Demonetisation was just the start, now 1.8 million Indians have probing emails from tax officials

First came the pain of demonetisation, now come the emails.

First came the pain of demonetisation, now come the emails.

With demonetisation unexpectedly sucking out 86% of the country’s money in circulation last November, pushing millions of Indians to deposit old bank notes, Indians are now weathering the last waves of its impact. The income tax (I-T) department is sending mails to over 1.8 million taxpayers questioning the source of the money they deposited.

The objective of the exercise, dubbed Operation Clean Money, is to sift through the countrywide deposits, especially of amounts more than Rs2.5 lakh, to determine whether the money was legitimate and has been mentioned in previous tax returns.

“In the first batch, around 18 lakh (1.8 million) persons have been identified in whose case, cash transactions do not appear to be in line with the tax payer’s profile. The department has enabled online verification of these transactions to reduce compliance cost…The information in respect of these cases is being made available in the e-filing window of the PAN holder,” the tax department said in a statement.

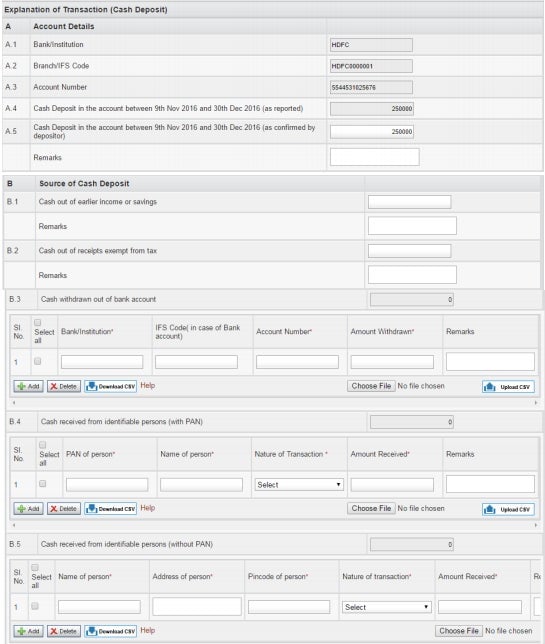

The e-mails contain queries based on the total amount that a tax payer may have deposited between Nov. 09 and Dec. 30 last year, with separate columns provided for explanations. The government wants to know whether the money was from income/savings from previous years, from the current year’s income, or part of petty cash that companies and individuals typically save to meet direct expenses.

The allotted explanations, however, do not specify the remedy for money that may have been withdrawn over the years and kept at home to meet unforeseen expenses. “We have provided adequate room for explanations. In cases where a tax payer may have periodically withdrawn earlier, we will have to verify by matching such amounts with the person’s previous year tax returns. We will match and analyse the deposits according to the profile of the tax payer,” said Meenakshi Goswami, commissioner of income tax (media and technical policy) and the official spokesperson for the Central Board of Direct Taxes.

Over 527,000 taxpayers, out of the 1.8 million targeted, have already acknowledged that they’ve made deposits during the period under review. The value of these deposits though has not been disclosed. Voluntary disclosures have also featured prominently. “People have provided information voluntarily on their own to about 25,000 additional accounts, which were not mentioned in the mails,” said Goswami.

But some taxpayers are having a hard time making their case clear.

“I received such a mail in the first week of February,” said Arun Chokhani, a former senior finance executive with the MP Birla group who lives in Mumbai. “I had withdrawn money to meet emergency medical expenses. Since only a part of that was used, I had to deposit the remaining in my bank account. But as my reason could not fit into the slotted explanations, I faced difficulty in providing an explanation.”

Demonetisation, among other stated objectives, was aimed at curbing black money or unaccounted money that had apparently built a parallel economy in India over the years, encouraging corruption and chipping away at government’s revenues through loss of income.

Indians, like most of their Asian brethren, save for the rainy day, which typically includes housewives diverting part of household expenses for use in future. Over the years sometimes, this practice leads to a large accumulation of money, mostly without the knowledge of other family members. Such savings were forced out into the open after the Rs500 and Rs1,000 notes were invalidated, pushing people to park this money in bank accounts.

But demonetisation also triggered massive opposition from political parties who even stalled Parliament, with senior Congress leaders alleging that this initiative had raised the possibility of harassment by tax authorities. “There is a worry that such a move may result in witch-hunting,” said the head of a large tax firm, requesting anonymity. “It gives increased discretionary powers to tax assessing officers. The penalties for unexplained deposits are huge, almost double the original amount,” he added.

The pattern of deposits following demonetisation may also have led the authorities to take a hard stance. “The government’s limit of Rs 2.5 lakh as the ceiling for deposits was cleverly used. For deposits of about Rs 10 lakh or more, people roped in family members; in a family of four, say, each member deposited Rs 2.5 lakh each in their accounts. The tax department is likely to initiate scrutiny of all such deposits,” said Devang Shah, founder of chartered accountant firm DK Shah & Associates. “The department may also change its mode of investigation based on the responses that have come in the first stage.”

Eventually, the exercise help prop up finance minister Arun Jaitley’s plan to increase tax revenue, by bringing in more people into the tax next. Latest government statistics from the union budget show that net tax revenue for the year ended March 2016 rose 17%, while there has been a 38% increase in the number of people filing personal income tax.

But given that only about 1% of Indian’s 1.25 billion pay income tax, there’s a whole lot of evaders to catch.

We welcome your comments at [email protected].