The Ukraine war is enriching oil company shareholders

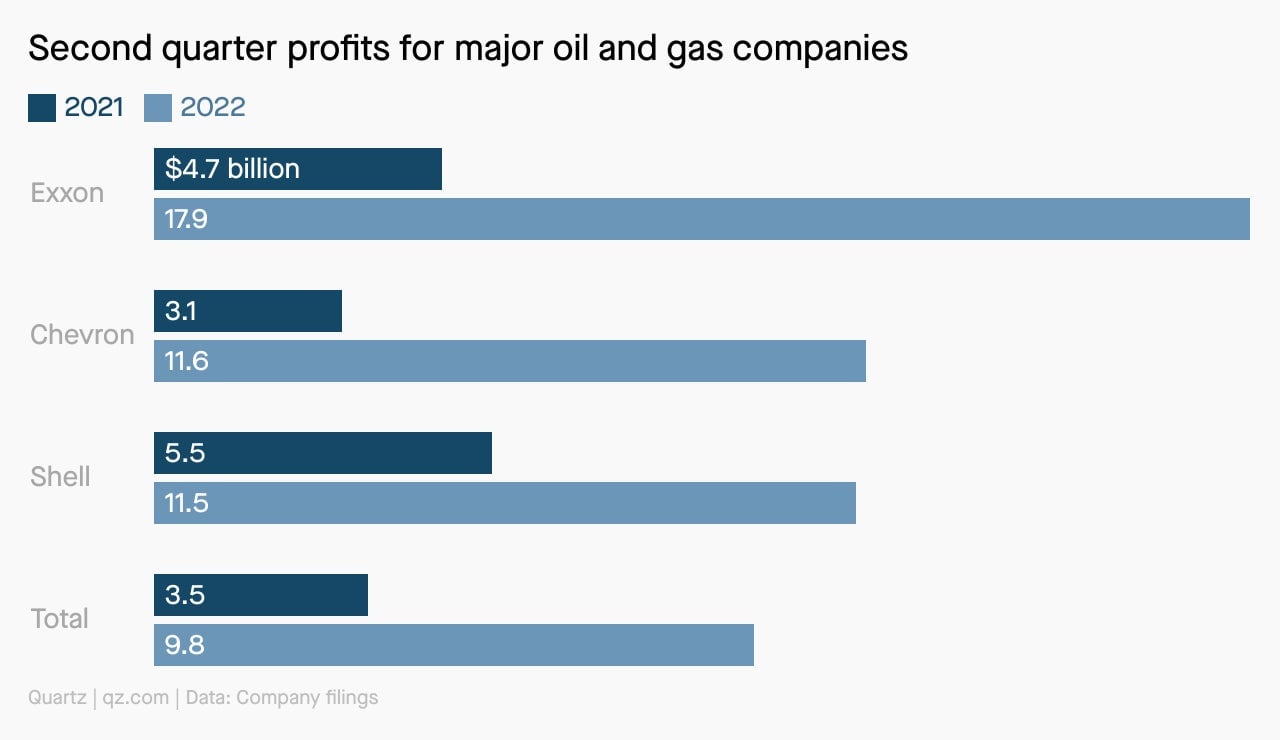

Major oil and gas companies in the US and Europe posted record profits for the second quarter of 2022, buoyed by surging commodity prices caused by Russia’s war in Ukraine, and by above-average profit margins from gasoline refining.

Major oil and gas companies in the US and Europe posted record profits for the second quarter of 2022, buoyed by surging commodity prices caused by Russia’s war in Ukraine, and by above-average profit margins from gasoline refining.

Shell, Total, ExxonMobil, and Chevron earned three times as much, on average, in the last three months compared to the same period last year.

All four companies continued a pattern they’ve established since the pandemic: Using windfall profits primarily to boost their share prices by paying off debt and rewarding investors with share buybacks and dividends. Shell and Exxon, in particular, each paid their shareholders more than $7 billion in the quarter; for Shell, this was a record, the company’s chief financial officer said in a call with investors. Total share buybacks for the year between the seven biggest oil companies are expected to reach nearly $40 billion, twice what shareholders received in the mid-2010s, the last time crude oil prices were above $100 per barrel as they are now.

On the back of an energy boom, oil giants are preparing to drill more

Most of these companies are also increasing their spending on oil and gas drilling after facing criticism from lawmakers that they were “war profiteering” by holding back on investment—a move that pleased shareholders but drove up prices for everyone else. Chevron spent a billion dollars more on capex in the first six months of this year compared to the same period last year; Exxon spent $2.5 billion more. Spending on carbon capture and low-carbon energy technologies remains a small share of total spending—about 13% of planned annual capex for Exxon.

The next quarter might not be so hot, though. Inflation is driving up operational drilling costs, meaning companies will need to spend more to maintain production levels. Refineries will also likely be less profitable as exceptionally high gasoline prices come back to earth. European policymakers are also implementing or considering windfall taxes on energy companies to chastise them for not doing enough to make more oil and gas available. For shareholders, this cash bonanza may be short-lived.