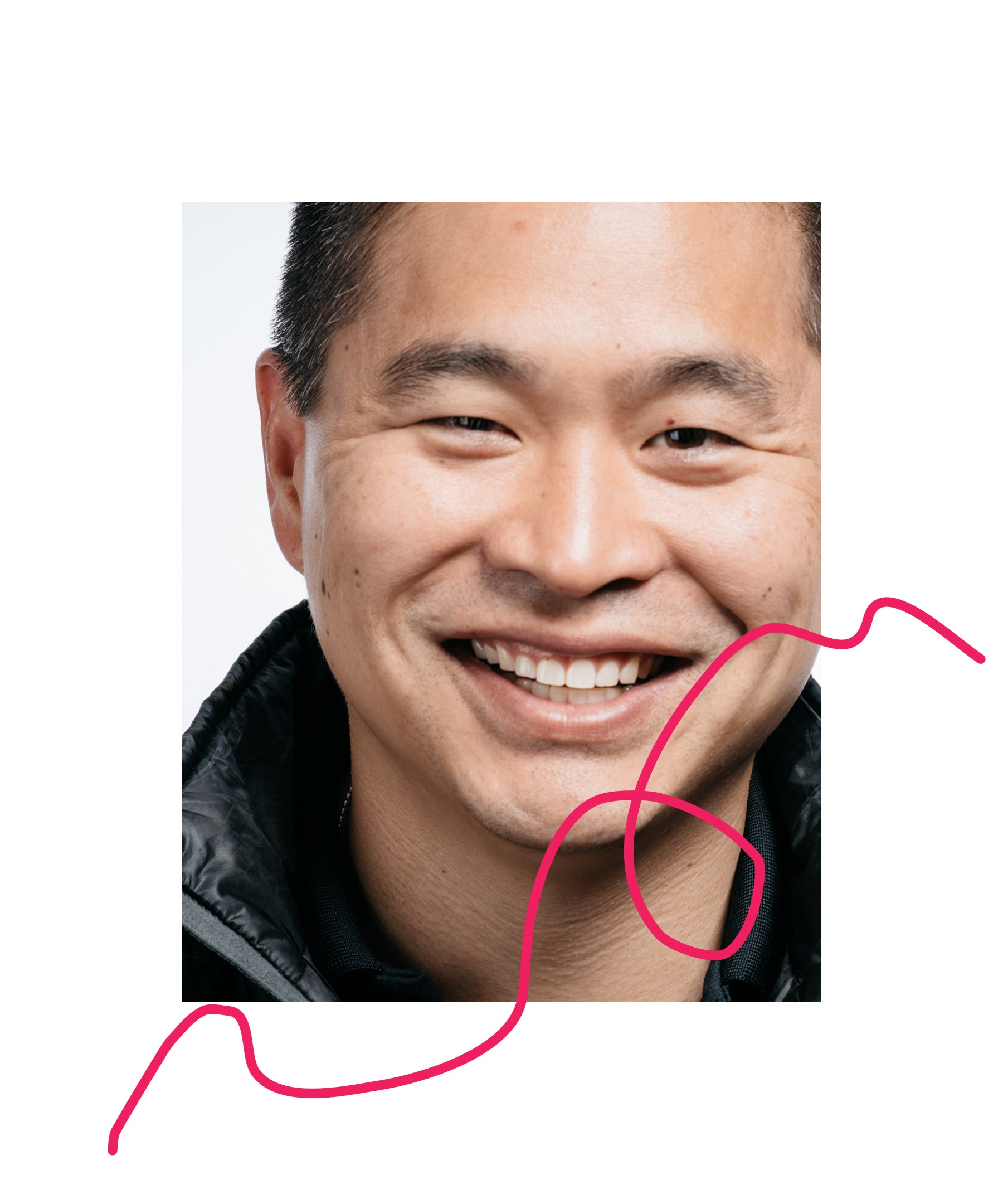

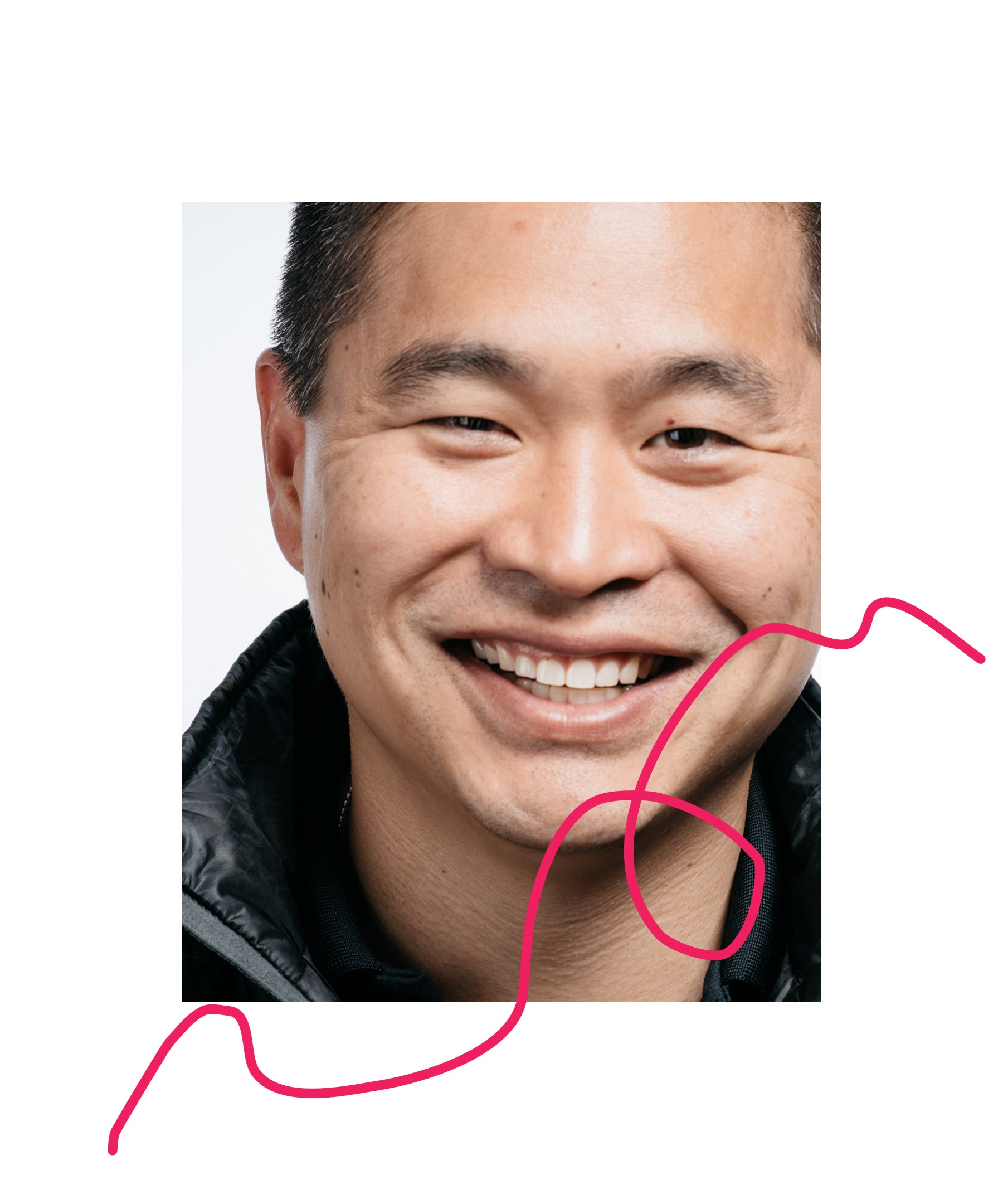

Why a Wall Street rebel left a $1.5 million job

Six years ago Brad Katsuyama walked away from a $1.5 million salary at the Royal Bank of Canada (RBC) with the audacious goal of creating a new stock exchange. Katsuyama, the main character of Michael Lewis’s 2012 book Flash Boys, left to co-found IEX and take on fabled Wall Street institutions like the New York Stock Exchange and NASDAQ.

Six years ago Brad Katsuyama walked away from a $1.5 million salary at the Royal Bank of Canada (RBC) with the audacious goal of creating a new stock exchange. Katsuyama, the main character of Michael Lewis’s 2012 book Flash Boys, left to co-found IEX and take on fabled Wall Street institutions like the New York Stock Exchange and NASDAQ.

In the inaugural episode of FWD: Thinking podcast (Apple Podcast, Google Podcast, Spotify and Stitcher), I interviewed Katsuyama about how he came up with the idea for IEX, his contingency plan, and his advice for identifying new business ideas. Together we discuss how:

- Katsuyama made his mark as a college intern by nailing the lunch order for his team.

- His back-up plan was to move to Jacksonville, Florida or Toronto and become a medical salesman.

- A 25% success rate was enough to convince him and his co-founders to leave their high-paying jobs.

It all starts with the lunch order

Katsuyama discovered his success was rooted in two values that were uncommon on Wall Street: humility and other-centeredness. This behavior left Katsuyama with a cadre of colleagues who rooted for his success. He traces his approach back to one of his earliest tasks as an intern: ordering lunch. Katsuyama was doing data entry but tapped into his “creativity” and “attention to detail” to ensure that his colleagues were well fed each and every day:

“Lunch is a really important thing. I got that from day one. They’re like lunch is so important here. So creativity is about finding new places. So I would do these, like, master lunch prints that were really, really well-executed. And I liked it. I found it fun. And I didn’t view it as demeaning; I viewed it as these people need to eat and I want these people to notice me and I’m gonna try to be as interesting as I can.”

He almost left Wall Street for a completely different career

Michael Lewis describes how Katsuyama was viewed as RBC’s “golden boy.” Despite ascending the ranks, Katsuyama struggled to find purpose as a stock trader helping institutions buy and sell large blocks of stocks and noticed that he was starting to lose the “drive [he] felt early on in [his] career.” With the help of his wife, he took stock of his skills and contemplated his career reinvention:

“So I thought interpersonal skills are good, I’m good with numbers, I’m a strategic thinker, good critical thinker, and I can compete under pressure. And if you throw me into any environment like that, I think I’ll come out on top.”

They then ranked a handful of cities outside of New York considering factors, such as quality of life and the cost of living. One output from this spreadsheet: Medical sales in Jacksonville.But he had confidence to take the risk as an entrepreneur because his skills were dynamic and he had a backup plan.

Startups are risky

Ultimately, Katsuyama never became a medical salesman, instead opting to take on the injustices he saw in the stock market by co-founding IEX, which is an attempt to level the playing field for all investors. And while it’s well documented that startups are risky endeavors, Katsuyama and his founding team tried to ascribe a probability for the success of their new venture. He asked his co-founders to write their probabilities on a piece of paper and turned out that his was the “highest of them at 25%.”

Subscribe to FWD: Thinking on Apple Podcast, Google Podcast, Spotify and Stitcher

FWD: Thinking is a new podcast about bold professionals who have challenged the status quo to recreate their careers. They’ve grown out of the cracks in the org chart, punched above their titles, and when all else failed, started their own companies. Hosted by Khe Hy and created by Quartz, this podcast traces the blueprints that lead to a more fulfilling work life. Subscribe on Apple Podcasts or wherever you get your podcasts.