The tariff truce is teetering as Trump and China trade fresh threats

Weeks after a trade war ceasefire, U.S.-China negotiations are once again frozen, and both Trump and Beijing are threatening retaliation

The fragile U.S.-China tariff truce is showing signs of unraveling.

China’s Ministry of Commerce issued sharp warnings over the weekend and into Monday, accusing the U.S. of “undermining China’s interests” and vowing to “take forceful measures to safeguard its legitimate rights.”

The statement, posted by official channels and widely republished across financial news outlets, followed President Donald Trump’s accusation that China violated the truce achieved in trade talks early last month, when both sides slashed tariffs in a surprise May reset.

Beijing’s comments mark a dramatic shift in tone

“China has taken seriously, strictly implemented and actively upheld the consensus reached at the talks with the U.S. in Geneva,” the ministry said in a second statement, expressing frustration over what it views as aggressive moves and comments from Washington.

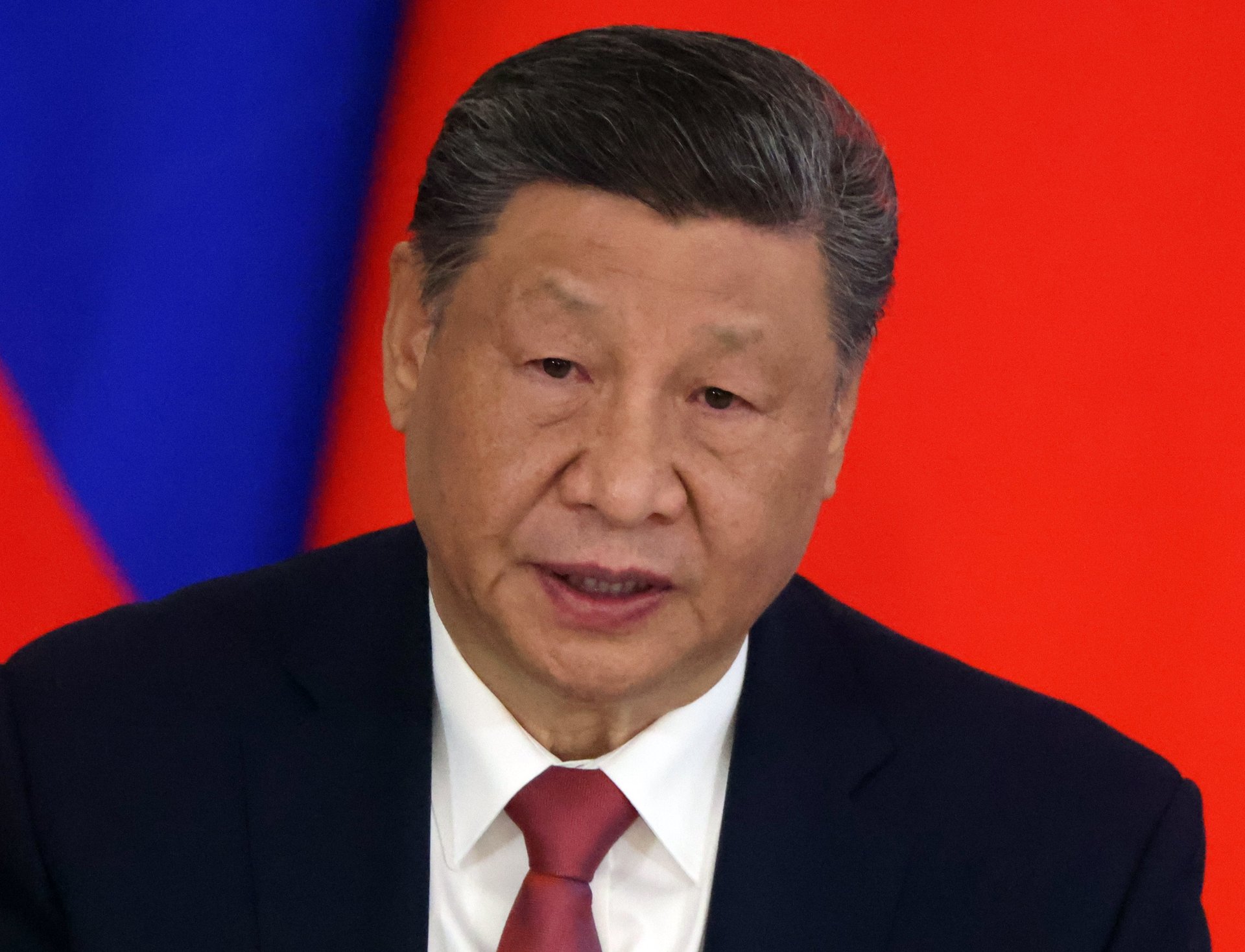

Last week, Treasury Secretary Scott Bessent said the negotiations were “a bit stalled” and suggested that further progress would require direct talks between President Trump and China’s Xi Jinping.

Meanwhile, legal uncertainty continues to count. A U.S. federal court last week ruled that portions of Trump’s original tariff agenda may have been unlawfully enacted, but then a temporary stay from an appeals court preserved them, pending review of each side’s arguments.

The White House has until June 9 to defend its position and has floated fallback measures under the Trade Act of 1974, including emergency tariffs of up to 15%.

For business leaders, the turn of events is fueling déjà vu — and dread

According to the Conference Board, 83% of U.S. CEOs now expect a recession in the next 12 to 18 months. It’s no wonder: Business leaders are having to navigate without clarity from policymakers, confidence that the current truce will remain in effect, or any sense of where matters stand from hour to hour, much less from week to week.

As of Monday morning, stocks appear to be reflecting that same loss of confidence. Nasdaq futures slumped down by 0.5% and the S&P 500 fell 0.4%, while the VIX (a key measure of volatility and fear) jumped nearly 6%. Gold shot up almost 2%.

In other words, the tariff ceasefire may be intact for now, but trust in its durability is rapidly eroding.