9 grocery store staples that could take a big hit if Republicans cut SNAP funding

Government cuts could impact over 40 million Americans

Lucky Charms (GIS) cereals could soon be piling up on store shelves across the U.S. – that is, if the GOP’s plan to slash government assistance programs moves forward.

As Republicans propose deep cuts to programs like the Supplemental Nutrition Assistance Program (SNAP), low-income consumers could feel the ripple effect, impacting snack, beverage, and retail giants that provide staples to millions who rely on food benefits.

A JPMorgan (JPM) report predicts the companies like Kraft Heinz and Kellanova could face challenges, as a large portion of their sales comes from lower-income households. Republicans are pushing for reductions in government spending to offset tax cuts, with their proposed budget cutting $230 billion over the next decade from agricultural programs, including SNAP.

The Center on Budget and Policy Priorities warns that cutting SNAP benefits for low-income households would deepen food insecurity, making it harder for 40 million Americans to afford basic food purchases.

Such cuts would likely have a domino effect on beverage giants like Pepsi (PEP) and Coca-Cola (KO), along with discount retailers like Dollar Tree and Dollar General. During its March 26 earnings, Dollar Tree (DLTR) noted it was attracting wealthier shoppers but cautioned that it would have to raise prices to offset tariffs. Other retailers like Walmart (WMT) and Target (TGT) have also signaled price increases. Walmart CEO Doug McMillon recently acknowledged that sky-high food prices are forcing lower-income shoppers to buy smaller packages.

We’ve compiled a list of the nine companies likely to face the largest impact, along with the percentage of sales generated by lower-income consumers, based on JPMorgan’s analysis.

2 / 10

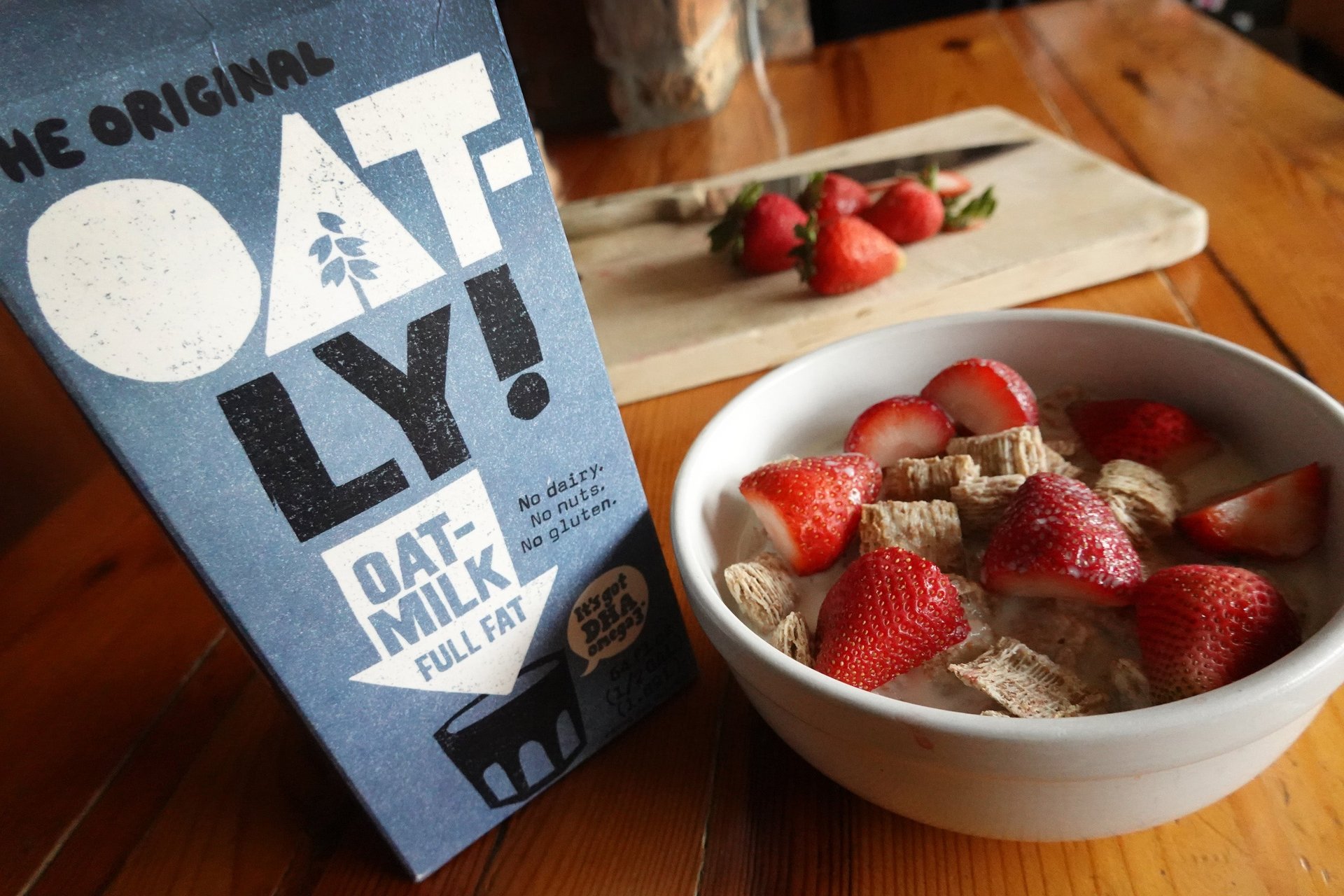

9. Oatly

- Percentage of sales from lower-income consumers: 13.5%

3 / 10

8. Beyond Meat

- Percentage of sales from lower-income consumers: 14.6%

4 / 10

7. Campbell’s

- Percentage of sales from lower-income consumers: 17.2%

5 / 10

6. General Mills

- Percentage of sales from lower-income consumers: 18.3%

6 / 10

5. Kellanova

- Percentage of sales from lower-income consumers: 18.9%

7 / 10

4. Hershey

- Percentage of sales from lower-income consumers: 19.5%

8 / 10

3. Kraft Heinz

- Percentage of sales from lower-income consumers: 20.6%

9 / 10

2. Tyson

- Percentage of sales from lower-income consumers: 21.6%

10 / 10

1. WK Kellog

- Percentage of sales from lower-income consumers: 21.8%