Why is BlackRock betting on Coinbase in a crypto bear market?

The exchange inked a deal to offer crypto products to BlackRock's institutional clients.

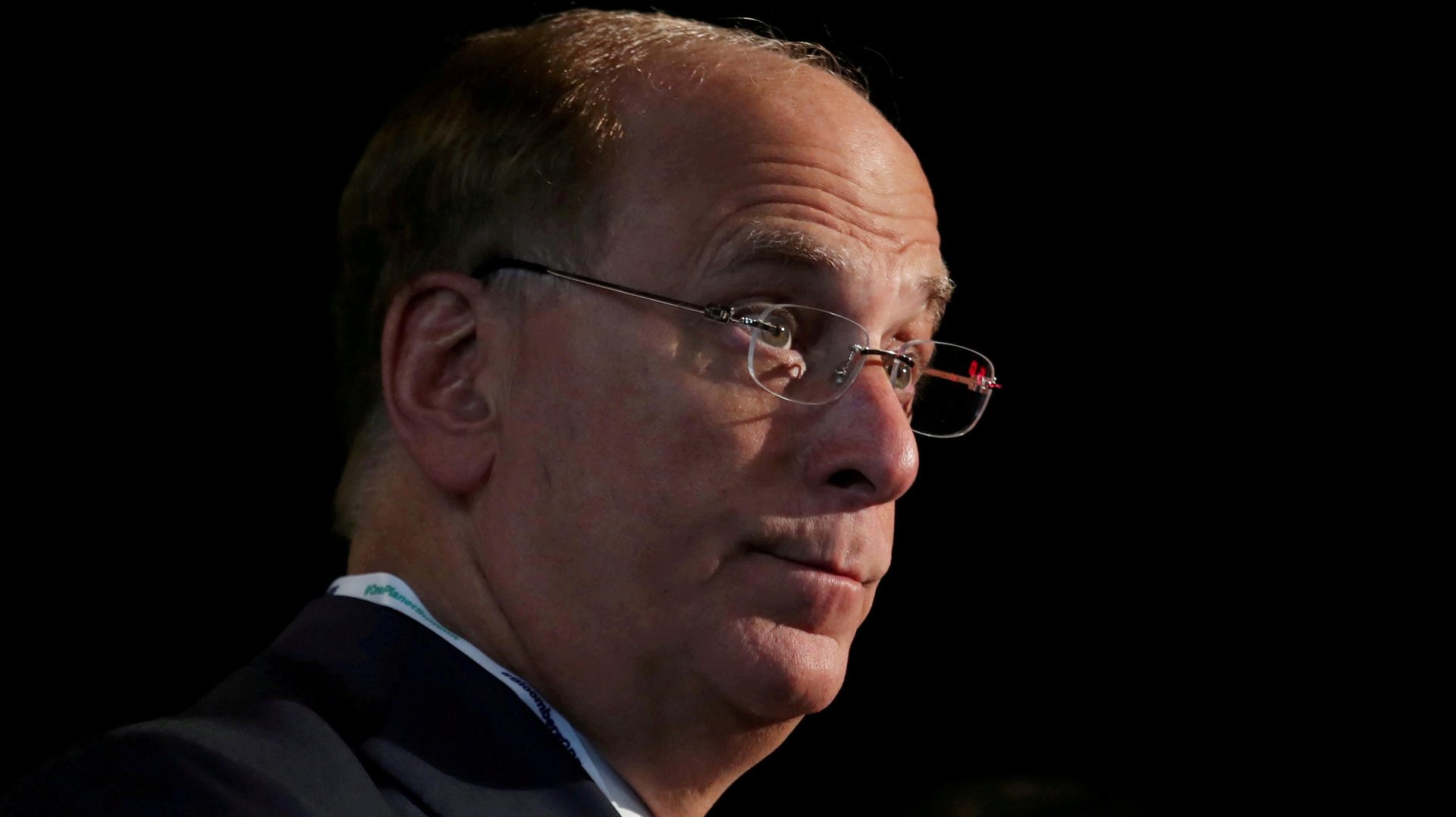

For years, BlackRock CEO Larry Fink flirted with the idea of widespread adoption of cryptocurrencies, but steered clear of them, saying his firm’s institutional clients were not interested. On Thursday, BlackRock inked a deal with Coinbase that will allow the investment company’s customers to trade bitcoin.

The move comes as the bitcoin has lost more than 50% of its value since the beginning of the year due to tighter global financial conditions. After dropping more than 60% since January, Coinbase’s stock jumped 40% on the BlackRock news.

For BlackRock, the deal is a way to dip into crypto markets with little effort and risk. By working with Coinbase instead of building its own crypto capability, the firm can abandon the project if clients lose interest, or regulators crack down on crypto trading.

Under the deal, BlackRock clients on the investment firm’s Aladdin platform will be able to use its tools to manage bitcoin they own on Coinbase.

Fink changes his tune on crypto

The partnership cements a big shift for Fink, who just last summer said there was little demand for digital assets among Blackrock clients. Earlier this year, he reversed course, saying he saw Russia’s invasion of Ukraine accelerating demand for digital currencies.

“I don’t know how they didn’t see demand and then they see demand,” said Owen Lau, an analyst at Oppenheimer who covers Coinbase. “I do believe that they see demand in the longer term.”

Last month, BlackRock’s global head of index investments, Salim Ramji, said at a Barrons Live event that the investment giant preferred blockchain over bitcoin products, the London-based Financial News reported. “In terms of the underlying technology of blockchain, it is incredibly innovative and incredibly disruptive,” he said.

A needed boost for Coinbase

The partnership is welcome news for COIN’s embattled stock. Blackrock’s Aladdin has more than 200 institutional users, including insurers, pensions, corporations, banks, and asset managers. This also means that Blackrock could introduce Coinbase to more traditional financial institutions, noted Lau.

The exchange has been looking to diversify its revenue streams from retail trading fees, which have been the bulk of its business in the past. That revenue, however, dries up when bitcoin is less volatile, creating fewer opportunities for users to trade.

Coinbase under SEC scrutiny

The deal comes as Coinbase is under investigation by the Securities and Exchange Commission over selling digital assets that the regulator said should have been registered as securities. Though the probe might not affect the early stages of Coinbase’s deal with BlackRock, it could prove difficult later on if it’s expanded to include other crypto currencies. SEC chairman Gary Gensler has deemed bitcoin a commodity, meaning it wouldn’t be treated as an unregistered security.

“The problem is if they go down the list to the 10th token or hundredth token, that would create some concern,” Lau said. “But bitcoin is still about half or 40% of the total market cap of crypto.”

Blackrock and Coinbase declined to comment on how the SEC’s inquiries into Coinbase’s business might affect the partnership.