India's cyber fraud redressal system helps only 17% of those duped

Only banks are mandated to report frauds, not payments apps.

Indian banks are battling online financial frauds but just not well enough.

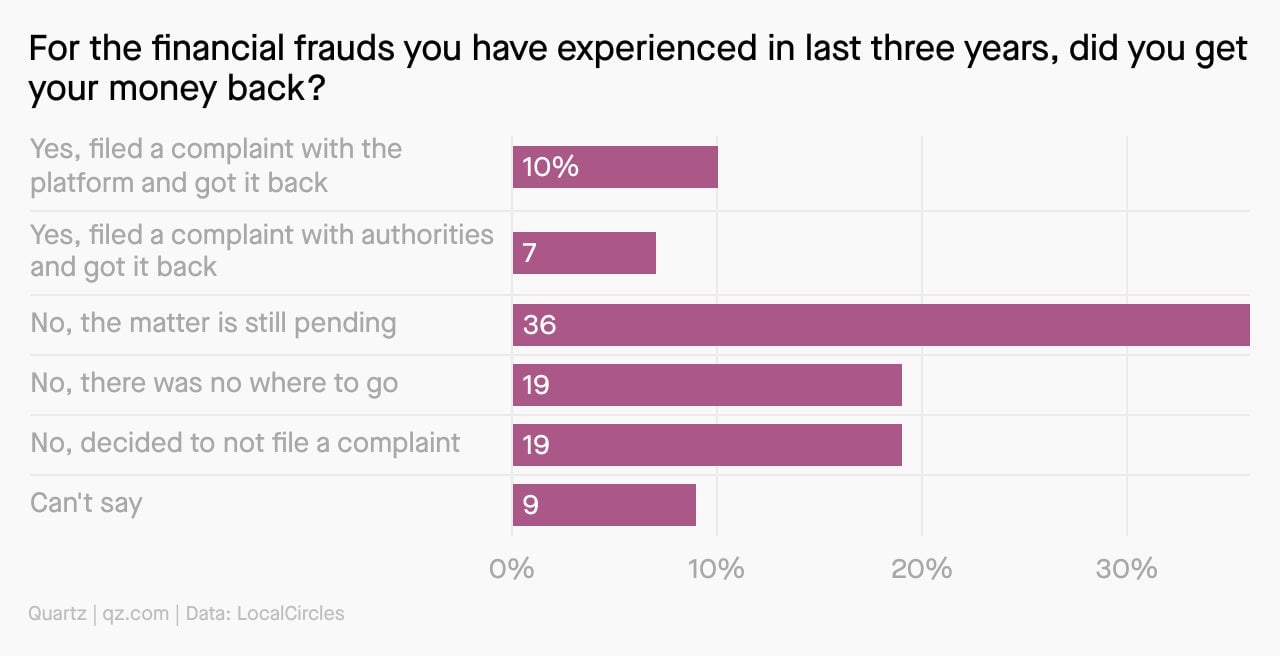

In the past three years, only 17% of those who were duped got their money back, a survey by social community platform LocalCircles has shown. Up to 75% couldn’t find a solution. These dismal numbers indicate a poor redressal mechanism.

Digitisation of payments and banking has led to a surge in financial frauds through unverified mobile apps, ATM card skimming, and SIM card cloning, among others, LocalCircles said.

Storing of sensitive information like passwords or card numbers on phones, emails, or computers is another major cause.

In 2021, nearly 70% Indians got duped online, which is among the highest in the world (pdf), according to the Global Tech Support Scam Research report by Microsoft.

The LocalCircles survey involved responses from nearly 32,000 citizens across 301 districts.

Using bank accounts to swindle people is most common

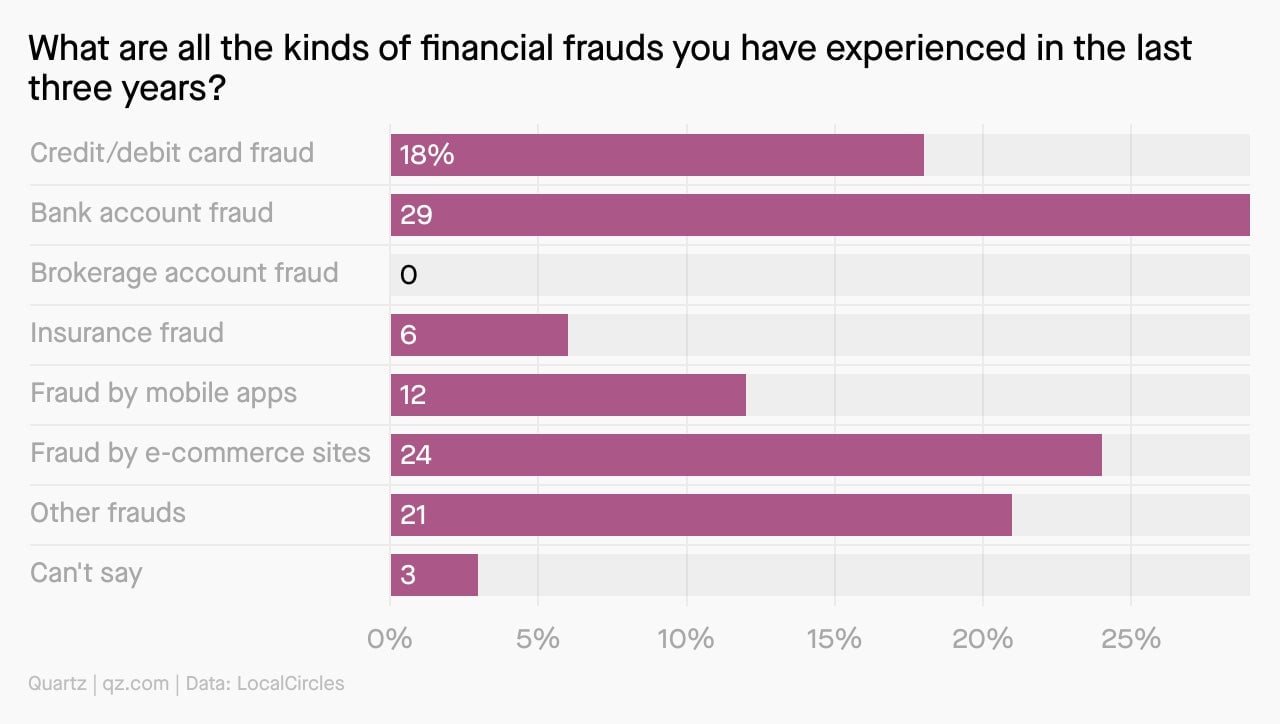

The survey showed that money was siphoned off bank accounts of nearly 30% of the respondents. Fraud via e-commerce sites (24%) was a close second followed by fraud by other means (21%).

Similarly, scamsters have begun using India’s unified payments interface (UPI)—around 80,000 cases are reported every month, with the swindled amount totaling to 200 crore rupees ($25.1 million), The Ken reported.

Payments companies, shockingly, lack institutional mechanisms to plug the problem. Unlike banks, they are not mandated to report frauds. Experts believe that risk management comes as an afterthought in most cases.

The government may have made the reporting of cyber frauds easier, but scams continue to grow in size and complexity.