What is APR? How to think about your card's annual percentage rate

Learn what APR is, how it works, and why it matters when comparing loans and credit — so you can borrow smarter

APR stands for annual percentage rate, and it tells you the yearly cost of borrowing money. Think of it as a price tag. It shows not just the interest, but also the fees that come with credit cards or loans, which makes it easier to compare offers.

APR differs from simple interest, which just calculates the cost based on the initial amount borrowed. APR factors in extra costs (including certain lender fees but not optional or penalty fees) to give you a more accurate view of the loan price.

Imagine buying a new car. You see a price tag that includes the item cost and any service charges. APR does the same thing for borrowing money by packaging the interest and fees into one clear number.

That clarity helps you when choosing between credit cards, personal loans, and auto loans. It shows you the total cost before you sign a binding agreement.

2 / 8

How is APR calculated?

RDNE Stock project via Pexels

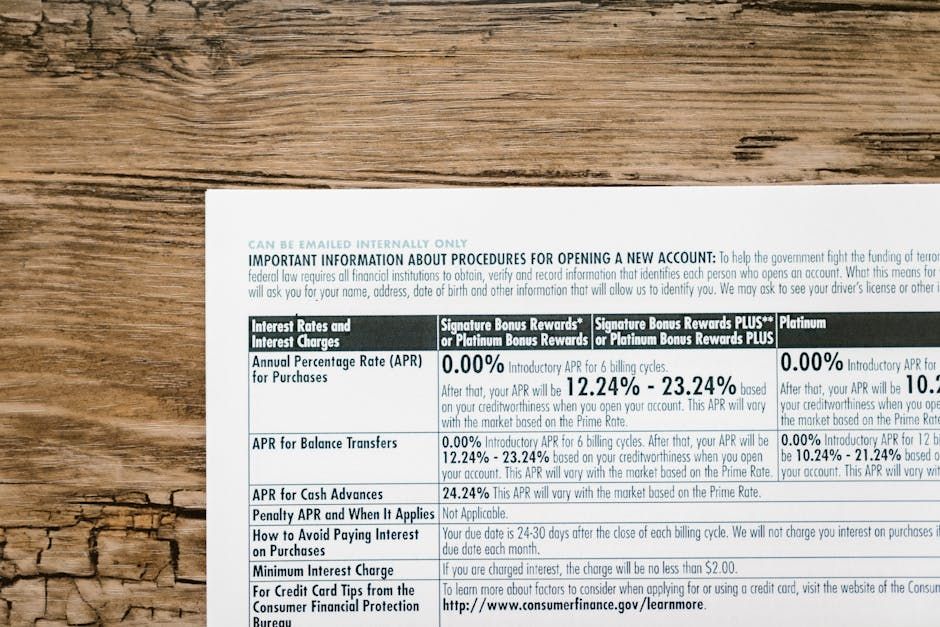

APR shows both the interest rate and certain fees averaged over a year. Here's what is included and what isn't:

- Included. Interest charged each period, origination fees, and lender fees.

- Not included. Late fees, membership fees, and penalties.

Here's a simple example of how it's calculated:

- You borrow $10,000

- Interest rate is 5%

- Origination fee is $100

- Total cost first year = $500 in interest + $100 fee = $600

- APR = $600 / $10,000 = 6%

This shows how even a small fee can raise your APR compared to the loan's interest rate. Lenders may factor in origination costs as part of finance charges.

3 / 8

Types of APR you should know about

Here are some common APR types:

- Fixed vs. variable APR. Fixed stays the same. Variable can change with market indices.

- Introductory or promotional APR. These are typically low or 0% for a limited time.

- Purchase APR. This is the rate for regular credit card purchases.

- Balance transfer APR. This can be useful for moving debt from another card.

- Cash advance APR. Cash equivalent transactions often have higher rates and no grace period.

- Penalty APR. Late payments or violations can trigger penalty fees.

4 / 8

APR vs. interest rate: What's the difference?

Understanding the difference between the APR and interest rate can save you money and frustration. They’re closely related, but they measure costs in different ways.

The interest rate is like the sticker price on a car. It’s the basic cost of borrowing, expressed as a percentage of the loan amount. It shows how much you’ll pay each year in interest alone, without including any other expenses.

The annual percentage rate (APR) is more like the "out-the-door" price you’d pay at a dealership. It includes the interest rate plus certain lender fees, such as origination or processing charges. This gives you a more complete picture of a loan’s true cost.

For example, Loan A has a 5% interest rate and no fees, so the first-year APR is also 5%. Loan B has a 5% interest rate but includes a $200 origination fee on a $10,000 loan, which increases the first-year APR to approximately 7%.

When comparing loans, focusing on APR is like looking at the total cost of a car rather than just the sticker price. It helps you see what you’ll really pay, so you avoid being caught off guard by hidden costs.

5 / 8

Why APR matters when comparing financial products

Think of APR as the price tag on borrowing money. Just like a store price includes both the product and any required extras, APR combines the interest rate with certain lender fees to show the true yearly cost. This makes it easier to compare financial products side by side without getting distracted by flashy marketing.

A low introductory APR is like a sale price that jumps back up after a short time. The initial number might look great, but the ongoing rate after the promo ends can be far higher. Some lenders also advertise a low interest rate but tuck fees into the fine print, so knowing the APR helps reveal these hidden costs.

Even small APR differences matter. It’s like comparing two similar cars. One gets slightly worse gas mileage, and over time, you’ll spend much more on fuel. Likewise, a higher APR means you’ll pay more in total over the life of your balance or loan.

APR also keeps lenders transparent in their total pricing. They must display it clearly, so you know exactly what you’re signing up for. Understanding APR is like reading the full menu before ordering. It helps you see the complete picture before you commit.

6 / 8

How to find the APR on a financial product

The Truth in Lending Act requires lenders to show the APR clearly, so borrowers can compare the real cost of credit. This law ensures transparency and helps you make informed decisions before signing any agreement.

You'll find the APR in the credit card Schumer box or in the loan agreement documents. It should be front and center, often placed near the interest rate for easy reference. If you're reviewing online offers, check the "rates and terms" section or product summary page for this information.

Tips for comparing offers: Always compare APRs for similar products over the same repayment term. A low interest rate with high fees can result in a higher APR than expected. Look beyond promotional rates to the standard APR you’ll pay after any introductory period ends.

- Check the fine print for fees.

- Compare APRs, not just interest rates.

- Watch for rates that expire or change after a set period.

7 / 8

How to lower your APR

If your APR feels like it’s eating into your budget, the good news is you have options. Lowering your APR can mean paying less interest over time, freeing up more of your money for savings or other priorities. The process isn’t always instant, but small, strategic changes can make a big difference.

Start by understanding what’s influencing your current APR — your credit score, payment history, and debt levels all play a role. Once you know the factors at work, you can target them directly. Even a modest reduction in APR can save you hundreds — or even thousands — of dollars over the life of a loan.

- Raise your credit score by paying on time and reducing balances.

- Shop around to find the best rates.

- Refinance to get a new loan with a lower APR.

- Ask your current lender for a rate reduction, especially if your credit has improved.

8 / 8

Common misconceptions about APR

There are some myths worth clearing up:

"0% APR means free forever."

This rate is usually just for a limited period. Once it ends, high rates may kick in.

"APR and interest rate are always the same."

Not if fees apply. APR includes some fees, while the interest rate doesn't.

"APR tells you everything you'll pay."

APR doesn't include late fees or optional charges such as insurance.