Rising affluence and urbanisation will turn India into a whole new world of possibilities by 2025

The elite and affluent households are emerging as major drivers of consumption in the world’s fastest-growing major economy.

The elite and affluent households are emerging as major drivers of consumption in the world’s fastest-growing major economy.

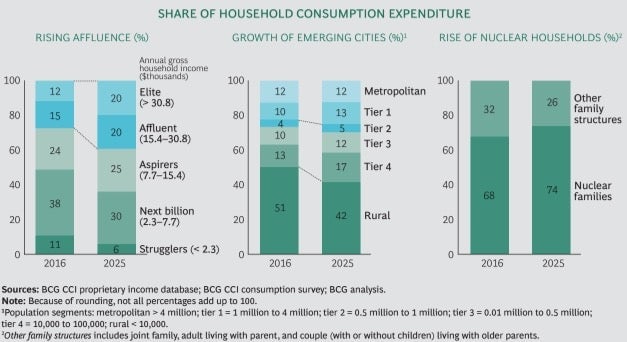

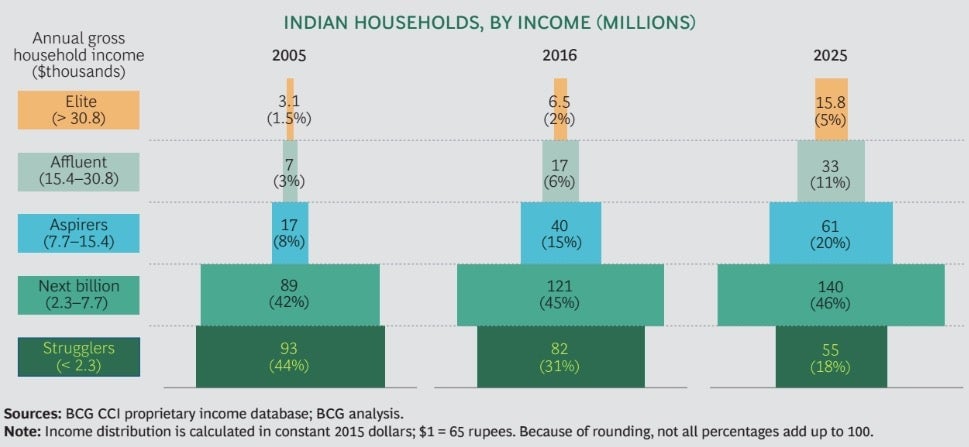

In 2016, the household segment termed “aspirers,” with average annual gross incomes of between $7,700 (Rs5,04,234) and $15,400(Rs10,08,469), and the “next billion” (between $2,300 and $7,700), together constituted a massive 62% of the consumption expenditure in India, according to a report by the Boston Consulting Group (BCG).

However, by 2025, these two segments will decline to 55%. The “elite” (earning over $30,800 or Rs20,16,938) and the “affluent” (between $15,400 and $30,800) will see their share rise to 40%, a 13-percentage-point increase from 2016, the BCG report suggests.

Titled “The New Indian: The Many Facets of a Changing Consumer,” the report says that for the first time, the wealthy will represent India’s largest consumption segment.

Rapid economic growth will result in more households moving up the income ladder: “elite” and “affluent” ones, which together form just 8% of the pie today, will double their share by 2025, the report says.

This demographic shift will be fuelled by socio-cultural changes, reshaping consumption patterns significantly, Abheek Singhi, a co-author of the report said. These changes include increased participation of women in the workforce, the emergence of nuclear families, and more connectivity across households through digital devices.

But that’s not all.

The cities

Economic growth is likely to benefit smaller markets too. Households in emerging cities, with populations of less than a million, will have the fastest growing consumption expenditure by 2025 across India, the report says. They will account for a third of all consumer spends, thanks to rising affluence as well as populations.

Currently, over 50% of Indians live in villages. But a shift is underway as more rural households, buoyed by job prospects, continue to migrate.

Over the next several years, newer pockets of consumption will open up, driven by investment in local infrastructure and industrial projects in tier-2 and -3 cities, BCG foresees. These will continue to house both middle-income as well as affluent households.

BCG has identified over 300 such cities, including Guntur in the southern state of Andhra Pradesh, Jalandhar in Punjab, Karnal in the northern state of Haryana, Meerut in Uttar Pradesh, and Warangal in Telangana, as the next growth centres. “These are cities that connect to rich rural pockets; are connected via highways and, with local state investments, can become prospectively big markets,” Nimisha Jain, a co-author of the report, said.

Consumption expenditures in these emerging cities are already increasing at a faster clip than those in the bigger ones, the report added. By 2025, BCG estimates that some 120 such Indian cities will match today’s major metropolitans in average household income.

All this will make the country the third-largest consumer economy in the world by 2025; it is currently the sixth-largest. The size of India’s consumer market itself will reach $4 trillion by 2025. That’s three times its current size.