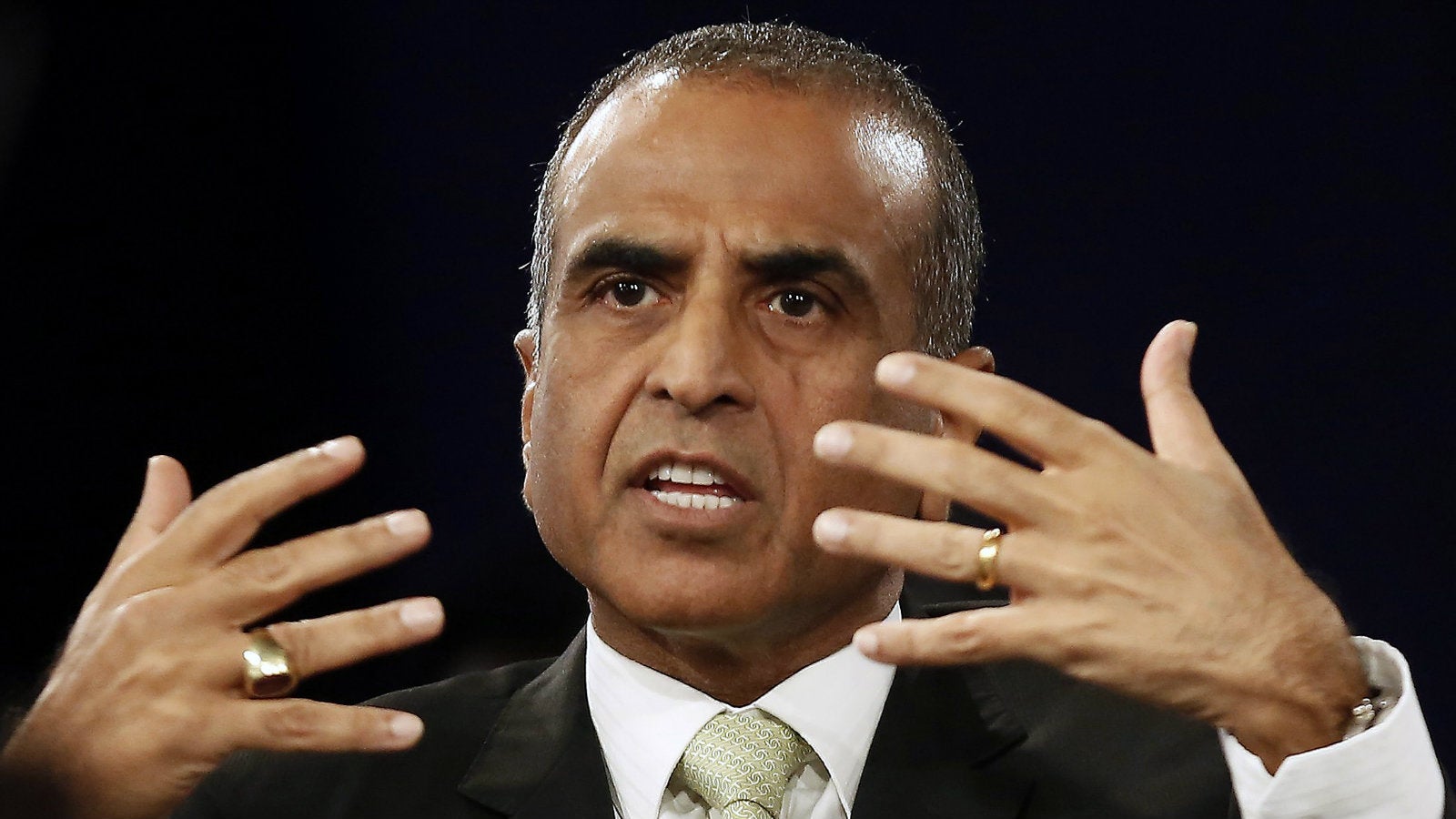

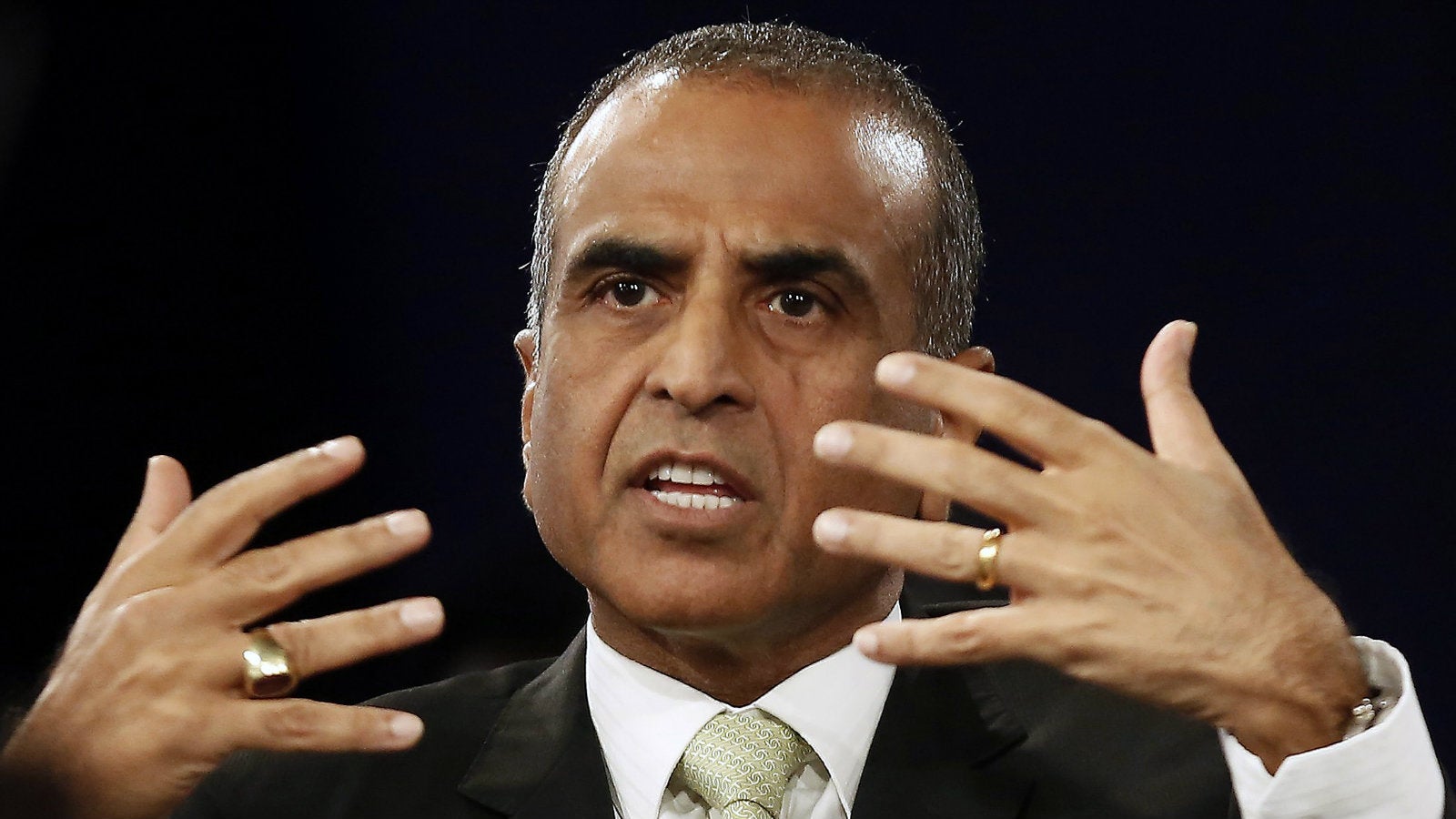

Airtel’s Sunil Bharti Mittal wants you to know he’s unruffled by the launch of Reliance Jio

Sunil Bharti Mittal, the man in charge of India’s largest telecom company, hasn’t had the best month so far.

Sunil Bharti Mittal, the man in charge of India’s largest telecom company, hasn’t had the best month so far.

Early in September, Mittal’s Bharti Airtel was taken by “some form of surprise” when Reliance Jio, a company promoted by India’s richest man, Mukesh Ambani, entered the country’s $50-billion telecom industry.

Jio promised the world’s cheapest data prices and did away with voice call charges, which contribute nearly $20 billion in annual revenues to telecom companies in Asia’s third-largest economy.

If that wasn’t upsetting enough, an ugly public spat broke out between the two companies over points of interconnect that link networks, enabling consumers to make calls unhindered between different operators. Both Jio and Airtel blamed each other for this, alleging ulterior motives.

On Sept. 21, Mittal, who launched Airtel in 1995 and has built a solid subscriber base of over 350 million, spoke to The Economic Times, Business Standard, and the television channel ET Now. This comes weeks after rare interviews with Ambani were published by two newspapers.

Here are the key takeaways from Mittal’s three interviews.

Voice calls aren’t dead, but they are dying

Ambani’s Jio has promised free telephone calls, saying that the era of paying for voice calls is over. While Mittal agrees that times are changing, he believes there’s still a long way to go.

“I see more and more people using WhatsApp, SMS, and Hike and such forms of communication than talking more. In the last 16 quarters, there is less voice growth and in some cases voice de-growth. What Jio has done is accelerated that path now.”

Mittal also believes Jio’s plan to do away with charges for voice calls isn’t really innovation. “Making things free is not innovation,” Mittal told Business Standard (paywall). ”It’s just a strategy to acquire market share quickly.”

Airtel isn’t scared of Jio

While Airtel had been anticipating Jio’s ridiculously low data prices, Mittal says he was taken by some surprise over the goodies that Jio offered. ”More GBs, more SMSes, night usage. And yes, the voice (call) thrown in with that, you can say, has been some form of surprise,” Mittal said.

But he believes Airtel has nothing much to worry about.

“Margins could tighten possibly. At the moment, things are alright. But we are very confident that Airtel’s CMS (customer market share) and RMS (revenue market share) should actually get a little bit of a boost,” Mittal told the Economic Times. ”We are a product of competition. AT&T, Hutchison, Telstra, Telenor, MTS, Etisalat were here and Vodafone is here. Airtel not only stayed on its course but kept on improving.”

It’s not a dirty war

In the past week, there have been many reports of a war between the two business titans, with the two companies publicly squabbling via press releases and statements. The big battle has been over points of interconnect, with Reliance Jio accusing Airtel of deliberately not cooperating to smoothen customers’ transition to the new network. But Mittal says all this is an exaggeration.

“I meet Mukesh all the time. 10-12 days back we had a lovely lunch so it is not that we do not meet… We talk to each other. We visit each other,” Mittal told ET Now. “I have sent messages to Mukesh and his team, let us sit down and resolve this, every passing day and every passing week this will get resolved. Already, a few days back, Airtel tripled the capacity, I heard Voda and Idea are also increasing their capacities, this will keep on happening.”

Big boys only

Mittal believes that the impact of Jio’s entry can only be seen over a period of time. The 58-year old also thinks that smaller operators, who charged half of what the big operators were charging, will soon die. “They don’t have the network nor the spectrum pool to be on the table to play the big game,” Mittal added.

That also means that the big players have to rework their strategies.

“Airtel, Vodafone, Idea, and BSNL will need to look at their strategies—how to make an economic case within the lower tariff scenario.”

Still a risk taker at heart

Jio’s entry has, meanwhile, reinvigorated the risk taker in Mittal.

“Moments like these (the Jio launch) bring back your risk-taking ability,” Mittal told Business Standard. “I am back as a risk-taker. As entrepreneurs, you give it all in the beginning. And, then, you start to manage risks, as there are shareholders. Then you reach a point where you stop taking risks. I had not reached that point, but I had reached a stage where I was managing risks as an entrepreneur.”