Even educated Indians think of the Reserve Bank as a mysterious black box

It struck me that the large majority of people, even educated people, do not know very much about what the Reserve Bank does. Many know it prints currency but beyond that, the Reserve Bank is a black box, a mysterious institution, a sort of monolith, doing obscure things that have no real relevance for the everyday lives of people.

It struck me that the large majority of people, even educated people, do not know very much about what the Reserve Bank does. Many know it prints currency but beyond that, the Reserve Bank is a black box, a mysterious institution, a sort of monolith, doing obscure things that have no real relevance for the everyday lives of people.

The reality is, in fact, very different. The Reserve Bank prints and distributes currency, of course, but it does a lot of other things besides. It is the monetary authority of the country, which means its main job is to keep inflation under control while also supporting growth. It is the gatekeeper of the external sector which entails monitoring and regulating capital inflows and outflows, and keeping the exchange rate steady.

It regulates and supervises banks to ensure that the money which people save in banks is safe and is productively deployed towards generating economic activity; similarly, it regulates non-banking financial companies and segments of financial markets, again with the aim of channelling savings into productive investment.

The Reserve Bank’s regulation extends also to the payment and settlement systems with the objective of making financial transactions safe, robust and efficient. The Reserve Bank is the central bank—that is, it is the bank of banks, and the bank for the Central government as well as state governments. On top of all this, and importantly, the Reserve Bank has a key role in the economic development of the country and drives an impressive social development agenda.

That, in a nutshell, is the range and diversity of responsibilities of the Reserve Bank. And what it does affects the everyday lives of people across the country—from the prices they pay in the market, the interest they earn on their bank deposits, the interest they pay when they borrow from a bank, like, say the size of the EMI (equated monthly instalment) they pay on a house loan. It affects how much foreign exchange they can take out to spend or invest outside the country, say, for medical treatment or to educate a child abroad, and how the government pays for new roads, schools and hospitals.

My view was that if the Reserve Bank had to be held to account, we needed to demystify the institution so that the larger public understood what it did and how that connected to their lives.

There was another equally important motivation for my wanting to demystify the Reserve Bank. Not only do people not know what the Reserve Bank does, but they also have negative perceptions of the institution. A widely held stereotypical view of the Reserve Bank is of a rigid, wooden-headed monolith, making rules and regulations with little understanding of the realities of India.

I have personal experience of this negative stereotypical view of the Reserve Bank and how it becomes the scapegoat for virtually all maladies in the financial sector.

My first posting in the IAS after I completed training was as subcollector of Parvathipuram division in Srikakulam district of Andhra Pradesh. Those with long enough memory will recall that the tribal belt of north coastal Andhra Pradesh, particularly the tribal belt of Srikakulam district, was the first region outside of Naxalbari in West Bengal to come under the hold of the Naxalite movement in the late 1960s. By the time I went to Parvathipuram in the mid-1970s, the Naxalite influence in Srikakulam was tapering off; they had moved on into neighbouring Chhattisgarh.

The tribal people had historically suffered ruthless exploitation by the non-tribals—the ‘plains people’, as they were called— which pushed them into debt and even bondage…

One of our tribal welfare tasks, therefore, was to reduce their dependence on moneylenders by designing and implementing income-generating schemes supported by bank credit. It was quite common for me as subcollector to visit banks to canvass loans for these tribal welfare schemes. Banks, however, used to be quite wary of lending to the tribals for fear of default. They would come up with one excuse after another, and when their imagination ran out, they would invoke their brahmastra—they can’t give more loans because of ‘RBI restriction.’

I remember one MLA who, while campaigning for re-election, had gone to the extent of saying that if the government was really interested in tribal welfare, the first thing they should do was to abolish the Reserve Bank!

This is just one example, perhaps an extreme one, of the common misperception about the Reserve Bank. As I moved on in my civil service career, I realized that there was much exaggeration in this negative stereotype. But I was never fully convinced that there was not some justification behind it.

Not until I became governor and got to see the Reserve Bank from within. In the one year that I spent in the bank… all my misperceptions… completely melted away. Not only is the Reserve Bank not closed and negative, but on the contrary, it is a remarkably open- and positive-minded institution. Its staff are caring and sensitive, and they always act in the larger public interest.

So, what explains the negative image? I figured that the reasons are inadequate information and even misinformation. Let me illustrate with an example.

The Reserve Bank, among other things, is also a financial sector regulator with the responsibility of ensuring that financial activity in the economy serves the larger collective good. For example, the Reserve Bank has decided to restrain the growth of deposit taking NBFCs. A narrow evaluation might make this seem like a negative measure depriving the public of an opportunity of a high-risk, high-reward investment option. But if you factor in how millions of poor households are lured by these high rewards, not knowing the risk involved and end up in financial ruin, the wisdom behind this regulation becomes clear. The culprit here is inadequate information about the rationale for this regulatory restriction.

By far the most systemic and sustainable way to demystify the Reserve Bank is through spreading financial literacy. Financial literacy is a large programme with several dimensions and the Reserve Bank is only one of the many players in the space. The Reserve Bank runs a huge financial literacy programme and also encourages banks to do so.

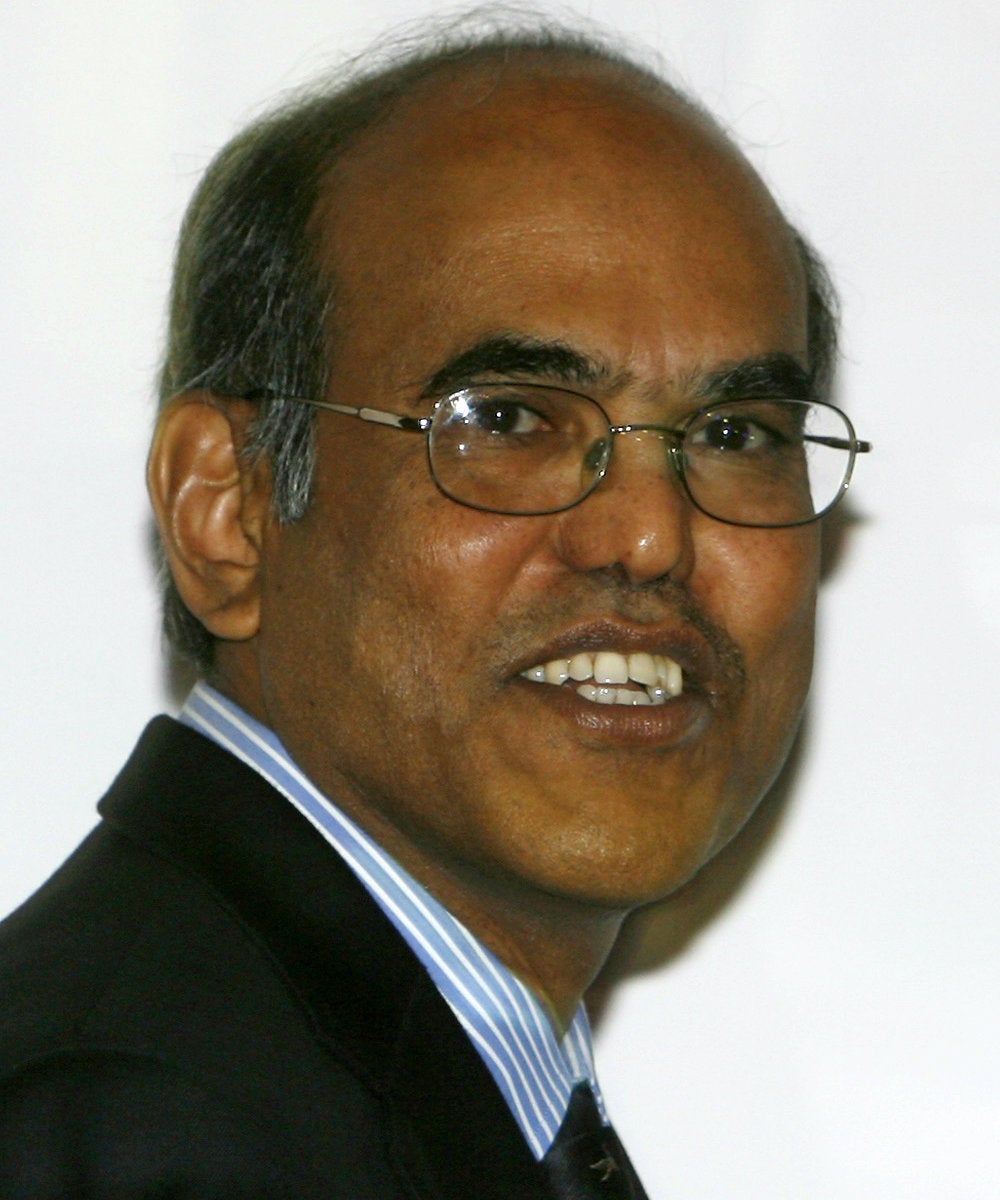

Excerpted from D Subbarao’s book Who Moved My Interest Rates with permission from Penguin India.