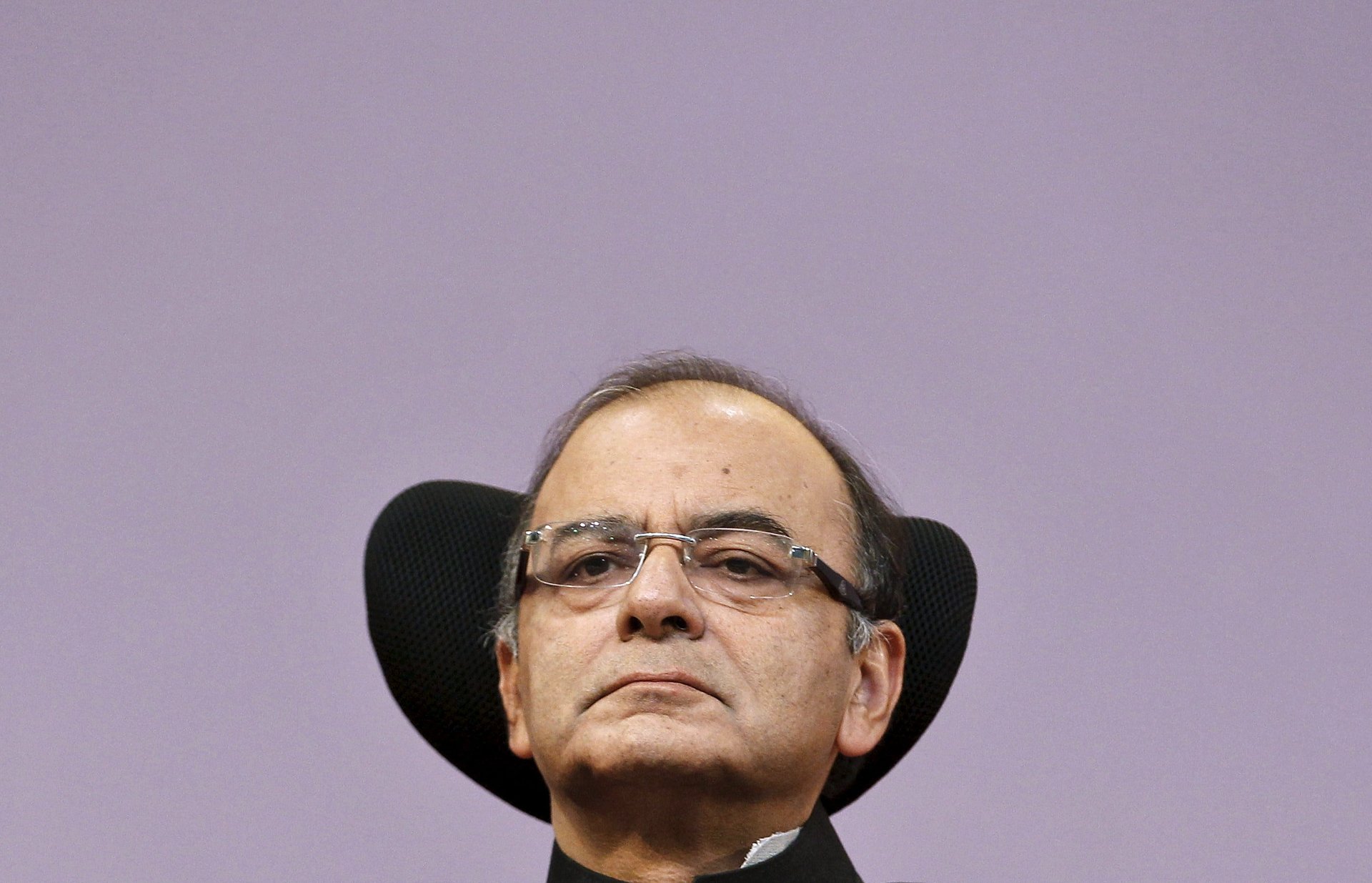

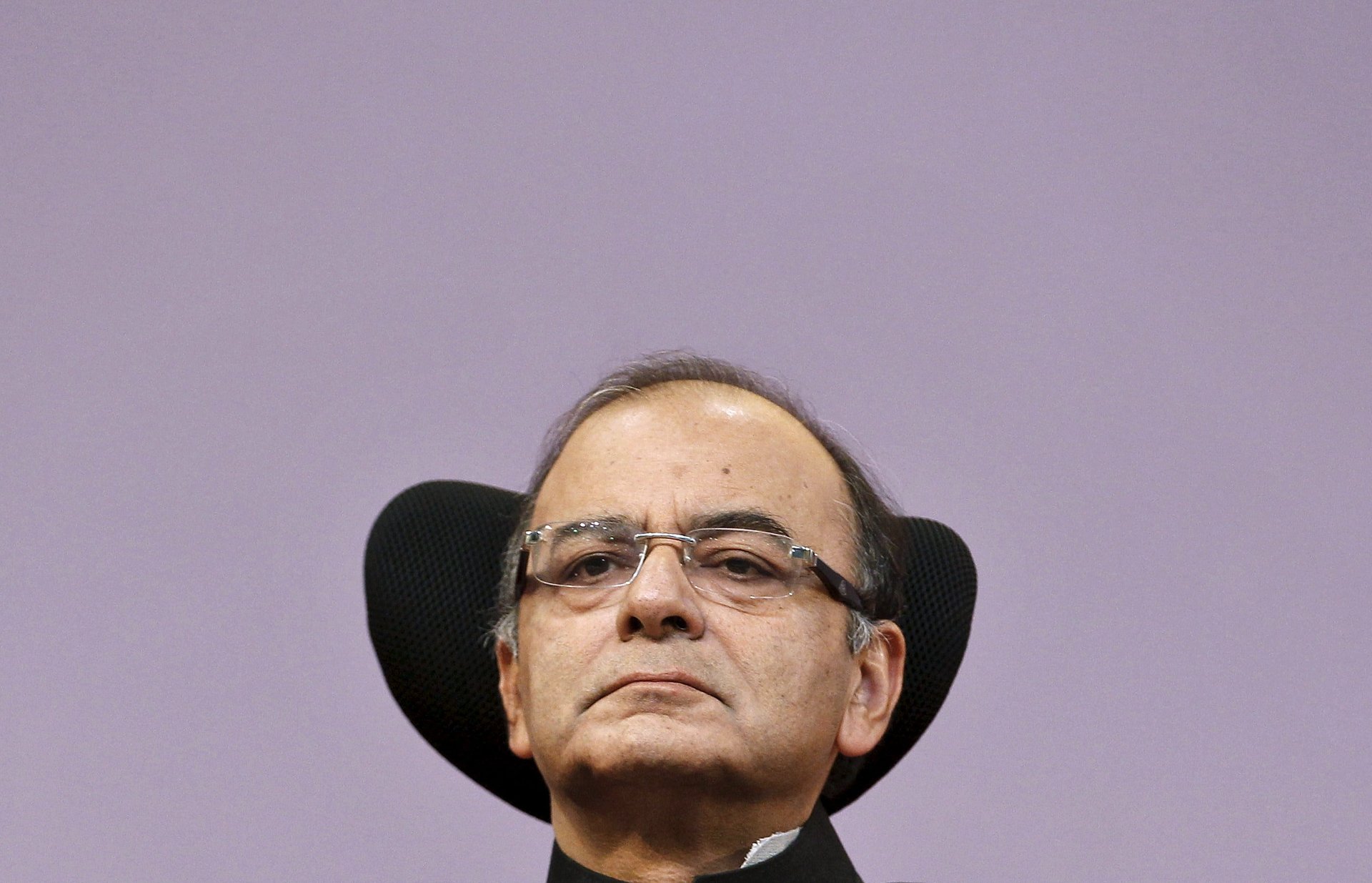

Budget 2017 has brought to fore the astute lawyer-politician in Arun Jaitley

India’s finance minister Arun Jaitley has lived up to his credentials as a lawyer-politician adroitly: he has presented a budget for 2017-18 that pleases everybody but satisfies very few.

India’s finance minister Arun Jaitley has lived up to his credentials as a lawyer-politician adroitly: he has presented a budget for 2017-18 that pleases everybody but satisfies very few.

The capital markets investor class, including the foreign portfolio investor (FPI), is certainly happy. The movement of the stock market index reflected joy at being left alone: at closing time, the 30-share benchmark sensitive index was up 485 points in a relief rally. Investors were pleased that a rumoured restructuring of long-term capital gains tax was avoided. FPIs, who bring liquidity to India’s shallow markets, were spared additional tax blushes under something called the “indirect transfer provision,” which required tax to be paid on transfer of shares overseas if the underlying assets are located in India.

In the end, budget 2017 seems to be more about being seen to be doing the right thing rather than doing it. Jaitley’s thrust can be summed up in his own words: “My overall approach…has been to spend more in rural areas, infrastructure and poverty alleviation and yet maintain the best standards of fiscal prudence. I have also kept in mind the need to continue with economic reforms, promote higher investments and accelerate growth.”

This requires walking a fine line and Jaitley has husbanded all the political smarts he could muster.

Delicately balanced

On one side, the impending state assembly elections (in Uttar Pradesh, Punjab, Goa, Manipur and Uttarakhand) which begin on Saturday (Feb. 04) was bound to cast a long shadow on his plans. On the other side, Jaitley had to present a political budget without breaching the election commission’s restrictions.

Jaitley also needed lots of political nous since the budget had to be drafted in the backdrop of some momentous changes: demonetisation (which has dealt a severe demand and supply shock to the economy), the planned move to goods and services tax (GST), political developments in leading developed countries which could lead to severe economic consequences for India and other emerging economies. In addition, the fiscal responsibility and budget management committee’s report tied his hands by advocating fiscal prudence, barring exceptional situations.

On sum, though, there are a lot of announcements and political grand-standing but little by way of on-the-ground impact. For example, total expenditure planned for 2017-18 is up only 6.57% over the Rs 20,14,407 crore actually spent during 2016-17. That barely covers the rate of inflation. What’s even more disappointing, capital expenditure is budgeted to go up by only 10.7%. The country needs public expenditure to kickstart economic growth, especially in the absence of any private sector investment. Strangely, even though Jaitley has acknowledged this in his budget speech, he has failed to walk the talk.

Revenue could be a legitimate constraint. Tax revenues are expected to grow by only 12.7%, while non-tax revenues are actually budgeted to drop. Total revenue, including capital receipts, is expected to rise only 9.7%. One reason for the conservative estimates could be the expected shift to GST from July. The demand compression arising out of demonetisation could be another reason.

Political imperatives

Despite these limitations, the electoral imperative seems to have forced Jaitley to make numerous announcements for farmers, rural areas and allied sectors. In this, Jaitley has chosen to follow the footsteps of his predecessors by announcing grand schemes and allocating large sums. For example, he announced a Rs10 lakh crore agricultural credit target, against Rs9 lakh crore in 2016-17.

It’s curious that successive finance ministers chose to make this proud proclamation in the budget document when the money will actually be lent by various agri-lending agencies, such as the National Bank for Agriculture and Rural Development. There’s another strange twist: while the government promises to bear the interest subsidy on these concessional loans, the money kept aside for meeting the interest subsidy bill remains unchanged from last year. If the loan volume is likely to go up by Rs1 lakh crore, surely the subsidy element should also rise correspondingly?

Jaitley’s made another strange claim: he maintained that the pace of construction of rural roads under the Pradhan Mantri Gram Sadak Yojana had reached 133 km per day during 2016-17. This fact sits uneasily with roads minister Nitin Gadkari’s admission a couple of months ago that his ministry was unable to meet the highway construction target of 40km every day.

The political framework also probably stayed the finance minister’s hand from slashing corporate tax rates further, as had been promised in last year’s budget. In a year when demonetisation has affected millions of livelihoods and the ruling Bharatiya Janata Party wants to win Uttar Pradesh elections, the optics of helping large corporates could be a recipe for electoral hara-kiri.

He has instead cut tax rates for micro, small, and medium-scale enterprises with annual turnover up to Rs50 crore. His contention: their effective tax rate is higher than large companies and it is these units which actually create employment at the grass-roots level.

Arun Jaitley’s budget for 2017-18 pushes the political messaging of demonetisation further. He has painted a multi-hued picture that appeals to the stock market investor, because a rising stock index is often mistaken for economic health. His brushstrokes also strive to attract voters in various states by not only promising employment and income opportunities but also by painting the government as pro-disenfranchised and anti-privileged.

We welcome your comments at [email protected].