From Alibaba to Xiaomi, why Modi must chase China’s booming tech companies

Xiaomi, now the fifth largest smartphone vendor in the world, has already sold more than 1 million units in India since it entered the market a year ago. It is such a craze that at its March launch event of its latest Mi 4 phone in New Delhi, it drew a crowd of thousands of young, Indian “fans” eager to be a part of the Xiaomi story.

Xiaomi, now the fifth largest smartphone vendor in the world, has already sold more than 1 million units in India since it entered the market a year ago. It is such a craze that at its March launch event of its latest Mi 4 phone in New Delhi, it drew a crowd of thousands of young, Indian “fans” eager to be a part of the Xiaomi story.

What makes these Chinese companies so special? They are competitive, use unique marketing means, and understand technology. Xiaomi has quickly become the “hipster” alternative to existing competitors in India such as Samsung and Micromax. It has generated a buzz on social media and has been selling phones through flash sales exclusively through Indian e-retailers. Xiaomi has less than 4% of the smartphone market share in India so far, and wants to grab a larger share.

Building on Indian prime minister Narendra Modi’s Make in India push, Xiaomi now plans to set up a local manufacturing unit and service centres by the end of 2015. As a further endorsement of its serious intent in India, the venerable corporate titan Ratan Tata on April 27 announced an undisclosed personal investment into the company.

China’s two largest internet giants, Alibaba Holdings Group, an e-commerce company, and Tencent Holdings, an internet services and entertainment company, have noticed Xiaomi’s India success. They are already big investors in Silicon Valley—and India’s young e-commerce space is alluring for them.

Alibaba, flush from a $25 billion IPO in New York in September last year—the world’s largest—announced it would invest $575 million into One97’s Paytm, an Indian mobile wallet, similar to Alibaba’s own very successful Alipay. It is currently in talks with Micromax, India’s largest smartphone maker, for a 25% stake, amounting to $1.25 billion, in Micromax.

Tencent has been making its own inroads into India’s growing mobile space through its flagship messaging app, We Chat (Weixin in Chinese)—hugely successful in China with 396 million users. While Whatsapp and Facebook messenger are still the dominant mobile messaging apps in India, in just under a year We Chat grew by 2,350%, and now has 27% of India’s mobile messaging market.

What changed from the China of pure copycat companies and technology? Service became the key. China’s first generation of internet companies—Tencent, Alibaba, and Baidu—are playing the game with unique, innovative consumer technologies.

For instance, Alibaba’s Alipay, introduced in 2004, allowed users without credit cards to shop online most Chinese didn’t then have credit cards. Today, Alibaba’s Alipay and Tencent’s Tenpay handle over $200 billion worth of transactions and make up 60% of mobile payment in China.

Alibaba is a leader in biometric identification integration into mobile payment systems and is pioneering a facial recognition software called ‘smile to pay.’ All these services will be a part of the infrastructure that will create the world’s first e-banks—completely online banks where all transactions are conducted virtually—five of which are expected to become operational in 2015, two of which are backed by Tencent and Alibaba.

Alibaba is valued at $253 billion, Tencent at $135 billion and Baidu at $80 billion. They have become crucial players in the Chinese economy, driving the country towards a private capital and consumption-driven economy.

Chinese company DJI is the word’s leading producer of civilian drones, and Xiaomi is competing directly with Apple and Samsung by expanding from smartphones to smart bands, watches and other consumer products as it expands into the Internet of Things space.

What’s next for China’s internet companies? A dive into non-commercial spheres: Public utilities and governance. The big four—Alibaba, Tencent, Baidu and Xiaomi—are quickly, and with the blessings of Beijing, expanding into the public sector, a result of China’s “Internet Plus” initiative announced in March that aims to “integrate mobile internet, cloud computing, big data and the Internet of Things.”

Using public-private partnerships, they will address social issues such as healthcare, pollution, governance, taxes, and education. Tencent and Alibaba have already begun piloting healthcare and public utility services through their mobile apps.

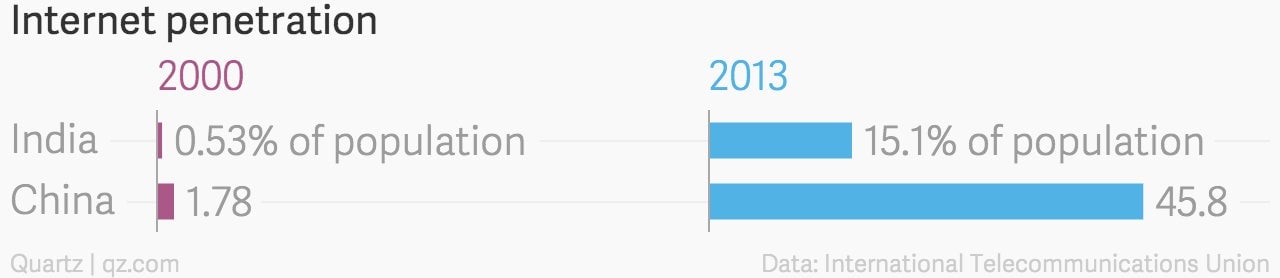

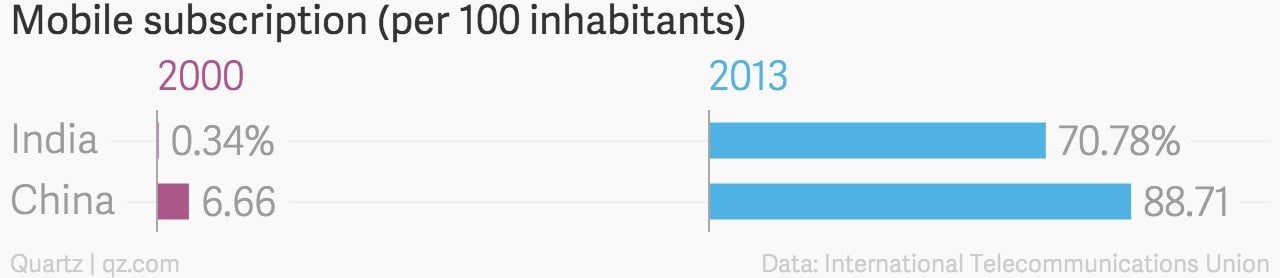

The direction that China’s internet and e-commerce companies are heading dovetails perfectly with the Digital India campaign, which aims to create “digital infrastructure, deliver services digitally and digital literacy.” Considering India and China had similar indicators of internet and mobile phone penetration, and that mobile technology is becoming the bridge in the digital divide, India can look to the Chinese model in order to achieve a similar growth trajectory.

Hopefully, as Modi meets Alibaba’s Jack Ma and Xiaomi’s Lei Jun in Shanghai, he will bring back ideas for upping the ante for Digital India. Modi can encourage Chinese companies to partner with Indian tech companies. He can also learn from the public-private partnerships which use technology to solve public issues.

Sure, Chinese companies don’t have qualified successes as yet. But their technology and experience in experimenting with similar issues can be useful as India tries to progress in the development it so desperately needs.

This post first appeared on Gateway House. We welcome your comments at [email protected].