Nvidia earnings have analysts optimistic the DeepSeek selloff was just a blip

Nvidia stock plunged 17% after the Chinese AI startup spooked investors

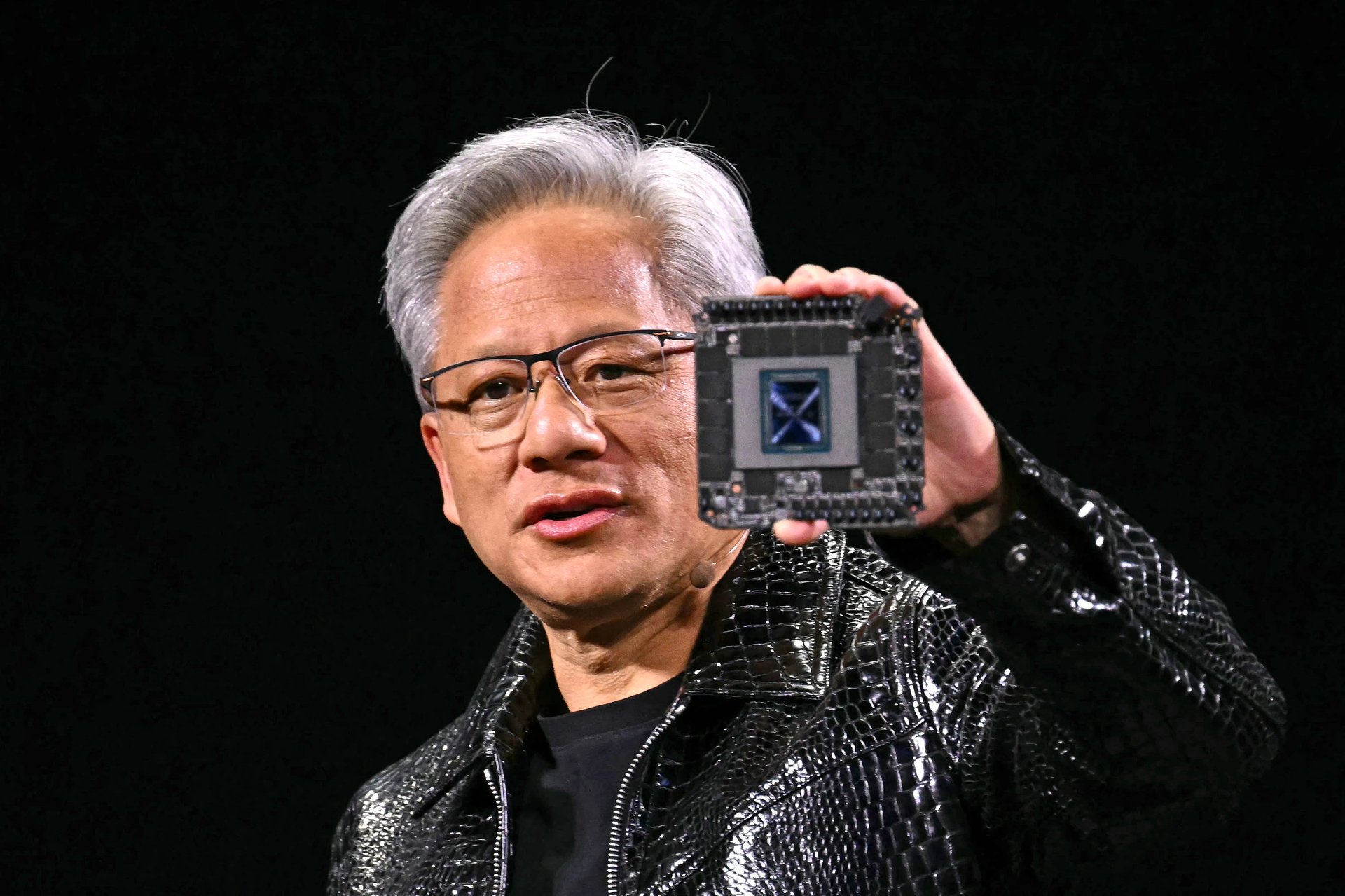

As Nvidia (NVDA) prepares to report its fiscal fourth quarter results in the wake of DeepSeek shock, analysts are optimistic that it will beat expectations and raise its outlook as it ramps up its Blackwell chips.

Suggested Reading

The chipmaker is expected to report revenue of $38.1 billion, according to analysts’ estimates compiled by FactSet (FDS).

Related Content

“Nvidia’s upcoming earnings will crush the DeepSeek anxiety,” Kevin Cook, senior stock strategist at Zacks Investment Research, said in comments shared with Quartz. The company dominates “the technology stack that enterprises want and the next stacks they don’t even know they need yet,” Cook said.

After the Chinese artificial intelligence startup spooked investors with its competitive reasoning models in January, Nvidia’s stock plunged 17%, wiping out nearly $600 billion in value — a record loss for a U.S. company. In December, the Hangzhou-based company released DeepSeek-V3, a model it said cost just $5.6 million to train and develop on Nvidia’s reduced-capability H800 chips.

DeepSeek’s AI models — which demonstrated performance on par with those from OpenAI and Meta (META) for seemingly thousands of chips and billions of dollars less — brought Big Tech’s big spending on AI into question ahead of a spate of results from Alphabet, Amazon (AMZN), Meta, and Microsoft.

While investors waited to see if the tech giants “would lower their bold data center capex projections,” spending instead grew to $325 billion, Cook said.

“This is a long-term buildout for these goliaths,” Cook said, adding that companies are not looking for immediate returns on investment, but are rather making “a three to five-year bet when their infrastructure” will be crucial to future AI development.

Despite the declining costs of training and running generative AI models, “that doesn’t necessarily reflect overall spending on generative AI,” John Belton, a portfolio manager at Gabelli Funds, said in comments shared with Quartz. While “DeepSeek didn’t introduce anything fundamentally new” about lower costs leading to higher AI adoption, Belton said, “it did slightly accelerate the rate at which training costs are declining.”

However, DeepSeek’s advancements could have a near-term impact on Nvidia and other chipmakers as U.S. officials weight stricter export controls on China, Belton said.

On Tuesday, Reuters reported that Chinese AI firms including Tencent (TCEHY), Alibaba (BABA), and ByteDance are “significantly” increasing orders of Nvidia’s H20 chips as demand rises for lower-cost AI models such as those from DeepSeek. The H20 chip was designed specifically by Nvidia to comply with existing export controls targeting China, and is less advanced than chips being sold to U.S. firms.

Another area of concern, Cook said, is gross margins as Nvidia delivers its Blackwell chipset, which “has been rumored to have overheating issues that may drive up costs.” Investors could be spooked if gross margins fall below 73%, he added.

Analysts at Jefferies (JEF) said in a note that it still expects Nvidia to deliver a beat and a raise despite supply chain issues with Blackwell.

Meanwhile, FactSet analysts are expecting Nvidia to set fiscal first quarter guidance at $42 billion.

“I think there was concern that DeepSeek would lead major companies to cut capital expenditures,” Joe Tigay, portfolio manager of the Catalyst Nasdaq-100 Hedged Equity Fund, said in comments shared with Quartz. “However, we’ve seen significant capex from these companies, and the market no longer seems worried about it. Nvidia’s guidance should further confirm that.”