Nvidia stock plunges 7% as a U.S. ban on China AI exports means a $5.5 billion hit

Some of Big Tech's crown jewels are collateral damage in the trade war, with markets caught in the crossfire

The U.S.-China tech war just claimed another high-profile casualty.

Suggested Reading

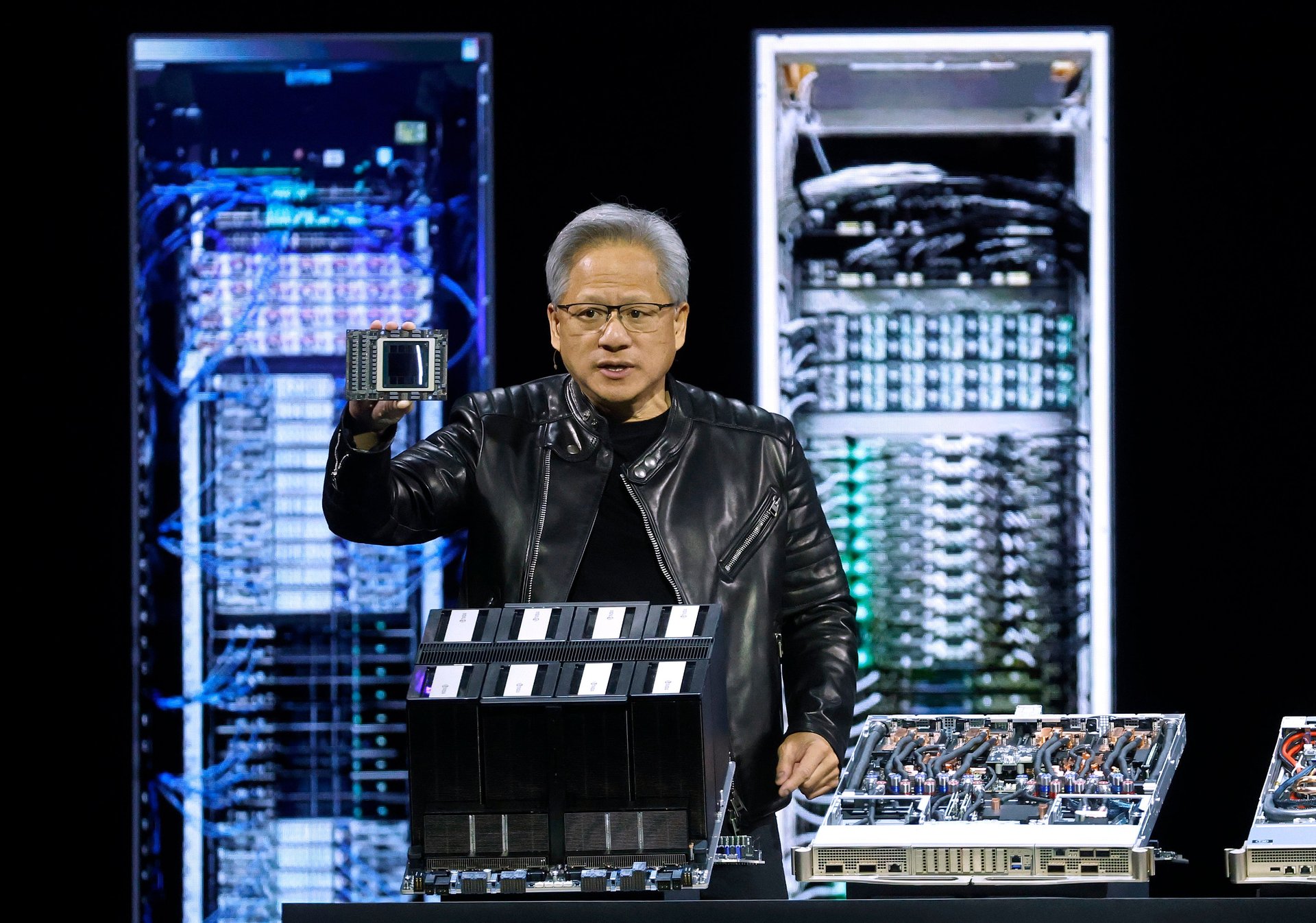

Nvidia (NVDA), America’s third-largest company by market cap, said Wednesday it will take a $5.5 billion charge after the U.S. government moved to block exports of its H20 AI chips to China — citing national security risks tied to their potential use.

The H20 had been engineered to comply with earlier Biden-era restrictions and had become a key product for Nvidia in China, one that was quickly gaining traction. But the sudden reversal by the Trump administration, after months of policy limbo and back-channel talks, signals another hard turn in trade policy — and lays bare the high-stakes game playing out among Silicon Valley, Washington, and Beijing.

Let’s rewind: On April 9, Nvidia CEO Jensen Huang attended a $1-million-a-plate Mar-a-Lago dinner with President Trump, where AI exports were reportedly a topic of conversation. Proceeds from the dinner went to MAGA Inc., a Trump-aligned super PAC that can raise unlimited funds but isn’t allowed to coordinate directly with the campaign. Five days later, on April 14, the U.S. informed Nvidia it would need a license to export H20 chips abroad. On April 16, Nvidia announced the multibillion-dollar charge — and markets flinched.

Meanwhile, ASML (ASML), the Dutch semiconductor equipment powerhouse, reported first-quarter sales of €7.7 billion — slightly below forecasts — and flagged “greater uncertainty” due to trade tensions. ASML makes the machines essential for cutting-edge chip production, giving it enormous influence over global chip supply. The company warned that new tariffs and tech restrictions could weigh on its outlook for 2025 and 2026.

Investors didn’t like what they saw.

Nvidia stock slid 6% at the market open Wednesday and retreated further in the afternoon before closing down about 7%, with AMD (AMD) and other chipmakers falling in tandem. The broader Nasdaq dropped over 3%, as Wall Street reassessed what a prolonged, escalating tech standoff could mean for supply chains, AI development, and the semiconductor industry.

In a Wednesday note, Jefferies (JEF) analysts said the H20 ban was expected — but the size of Nvidia’s write-down was not. It signals outsized demand from Chinese buyers, who had reportedly placed $16 billion in H20 orders this year. Still, Jefferies says China has likely stockpiled enough GPUs for ongoing AI training and will increasingly lean on local chips for inferencing tasks.

Markets may have priced in some pain, but they haven’t seen the last punch.