Not everyone is on board with a major business lobby’s new definition of corporate purpose

The Business Roundtable’s new statement on the purpose of companies has won a lot of praise today, mainly from critics of the kind of capitalism that serves shareholders at the expense of workers, society, and the environment.

The Business Roundtable’s new statement on the purpose of companies has won a lot of praise today, mainly from critics of the kind of capitalism that serves shareholders at the expense of workers, society, and the environment.

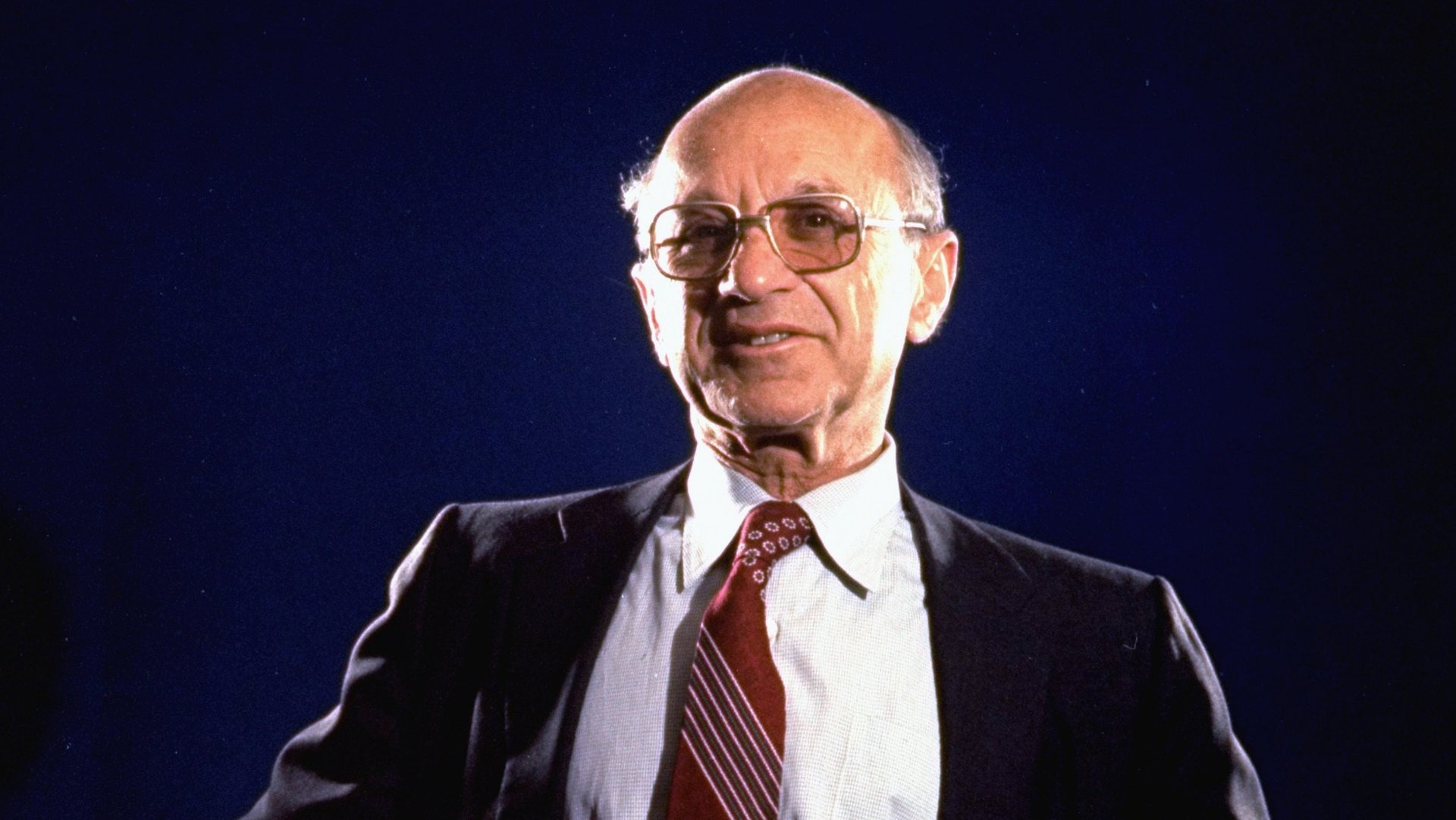

The powerful pro-business lobby previously advocated for economist Milton Friedman’s idea of shareholder primacy: Maximization of profits is the only driving force that matters when a company is making a decision. Now the group is formally acknowledging the existence and importance of other stakeholders. A company’s responsibilities to its customers, employees, suppliers, and communities are as vital as its responsibility to shareholders, the new statement suggests. Emphasizing the point, the portion of the statement dedicated to the interests of shareholders comes below those addressing everything else.

Another powerful lobby, the Council of Institutional Investors (CII), is taking exception, lamenting that the Business Roundtable has literally placed shareholders last. The council said that the new language references these investors “simply as providers of capital rather than as owners.” It urged boards and managers not to lose focus on long-term shareholder value.

“Accountability to everyone means accountability to no one,” the CII said. “It is government, not companies, that should shoulder the responsibility of defining and addressing societal objectives with limited or no connection to long-term shareholder value.”

However, the CII statement does not address how companies or individuals ought to respond when government either fails or refuses to shoulder that burden—or flouts its responsibility outright. So I put that question directly to CII executive director Ken Bertsch, who notes that “there clearly is a place for corporate social responsibility” and for shareholder proposals that raise a range of social issues. “But it is not realistic,” he says via email, “to expect that the Mark Zuckerbergs of the world are going to save us from a failure of politics (of governments, and of citizens in electing effective governments).” He adds that companies “dedicated to building long-term, sustainable shareholder value do need to gain confidence of various stakeholders, which means they must strive to do right by employees and communities.”

Read the CII’s full statement here:

The Council of Institutional Investors (CII) today expressed concern on a new Business Roundtable (BRT) statement on the purpose of a corporation. The statement undercuts notions of managerial accountability to shareholders, in CII’s view.

The Council has a productive relationship with BRT that has included discussion on corporate “stakeholder” obligations, but we respectfully disagree with the statement issued by the BRT earlier today. The BRT statement suggests corporate obligations to a variety of stakeholders, placing shareholders last, and referencing shareholders simply as providers of capital rather than as owners.

CII believes boards and managers need to sustain a focus on long-term shareholder value. To achieve long-term shareholder value, it is critical to respect stakeholders, but also to have clear accountability to company owners.

Accountability to everyone means accountability to no one. BRT has articulated its new commitment to stakeholder governance (which actually resurrects an older policy view) while (1) working to diminish shareholder rights; and (2) proposing no new mechanisms to create board and management accountability to any other stakeholder group.

Americans depend on strong companies not only as employees and communities, but also as owners, including through pension funds and other retirement holdings. CII supports putting capital to its best use for long-term performance, which includes addressing stakeholder contributions to that objective. It is government, not companies, that should shoulder the responsibility of defining and addressing societal objectives with limited or no connection to long-term shareholder value.

CII has welcomed BRT’s earlier focus on long-term value for shareholders, including recent BRT steps to combat excessive focus on the short-term, notably by discouraging company provision of quarterly earnings guidance. We do believe it is a challenge for boards and executives to keep their focus on the longer-term. But clearly companies with strong leadership have shown an ability to do so, particularly where they provide shareholders with thorough disclosure and clear articulation of long-term strategic vision.

Much of the discussion on “stakeholder” governance focuses on individual companies, and seems to downplay or ignore the role of markets. Shareholders have a very particular role in allocating (and re-allocating) equity capital. Public equity generally is highly liquid, and no doubt company managers often are frustrated by a sense that they are vulnerable to changes in company valuation that can be rapid, as investors reassess company prospects. While we appreciate that CEOs do not like to feel constrained and subject to market forces, nothing in the BRT statement will change this real-world dynamic of public equity markets.

While it is important for boards and management to have and articulate long-term vision, and sustain focus on the long-term strategy where they have strong conviction, a fundamental strength of the U.S. economy has been and continues to be efficient allocation of equity capital. If “stakeholder governance” and “sustainability” become hiding places for poor management, or for stalling needed change, the economy more generally will lose out.