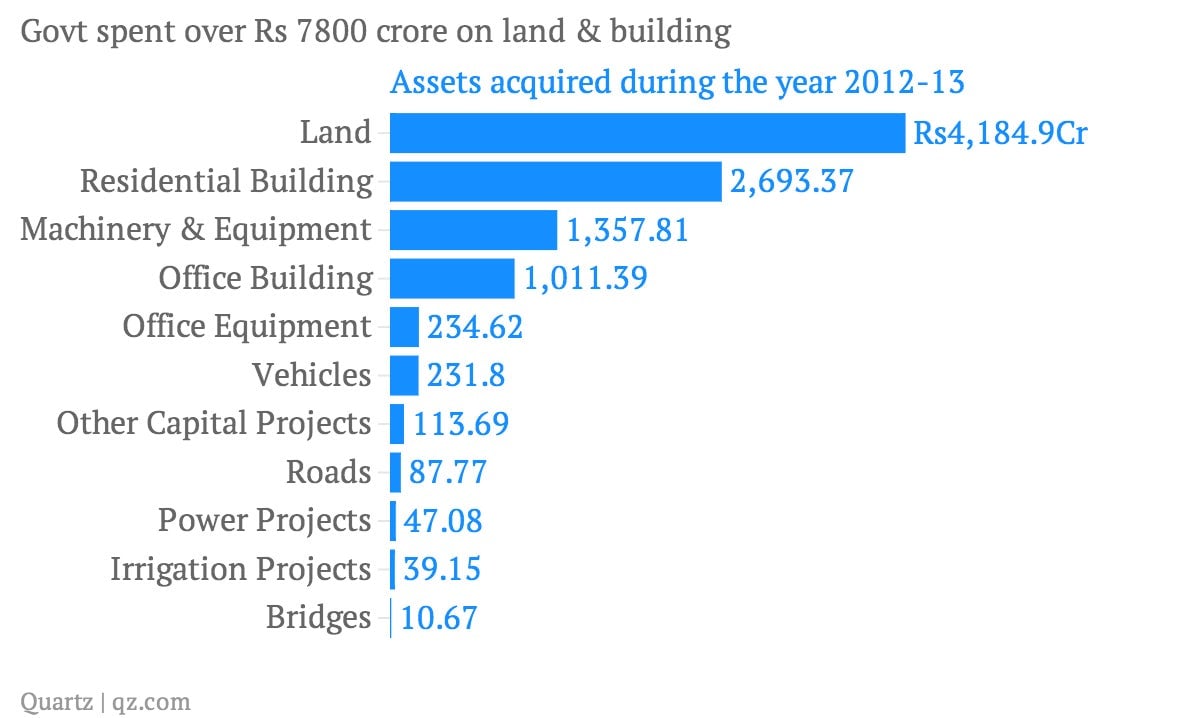

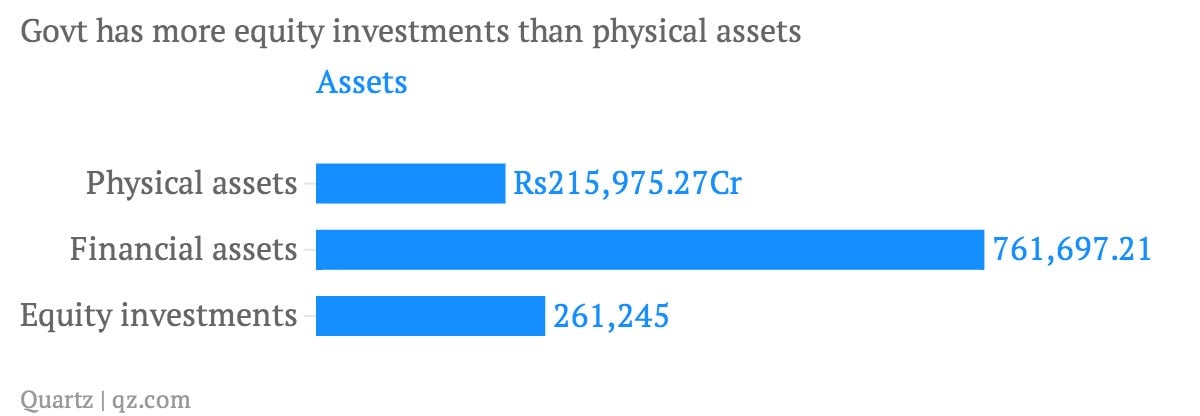

Three-fourths of the Rs215,975 crore of physical assets the government owns is in the form of land, residential or office buildings. And its spending on physical assets in 2012-13 suggests the state would like to maintain that ratio, and become bigger in the process. Minimum government, maximum governance might be the Modi government’s stated principle. But at least as yet, the government is not getting smaller.

Also, interestingly, the government’s assets in the form of equity shares in state-run firms amount to Rs258,259 crore. The government, at some point, could sell some of this to raise additional resources.

You can follow Ramnath on Twitter at @nsramnath.