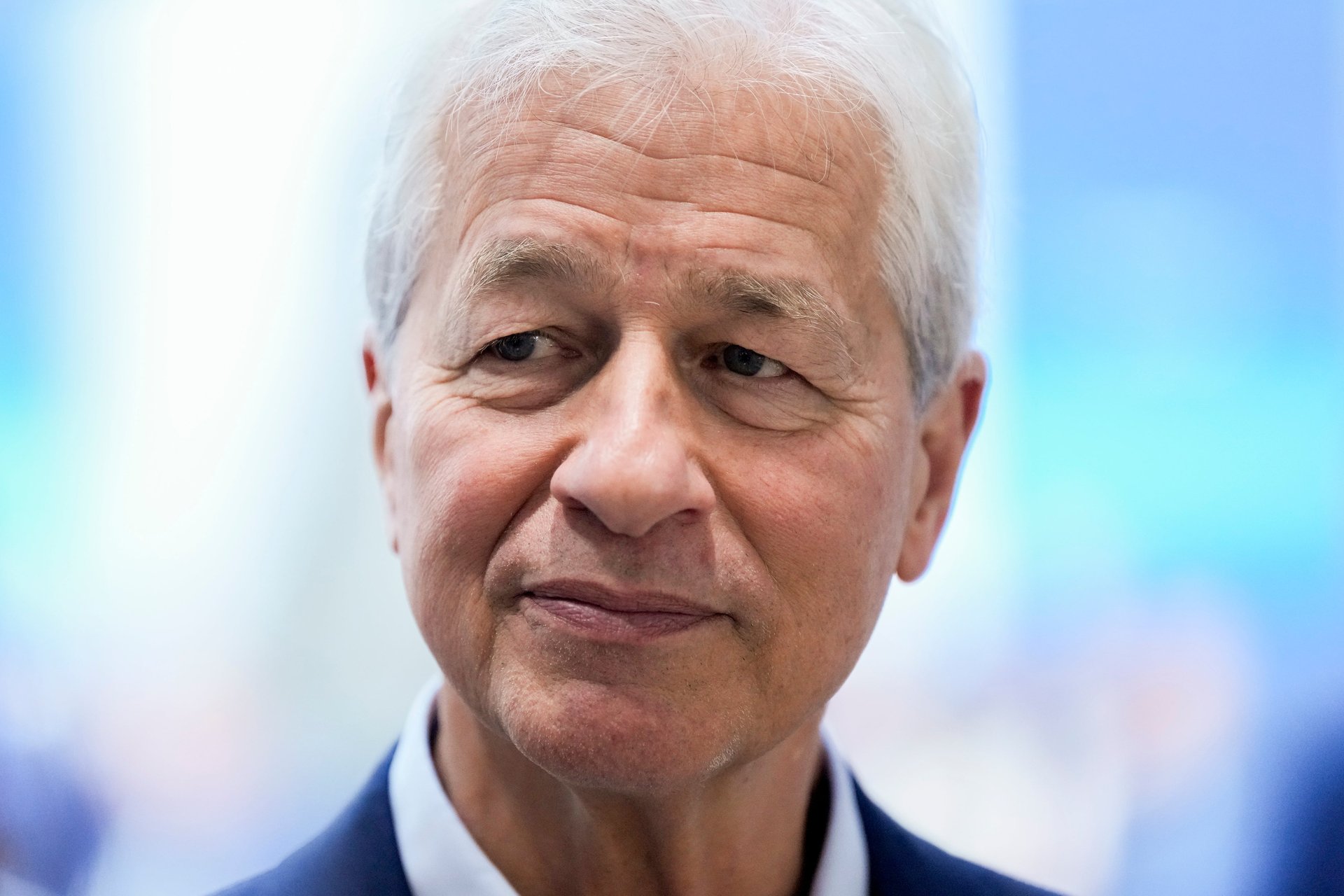

Jamie Dimon says Bitcoin has 'no intrinsic value'

The JPMorgan Chase CEO says people have a right to buy and sell Bitcoin — but that they still shouldn't do it

JPMorgan Chase (JPM) chief Jamie Dimon doesn’t think people should smoke — or buy Bitcoin.

Suggested Reading

“Bitcoin itself has no intrinsic value,” Dimon said in an interview with CBS News (PARA) Sunday. “It’s used heavily by sex traffickers, by money launderers, ransomware. So I just don’t feel great about Bitcoin.”

Related Content

Bitcoin’s price has more than doubled in the past year, fueled by the Federal Reserve’s interest rate cuts and hopes of a more supportive regulatory environment under the incoming Trump administration. As of Monday, Bitcoin fell back below $92,000, after surging to more than $100,000 in December.

The use of Bitcoin and other cryptocurrencies for illegal activities like money laundering has come under scrutiny as digital assets grow in popularity. A report by ChainAnalysis published last July found that bad actors are turning to cryptocurrencies to carry out crimes because they are “cross-border, virtually instant, and generally inexpensive to transact.” These transactions are also more difficult to track.

This isn’t the first time Dimon has bashed Bitcoin. Dimon called the leading cryptocurrency a “fraud” and “Ponzi scheme,” in an interview with Bloomberg last April. During his latest interview, the CEO of America’s largest bank likened it to smoking.

“I applaud your ability to want to buy or sell it, just like I think you have the right to smoke,” Dimon said. “But I don’t think you should smoke.”

These comments come as Donald Trump’s incoming administration is expected to take steps to further legitimize digital assets. On the campaign trail, Trump positioned himself as the “crypto candidate,” accepting campaign donations in a range of cryptocurrencies, including Bitcoin, Ether, Dogecoin, and Solana.

At the Bitcoin conference in July, then-candidate Trump vowed to set up a national Bitcoin reserve, reaffirming his stance that the U.S. must emerge as a crypto capital and superpower in the world or face competition from other economic powers, like China.

“He’s clearly an extraordinary talent. I mean look at Tesla (TSLA) and SpaceX,” Dimon said, referring to Musk, who has positioned himself as Trump’s right-hand man. “My attitude is: We should make government more efficient. Is this the way to do it? I don’t know. Do I want them to succeed? Absolutely.”

Musk, however, has already began to temper expectations about just how many cuts the so-called Department of Government Efficiency (DOGE) will be able to carry out.

While campaigning for Trump in October, Musk claimed he could slash “at least $2 trillion” in government spending. The SpaceX CEO told former Microsoft (MSFT) executive and political strategist Mark Penn last week that $2 trillion in reductions would be “best-case outcome,” although he expects that figure to be about half.