Another Indian airline company looks poised for an emergency landing

Update: SpiceJet’s operations have effectively come to a standstill on the morning of Dec. 17, reports suggest, because state-run oil marketing firms haven’t resumed the supply of jet fuel to the airline.

Update: SpiceJet’s operations have effectively come to a standstill on the morning of Dec. 17, reports suggest, because state-run oil marketing firms haven’t resumed the supply of jet fuel to the airline.

India’s fiercely competitive aviation industry has almost claimed a second victim in three years.

SpiceJet, India’s third largest airline operator, has flown into rough weather and informed India’s aviation regulator about its inability to continue operations without the government’s financial support.

If the airline goes down, it will be the second big casualty in three years after Kingfisher Airlines—once India’s second biggest airline—went belly up in 2012.

SpiceJet is owned by Chennai-based Sun Group, whose founder Kalanithi Maran and wife Kavery Kalanithi are currently the highest-paid business executives in India, together drawing almost Rs120 crore ($21 million) in salary last fiscal.

The airline needs fresh funding after its liabilities overshot its assets by as much as Rs1400 crore ($210 million), a result of incurring heavy losses over the past three years in an aviation market where fuel costs alone contribute up to 50% of operational costs.

Earlier this month, the airline cancelled as many as 1,861 flights scheduled for December, usually a peak travel season, after having offered tickets at prices as low as Rs2000 ($34) across various flash sales through the year. These flash sales had also forced other low-cost and full-fledged airlines to cut fares.

“SpiceJet has requested for relief. We will discuss within the government in the wider interest of the passengers. No commitment or assurance has been given” Mahesh Sharma, minister of state for civil aviation, said on Monday.

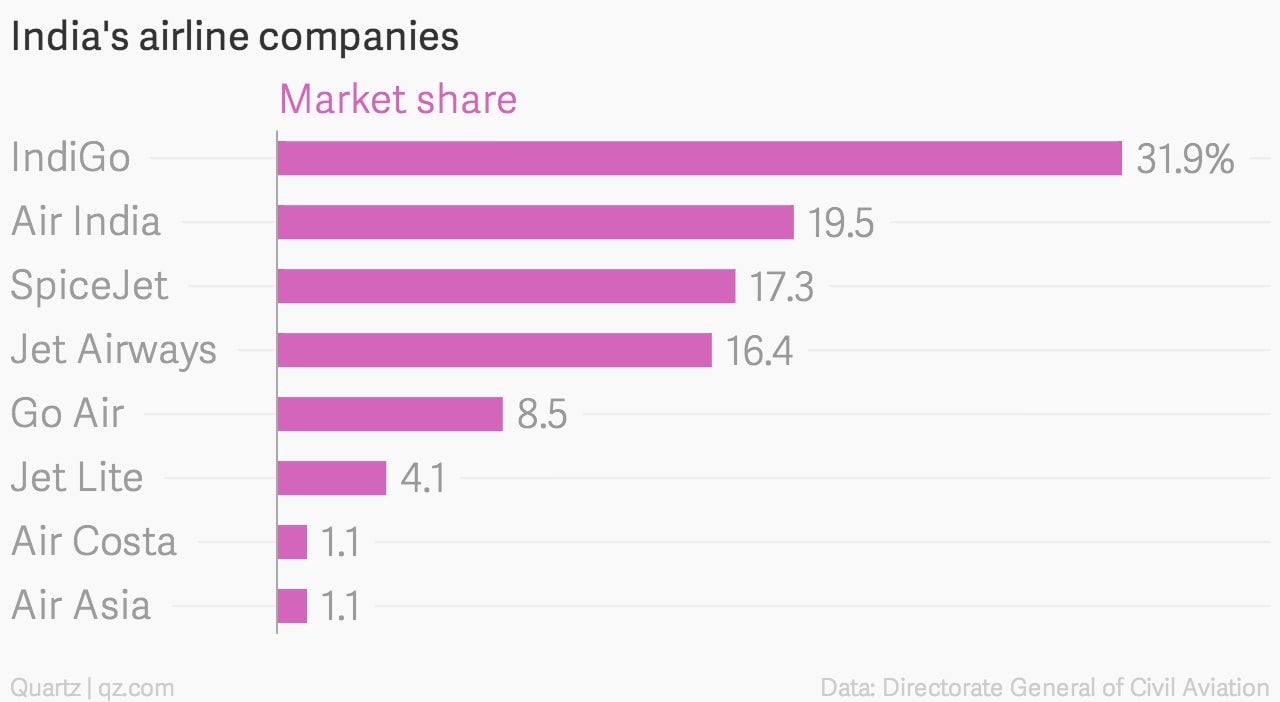

Despite heavy bookings during flash sales, SpiceJet, which captured about 17% market share, could not generate adequate revenues to sustain its operations. Centre for Asia Pacific Aviation has pegged SpiceJet’s immediate capital requirement between Rs1800 crore and Rs2100 crore ($300-$350 million).

SpiceJet’s plight seems similar to Kingfisher airlines, which shut shop in 2012 after accumulating massive debt.

For now, the airline has warned its employees of possible disruption in operations and has also cancelled in-flight meals and scaled down the number of its operational aircrafts from almost 35 in September to 17 on Monday.

In March this year, SpiceJet posted a net loss of Rs1,003 crore ($160 million) compared to a loss of Rs 191 crore ($30 million) a year ago.

India’s domestic aviation industry currently has five operators and is led by Indigo, a low-cost carrier whose promoters are yet to list the company at the bourses. According to estimates, Indigo’s net profit for last year stood at Rs317 crore ($50 million) while another private company, Go Air, posted net profit of Rs50 crore ($7.9 million) last year.

Meanwhile, state-owned Air India and Jet Airways, in which Abu Dhabi-based Etihad holds a 24% stake, registered losses last year.