New car sticker stock is coming: 5 ways auto analysts say the industry will hike prices

Automakers have kept prices relatively flat despite tariffs and other increased costs. That could be changing soon

Bloomberg

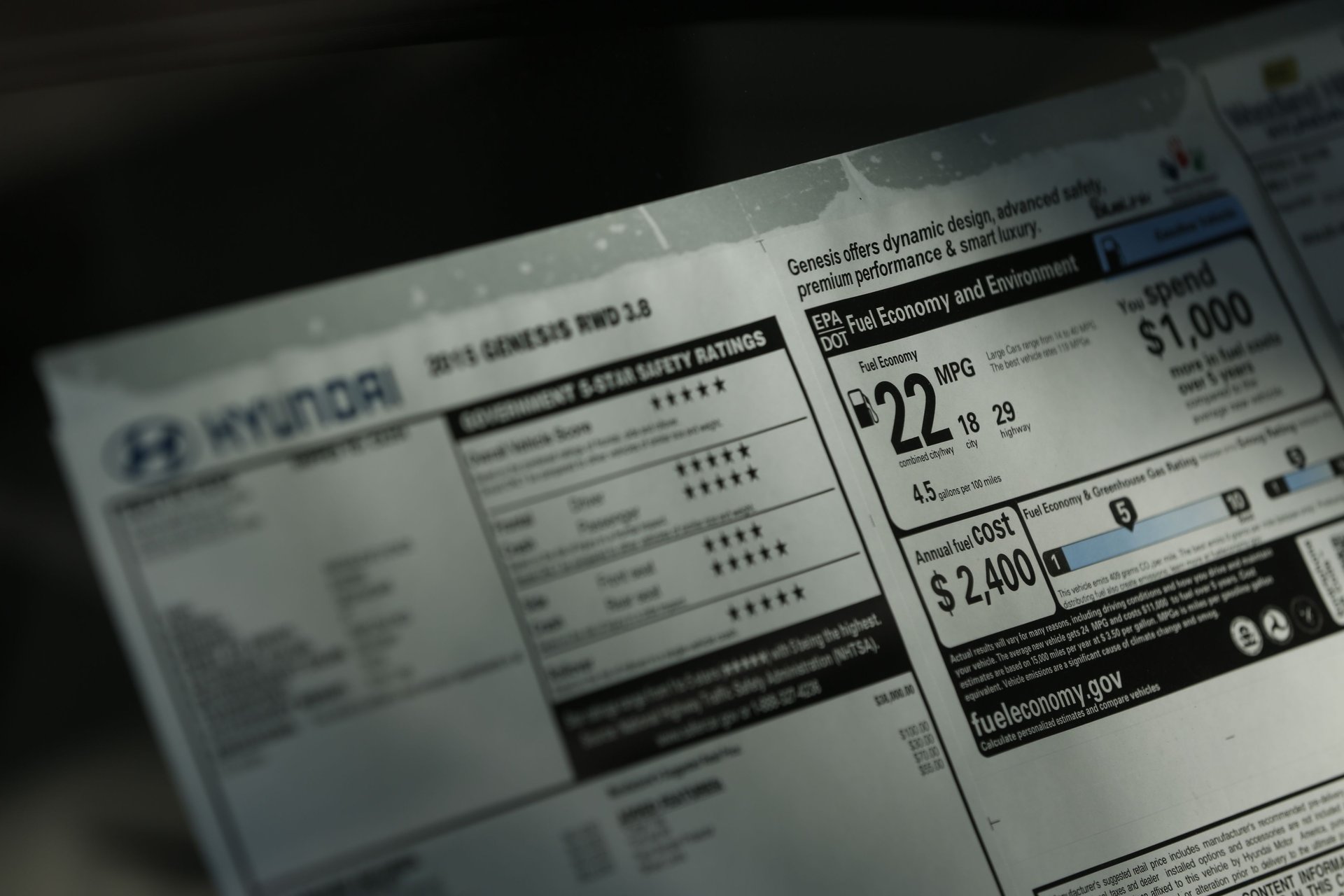

New car prices have held about steady since 2023, with the August 2025 average of $49,077 about the same as it was two years prior. Even the introduction of tariffs hasn't had much of an impact on sticker prices yet.

But as those levies are seemingly staying put for a while, analysts are warning that steep increases could be looming down the road.

Automakers would prefer to avoid that. Price point is the most important factor when it comes to selling a car. "Even though it's the last thing an automaker determines, it is the most crucial," says Ivan Drury, an analyst with Edmunds.

Prices are already near record levels, and consumers are holding onto cars longer than ever. But as tariff charges pile up, automakers are exploring ways to recoup those costs without significantly increasing the sticker price, which risks scaring away buyers.

It's a challenge the auto industry hasn't had to navigate before – and many aren't sure how to do so successfully.

"I think the tariffs are one of the more interesting questions today," says Karl Brauer, lead analyst at iSeeCars. "What will automakers do to shield their customer while still maintaining profile levels?"

Ultimately, it could come down to a handful of methods, analysts say.

Destination charges

While manufacturers and dealers build wiggle room into their MSRP, there is generally no negotiating the destination fees of a new vehicle. These are essentially the delivery fees the manufacturer pays to deliver the vehicle to the dealer. And the average price of these has jumped considerably this year.

For the past five years, the annual increase of destination charges fluctuated between 3.5% and 5.8%. In 20205, however, the price has jumped 8.5% to an average of $1,507, according to Edmunds. Compare that to a 2015 level of $952.

And if you're buying a luxury vehicle, be prepared to pay a lot more.

"We are seeing some automaker charge more for destination fees as way to cushion the blow on tariffs," says Matt Degen, senior editor with Kelly Blue Book.

Pushing the higher end

On virtually every vehicle model, there are a variety of option packages available. If a car starts at, say, $24,000, that's a base level price that very few consumers pay. Adding trim options like a moonroof or upgraded car stereo raises the cost. The higher the trim level, the greater the profits for the automaker (and the dealer) and these days, there are a lot more of those higher trim level vehicles on lots than there are base versions.

"There used to be seven trim levels and front or all-wheel drive [options]," says Brauer. "Now there are just three, all of which are upper level trim levels, and standard all-wheel drive."

Drury points out the increase in higher trim level inventory isn't just tied to tariffs. People have been opting for more high-end add-ons for years. However, he says, "some things that used to be standard are now optional. People are buying the same trim level, but don't get all the same niceties. … No matter what you're buying now, it's a luxury item."

Making money from repairs

Dealers make more from repairs than they do from the sale of new vehicles. Now, the cost of parts is rising quickly thanks to tariffs.

The Consumer Price Index shows the price of car repairs jumped 5% from July to August, the largest one-month increase on record. Compared to a year ago, repair costs are up 15%.

Consumers might be highly aware of the cost of whole vehicles, but when it comes to car parts, few people pay attention to those numbers, which opens a window for manufacturers to up the prices and spread out the cost of tariffs.

"There is no such thing as an all-American car," says Degen. "And you have to factor in the different tariffs that are making different parts more expensive. If, for example, something is made in Vietnam, it's going to face higher charges than something made in Japan."

Reducing incentives

To attract buyers, manufacturers offer a series of incentives for new cars.

One of the most frequent is zero percent financing for a set period. Drury says he's seeing a number of dealerships bump that number up to 3.9% for the same time period. That increases the consumer's financial outlay, while the car itself technically stays the same price.

Regulating supply

Few consumers want to wait an extended period for their car. And some brands have a deeper inventory of vehicles available than others. The laws of supply and demand could work to the advantage of automakers in the months ahead, says Degan.

Lexus or Toyota, for instance, have an average 40-day supply of their vehicles. Jeep, on the other hand, has a 117-day supply.

"What that means at the end of the day is if you're shopping for a Lexus or a Toyota, you're not going to expect to get a deal," says Degan. "If you're negotiating for a Jeep, there's going to be a more wiggle room."

By keeping the number of available vehicles at just the right level, dealers and manufacturers can increase their income for each car or truck sold — another tool for battling the rising costs of tariffs.