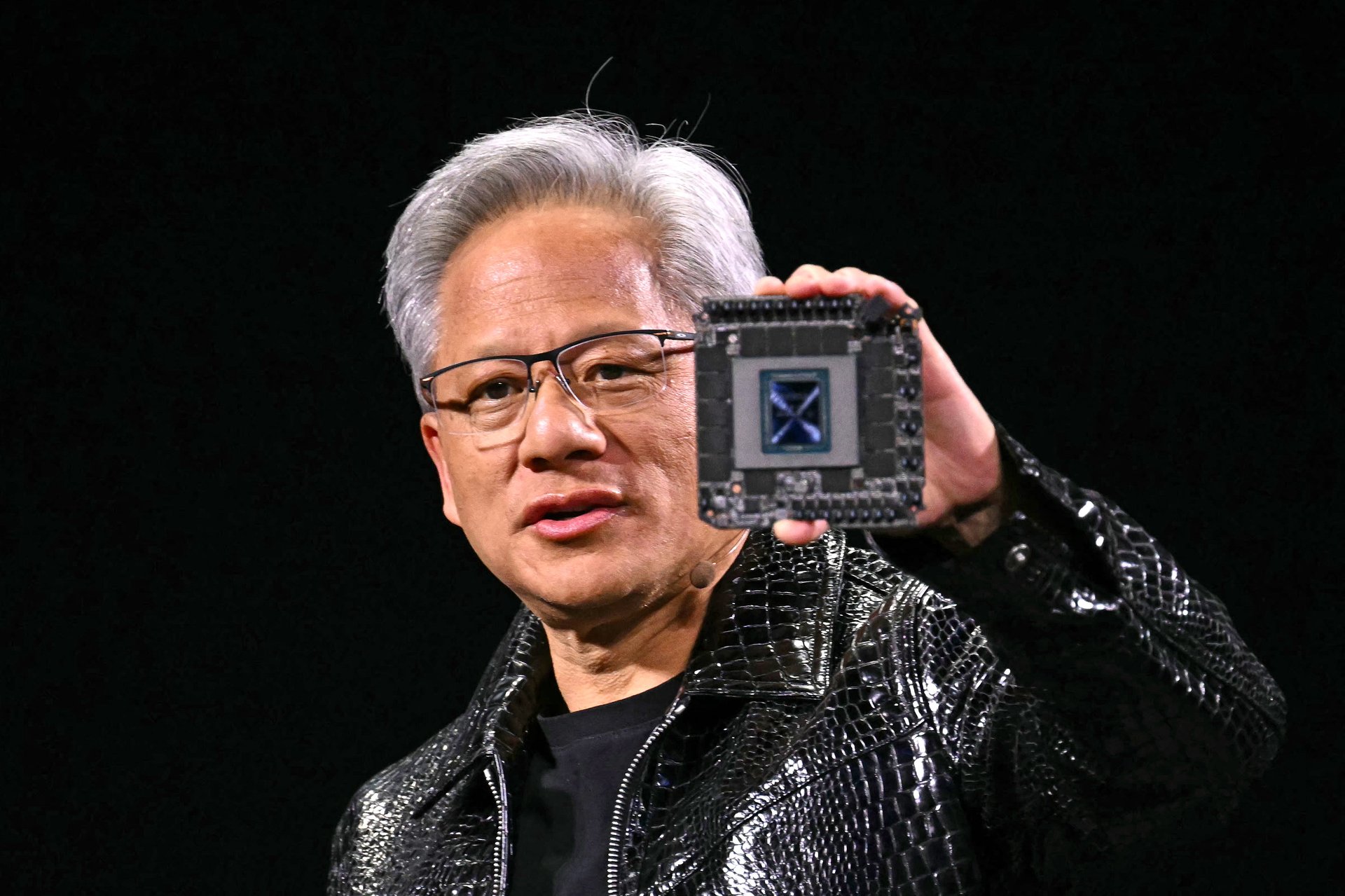

What Nvidia CEO Jensen Huang thinks about DeepSeek

With Nvidia earnings coming soon, Huang said he thinks the Chinese AI startup will lead to more demand for AI computing

Nvidia (NVDA) chief executive Jensen Huang doesn’t have hard feelings for Chinese artificial intelligence startup DeepSeek.

Suggested Reading

After the Hangzhou-based AI startup spooked investors in January, Nvidia’s stock plunged 17%, wiping out nearly $600 billion in value — a record loss for a U.S. company — amid a global selloff of tech stocks.

Related Content

In December, DeepSeek said it used a cluster of just under 2,050 of Nvidia’s reduced-capability H800 chips to train its DeepSeek-V3 model — much less than the tens of thousands of more advanced Nvidia chips U.S. firms are using to train similarly-sized models. The AI startup’s models, which it demonstrated to be on par with those from OpenAI and Meta (META), prompted questions over the tens of billions of dollars its U.S. rivals are spending on cutting-edge chips and AI infrastructure.

During an interview with DataDirect Networks chief executive Alex Bouzari, Huang said he thinks DeepSeek’s reasoning models, R1, which it released in January ahead of the stock rout, will lead to more demand for computing power, because reasoning is “fairly compute intensive.”

“I think the market responded to R1 as in ‘Oh my gosh, AI is finished. It dropped out of the sky, we don’t need to do any computing anymore,’” Huang said. “It’s exactly the opposite.”

Huang also noted that R1 is “the world’s first reasoning model that’s open-source,” meaning developers and consumers can freely use it.

“It is so incredibly exciting, the energy around the world as a result of R1 becoming open-sourced. Incredible,” Huang said.

Earlier this month, JPMorgan U.S. Equity Research (JPM) analysts said in a report that DeepSeek is likely to have a positive impact on Nvidia. DeepSeek’s demonstration of cost-efficiency and AI innovation will lead to “strong demand” for higher-performance graphics processing units, or GPUs, the analysts said. Therefore, Nvidia’s leadership in advanced AI chips “should enable them to unlock new use-cases.”

Nvidia is expected to report fiscal fourth quarter earnings next week.