Trump touts new China trade agreement — but details are scarce

Officials called it a “framework to implement the Geneva consensus.” But there were few specifics, and tensions remain

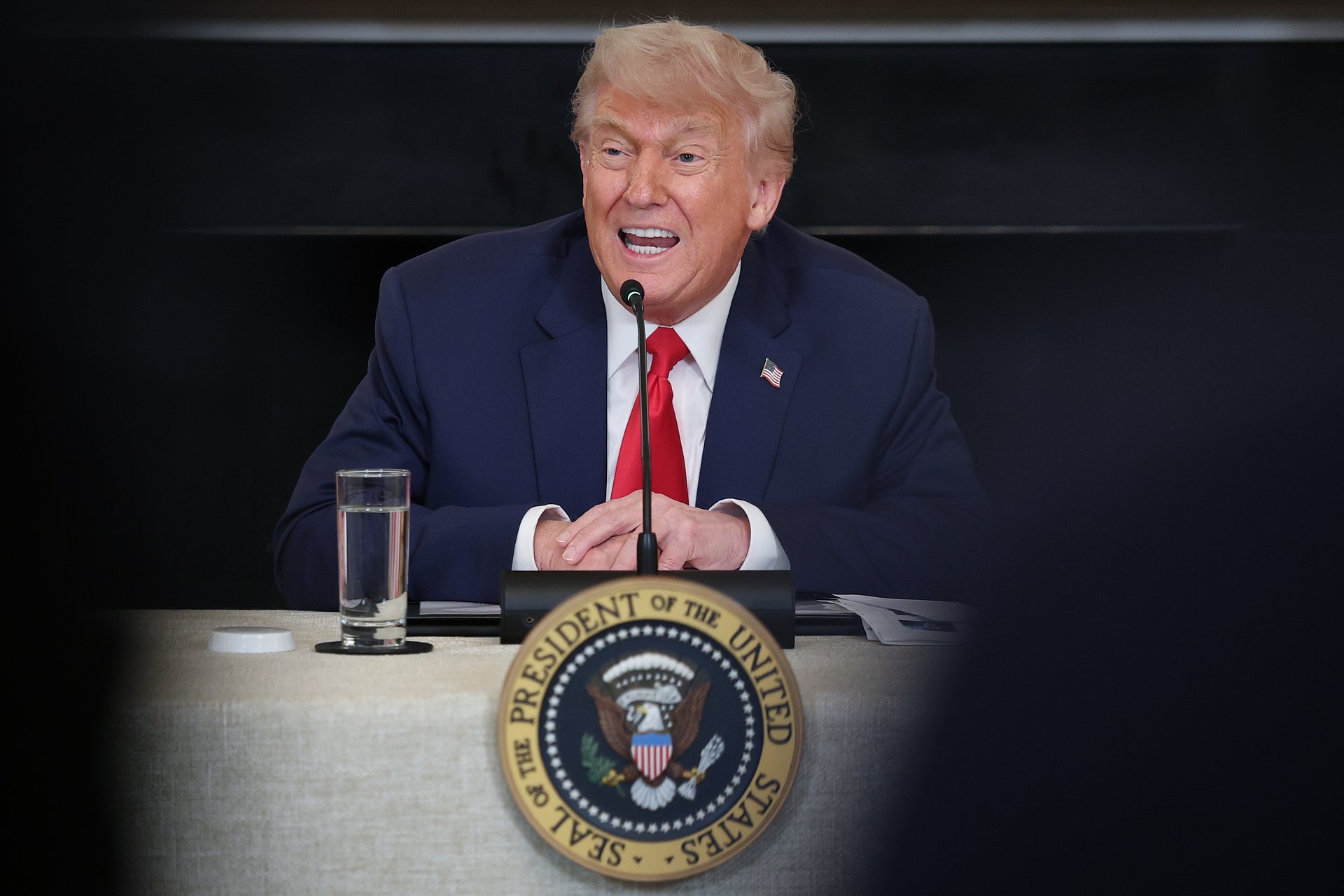

Win McNamee/Getty Images

The U.S. and China wrapped up two days of trade talks in London with what Commerce Secretary Howard Lutnick called “a framework to implement the Geneva consensus” — a hopeful-sounding phrase with little immediate detail.

Suggested Reading

Still, Lutnick, recalling the May gathering in Switzerland that produced that framework, described the London talks as a continuation that puts "meat on the bones."

Related Content

Chinese officials struck a similarly upbeat tone in state media, describing the talks as constructive and hinting that a path back to further, more structured negotiations is once again open.

Details of the agreement: scarce yet potent

The tentative agreement reportedly includes an acceleration of Chinese shipments of rare earth metals, a key ingredient for American tech, automotive companies, and defense contractors. In exchange, the U.S. is reportedly expected to loosen some export controls on semiconductors. But neither side offered firm commitments or timelines.

The proposals are now headed to President Donald Trump and Beijing for further rev/ew.

Trump didn’t wait long to weigh in. Posting to Truth Social on Wednesday morning, he declared a deal “DONE,” claiming that China had agreed to supply “FULL MAGNETS, AND ANY NECESSARY RARE EARTHS” up front. He also said the US would continue allowing Chinese students to study at American universities.

Tariff figures debated, more talks expected this summer

In characteristic fashion, Trump also asserted that the U.S. is imposing "a total of 55% tariffs." According to White House aides, that figure is a composite made up of existing 10% baseline tariffs, 20% drug-related tariffs, and a grab bag of sector-specific numbers.

Hard data suggests a different picture, however. Analysts at Yale’s budget lab put the effective U.S. tariff rate on Chinese imports closer to 30%, averaged across goods.

More talks are expected in August, though details are scarce on that front, too. And the U.S. market’s reaction was muted. At Wednesday’s opening bell, the S&P 500, Nasdaq, and Dow Jones Industrial Average ticked up slightly. After months of policy whiplash and gyrating stock prices, it appears analysts and traders aren’t assigning much value to the new, tentative deal — or that such an agreement was already baked in, with the major indexes already posting positive gains in 2025.