Scott Bessent rules out a U.S. stake in Nvidia after Intel deal

The Treasury Secretary's comments came days after the Trump administration took an almost 10% stake in Intel

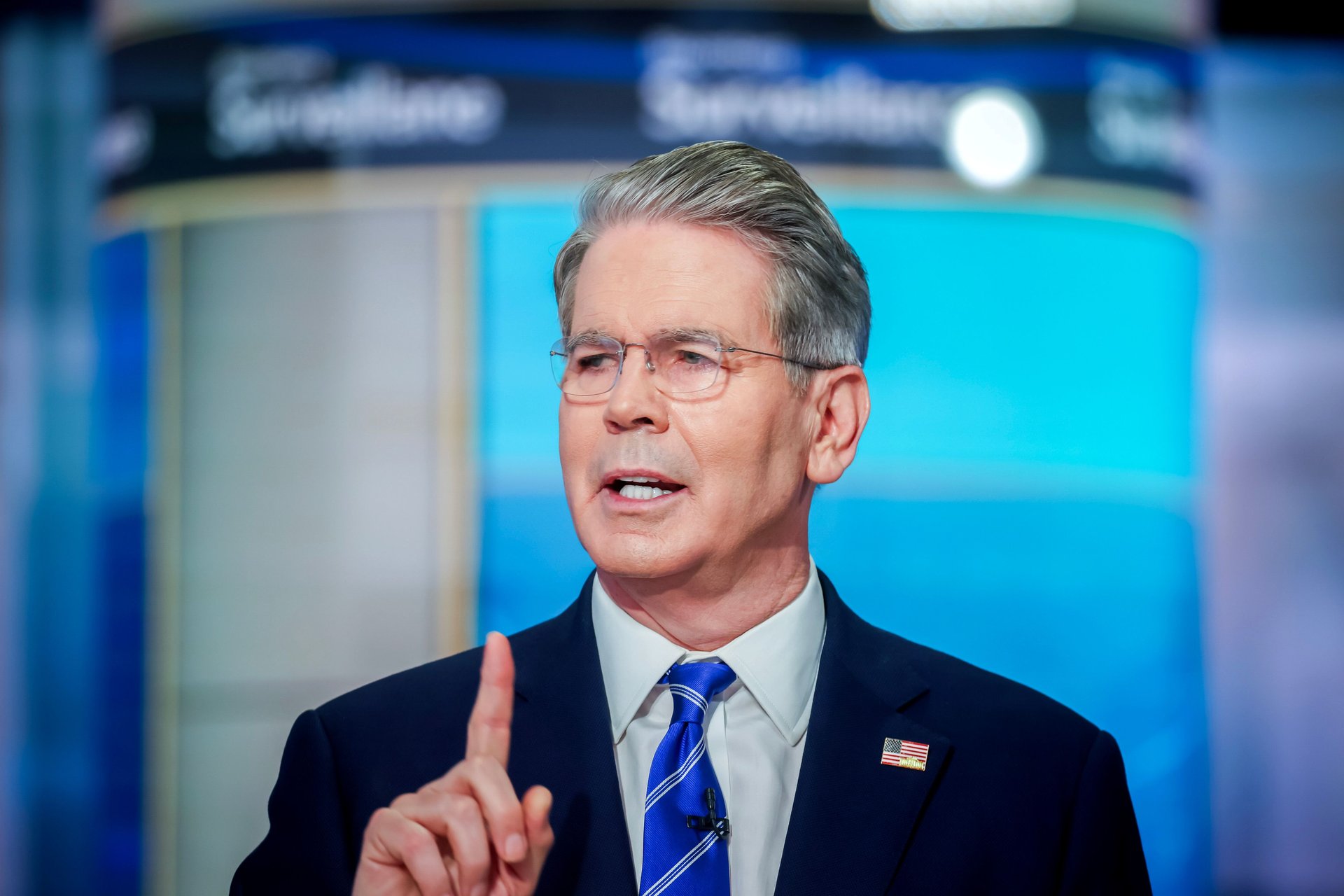

Michael Nagle/Bloomberg via Getty Images

Treasury Secretary Scott Bessent said Wednesday that the U.S. has no plans to buy into Nvidia, even as Washington steps further into private industry with new stakes in companies it considers strategically important.

Suggested Reading

"I don't think Nvidia needs financial support, so that seems not on the table right now," he told Fox Business, while suggesting that areas such as shipbuilding could eventually attract government investment.

Related Content

His comments came days after the Trump administration converted roughly $11 billion in subsidies and grants into a near-10% holding in Intel.

The move, which followed earlier interventions including in U.S. Steel, marked one of the clearest signs yet that the White House is willing to take direct ownership in corporate America.

"Could there be other industries where that we're reshaping, something like ship building? Sure, there could be things like that," Bessent said.

"These are critical industries that we have to be self-sufficient in, in the United States. And for 20, 30, 40 years, this was neglected.

"As I’ve said many times, the only good thing about Covid was that it was a beta test for if we were to go into a kinetic war, or get cut off from some of these industries."

It comes after Trump said Monday in the Oval Office: "I want to try to get as much as I can… I hope I’m gonna have many more cases like it."

Credit agency Fitch Ratings said the Intel deal improves liquidity but does little to address weak demand for its chips. Investors, too, are uneasy about what they see as an unusual level of government leverage over a publicly traded business.

"It sets a bad precedent if the president can just take 10% of a company by threatening the CEO," said James McRitchie, a California shareholder activist who owns Intel stock, in an interview with Reuters.

The Intel deal also reflects the company’s broader struggles. Once the dominant supplier of chips for personal computers, Intel has missed key technology shifts such as smartphones and artificial intelligence. Its stock has lost almost half its value since 2020, while rivals like Nvidia have raced ahead in AI chipmaking.

By becoming Intel’s largest shareholder, the U.S. has taken on a role more familiar in Europe and Asia, where governments routinely back "national champions" seen as vital to their economies. China’s state-supported Semiconductor Manufacturing International Corporation, or SMIC, plays a similar role in Beijing’s industrial policy.

"Once the U.S. government has an active stake in the success or failure of a company, it’s pretty hard to argue that it isn’t a ‘national champion,’" said Scott Lincicome of the Cato Institute.

Such arrangements are not easily unwound, analysts say. "The state has already put down some money, and the tendency is to give it more support," said Gary Hufbauer of the Peterson Institute for International Economics. Governments, he noted, are rarely willing to walk away from faltering projects once taxpayers’ money is at stake.

— Joseph Zeballos-Roig contributed to this article.