The U.S. and China called a trade war truce. Here's what to know

Stocks rallied as the U.S. and China both drastically slashed their reciprocal tariffs and agreed to a 90-day trade war pause

The U.S. and China have agreed to suspend and roll back most of their sky-high reciprocal tariffs for 90 days while negotiations continue, a significant move to ease weeks of escalating trade war tensions.

The agreement, announced early Monday after weekend talks in Geneva, marked a pivotal step toward deescalating a trade war that has disrupted global supply chains, rattled financial markets, and strained relations between the U.S. and China, not to mention with other American trading partners.

Officials in both Washington and Beijing have said they will continue working to hash out a more permanent solution.

What’s in the deal?

Under the terms of the truce, the U.S. will cut tariffs on Chinese goods from 145% to 30%, while China will reduce tariffs on American imports from 125% to 10%. The U.S. tariffs on Chinese imports still include a 20% levy from before the latest escalation in the trade war. President Donald Trump said at the time that that levy was meant to combat the fentanyl crisis.

The agreement significantly reduces the average U.S. tariff on Chinese goods to approximately 27%, bringing the U.S. weighted average tariff rate down to around 12%, a notable decline from a peak of 28% following Trump’s “Liberation Day,” when the president announced sweeping tariffs on almost all countries.

What the U.S. and China are saying

Speaking at the White House on Monday morning, Trump characterized the development as a “total reset with China” after months of mounting tariffs and trade tensions.

“The best part of the deal,” he said, is that “China agreed to open itself up to American business.” Trump said the U.S. had long been open to Chinese goods while receiving little access in return. “It never made sense to me. It’s not fair,” he said.

The president said he would be speaking with Chinese President Xi Jinping “maybe at the end of the week” as talks continue. Trump said the current relationship between the U.S. and China is “very good,” adding that “we’re not looking to hurt China.” He claimed that the trade war had taken a toll on the Chinese economy.

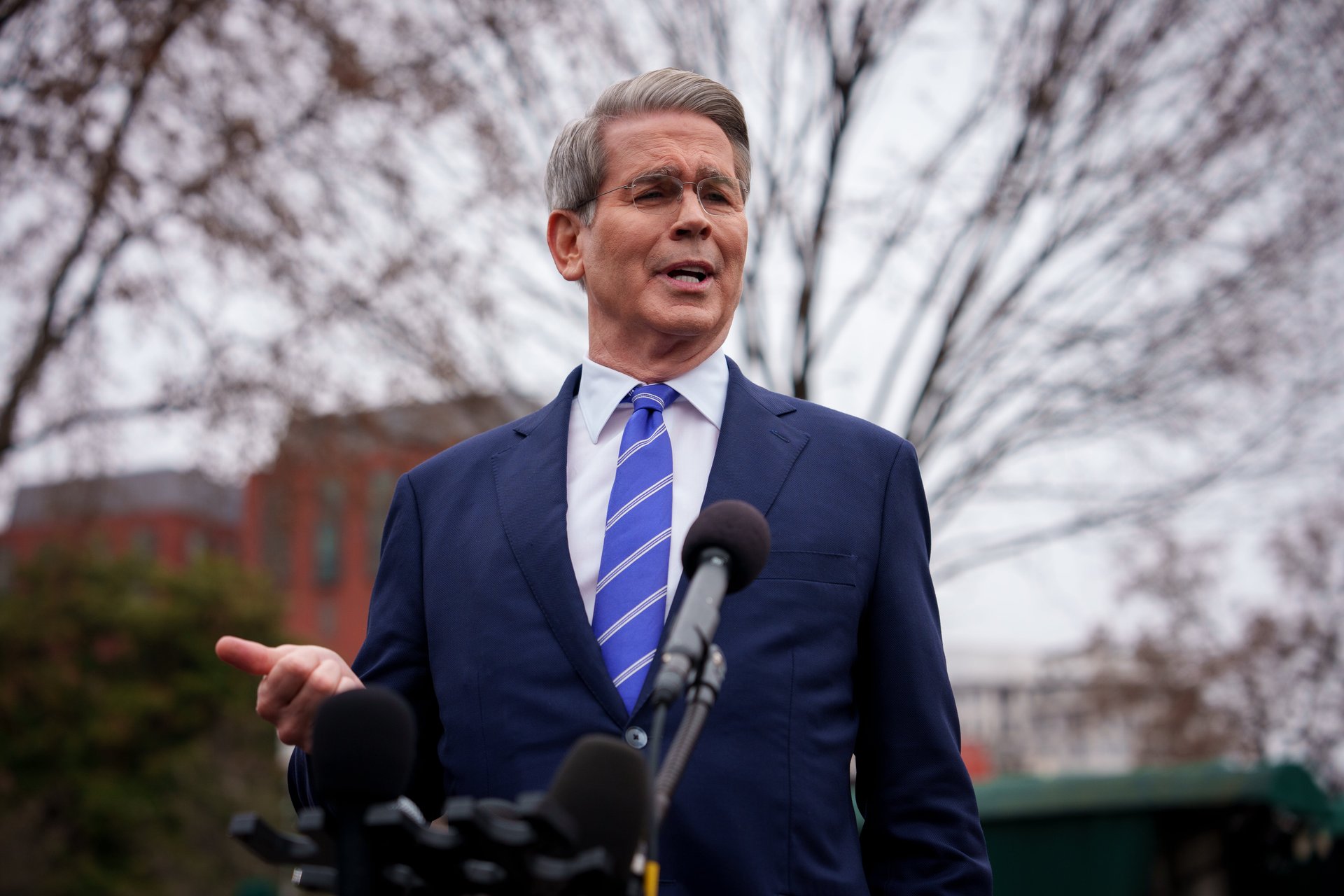

Treasury Secretary Scott Bessent said the agreement signals a shared interest in avoiding full-scale economic decoupling.

“The consensus from both delegations this weekend is neither side wants a decoupling,” he told reporters. “And what had occurred with these very high tariff... was an embargo, the equivalent of an embargo. And neither side wants that. We do want trade. ... We want more balanced trade, and I think that both sides are committed to achieving that.”

Bessent added that the U.S. would continue to pursue “strategic rebalancing” in sensitive sectors such as pharmaceuticals, semiconductors, and steel. Bessent also said he was impressed by how seriously the Chinese took conversations around the fentanyl crisis in the U.S. “For the first time the Chinese side understood the magnitude of what is happening in the U.S.,” he said.

Chinese Vice Premier He Lifeng echoed Bessent’s message of progress, calling the talks “candid and constructive” and pointing to progress toward a joint framework for further cooperation.

A joint statement from the two countries Monday said both sides would “continue to advance related work in a spirit of mutual openness, continuous communication, cooperation and mutual respect.”

The delegations, flanked by a heavy Swiss police presence, held more than a dozen hours of talks across both Saturday and Sunday at the official residence of Switzerland’s ambassador to the United Nations in Geneva.

How did stocks and analysts react?

The deal was met with immediate enthusiasm on Wall Street, with U.S. stocks soaring Monday morning. The Dow Jones Industrial Average was up 2.4% shortly after markets opened. The S&P 500 rose 2.6%, and the Nasdaq soared 3.6% as tech stocks led the market relief rally.

In a note released early Monday, analysts at Wedbush called the agreement a “dream scenario” for stocks, especially tech. While “supply chain and economic damage has been done,” they wrote, Wall Street is likely to “focus on normalized growth post this volatile six-week period,” with a near-term recession likely “off the table.”

They added: “This is very bullish news for the tech trade… although there is more wood to chop around chip restrictions (H20/Nvidia) and other issues in the AI trade.”

Analysts at the firm now expect the focus to shift from the economic doom-and-gloom of the past six weeks toward a more normalized growth outlook. Other analysts questioned the point of all the upheaval.

Beyond financial markets, analysts expressed cautious optimism. Paul Diggle, chief economist at investment group Aberdeen, told The Guardian that the deal “probably reduces some of the recession risks,” though he warned that “an underlying slowdown” is probably getting underway in the U.S. economy, with other economies also weakened by the trade war.

Still, big questions persist.

“It just seems like it’s a different story every day,” a former Morgan Stanley (MS) analyst told Quartz. “I don’t know how business leaders can really make any plans when policy changes so much from week to week or even day to day. “Hopefully the tariffs stay off. The market reaction shows how important that is.”

Speaking to The Wall Street Journal, ING’s (ING) Inga Fechner warned that the 90-day pause might be short-lived and could actually widen the trade deficit. Mark Williams at Capital Economics similarly noted that China hasn’t offered meaningful concessions. “It will be interesting to see whether China is willing to offer anything substantive in these talks, but I can’t see that they’ll feel under a huge amount of pressure to do so,” he told The Journal. “China has successfully called Trump’s bluff.”

What comes next?

While the truce is temporary, both sides have signaled a willingness to continue talks. Bessent told CNBC he is “likely to meet with China again in the next few weeks” to continue negotiations toward a more permanent agreement. Those discussions will likely address tariffs and issues such as intellectual property, market access, and China’s industrial subsidies — points of long-standing contention.

A spokesperson for China’s ministry of commerce said, “This move meets the expectations of producers and consumers in both countries, as well as the interests of both nations and the common interest of the world.

“We hope that the U.S. side will, based on this meeting, continue to move forward in the same direction with China, completely correct the erroneous practice of unilateral tariff hikes, and continually strengthen mutually beneficial cooperation,” the spokesperson added.

While the Trump administration has emphasized “strategic rebalancing” in key industries, critics say the scope and speed of the tariff cuts suggest a recognition that the economic fallout from the trade war — particularly for U.S. manufacturers and consumers — had become too steep to sustain.

That criticism reflects a broader tension in the interpretation of the deal: Is it the beginning of a constructive new chapter, or is it a tactical retreat under mounting domestic and global pressure? As for the broader trajectory of U.S. policy, signs point to a less combative tone — at least for now.

—Catherine Baab contributed to this article.