US wages show the economy is still very strong

Prices keep going up and the US economy is slowing down, but workers are still seeing their wages rise.

Prices keep going up and the US economy is slowing down, but workers are still seeing their wages rise.

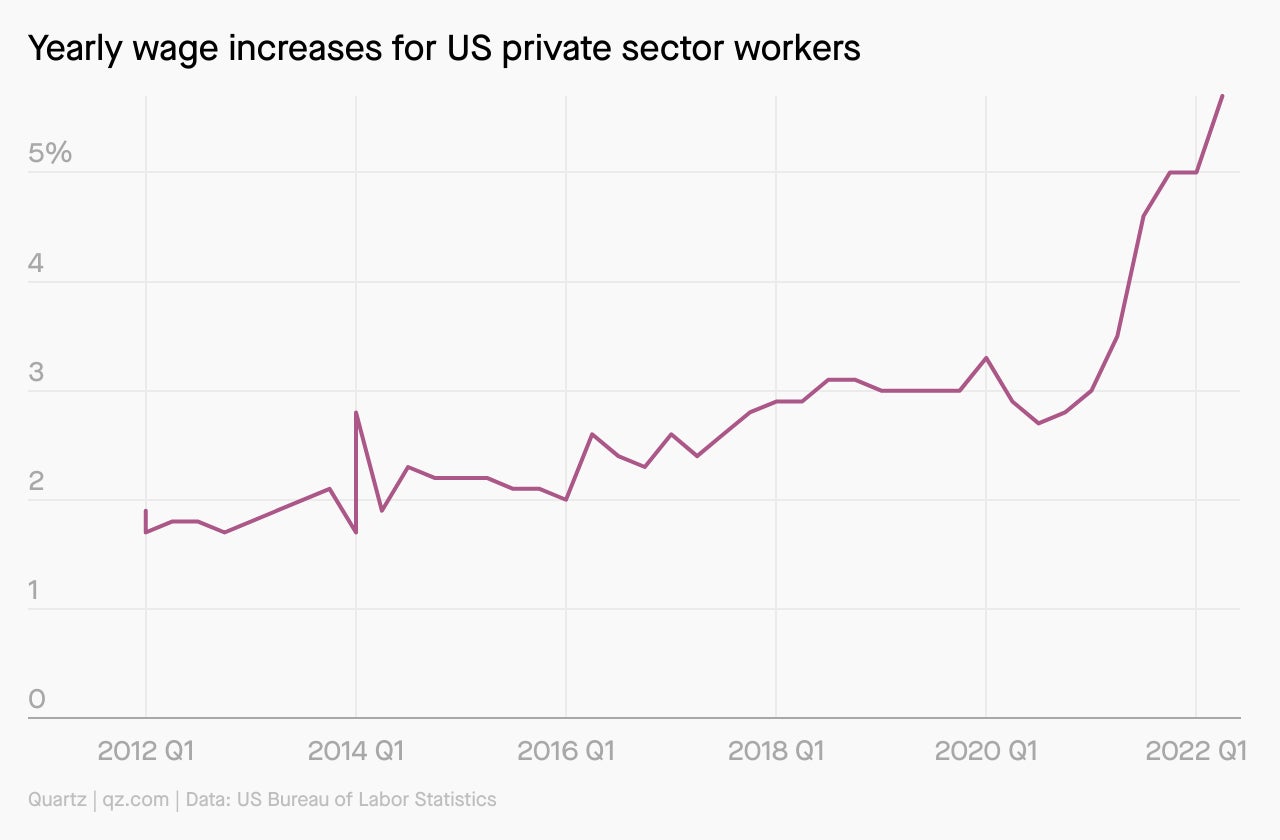

Private sector wages and salaries jumped by 5.7% on a yearly basis in the second quarter, compared to 5% in the first quarter, according to employment cost data released by the US Bureau of Labor Statistics Friday.

The continued rise in wages signals that employers are still struggling to hire workers. Overall, the job market is holding strong even as business investment drops off. For now, that should bolster the economy.

That may be little comfort for workers—and for policymakers at the US Federal Reserve. Adjusted for inflation, wages dropped by 3.1% in the past year, meaning workers can buy less with their paychecks. At the Fed, officials are likely to see Friday’s data through the eyes of employers, which are now paying more for labor.

It was a rise in the employment cost index in the third quarter of 2021 that triggered the Fed’s current cycle of interest rate hikes. Higher wages will continue to put pressure on the central bank to continue on the same path.

A better measure of wages

Economists say the employment cost index is a more accurate indicator of where wages are headed than the jobs report’s hourly earnings data, which is released once a month instead of quarterly. Unlike hourly earnings, which have stagnated in recent months, the latest employment cost data show that private-sector wage growth is accelerating.

The biggest wage increases were in sales, finance, and retail trade. One industry that cooled off somewhat was leisure and hospitality. On a quarterly basis, wages only moved up by 1.7% for this sector in the second quarter versus 1.9% in the first.

But the strong wage growth data comes as the labor market slows down. For the three months ending in June, there were about 375,000 jobs added on average each month, down from 523,000 in the prior period.

Inflation remains unabated

Meanwhile, the Fed’s preferred inflation measure, the personal consumption expenditures price index or PCE, jumped by 6.9% on the year in June.

Higher wages and disposable income are helping Americans outpace rapidly rising prices—barely. Adjusted for inflation, consumer spending rose by 0.1% on the month in June, more than economists expected.