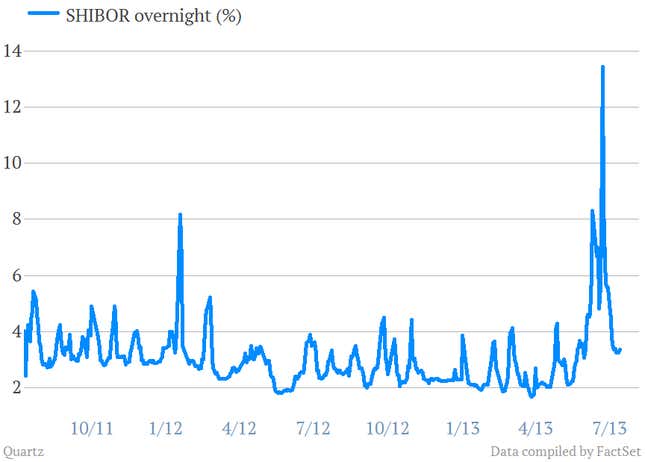

Evidence that China’s economy is drowning in debt continues to mount, amid a rapid slowing economy and a crackdown on fake trade invoicing. That led to June’s violent jumps in interbank interest rates and premier Li Keqiang’s vow to end China’s credit binge. But as of now, the binge goes on.

The “Big Four” state-owned banks—China Construction Bank, Industrial and Commerical Bank of China, Bank of China and Agricultural Bank of China—lent a combined $27.7 billion in the first week of July (link in Chinese), reported the Shanghai Seucrities News (SSN).

That’s compared with $44 billion for all of June. Some $35.4 billion of that was lent out in the first ten days of June, before rates hit prohibitive heights. July’s new loan gush included backlogged June credit, said the SSN report. Once the interbank rate has calmed—the overnight benchmark is not 3.35%, down from from its 13.44% peak on June 20—banks evidently think it’s safe to start cranking up the lending again.

This is odd, given that the Big Four banks are essentially the executors of government policy, and the fact that signals to turn down the lending spigots have been fairly clear.

Either the government is giving the banks a wink and nod to lend or they’re so desperate for profits that they’re flouting those signals while they still can. Either way, it’s a worrisome trend.

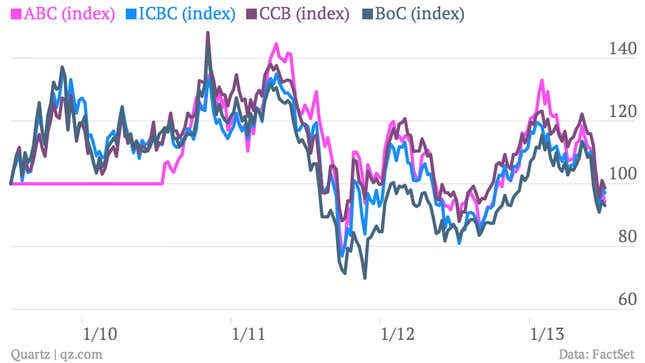

The past month has been hard on banks. Though they’ve rebounded slightly in the recent days, Big Four valuations are nearing record lows (link in Chinese):

No wonder then that even as credit seized up in June, CCB, BoC and ICBC all continued to pump out wealth management products (link in Chinese), which are retail products that securitize longer-term loans and are often tied to shadow lending.

WMPs only exacerbate the country’s liquidity and debt problems by channelling funding to questionable infrastructure and property projects at exorbitantly high interest rates, which are difficult for debtors to pay back. ICBC is reportedly gearing up to sell $32.6 billion in “guaranteed” WMPs in the near future (link in Chinese). Though banks profit from their sales, WMPs are typically kept off bank balance sheets.

The credit crunch is likely to continue, given that the deposit bases of the Big Four fell $117 billion in the first week of July (link in Chinese) and are more generally slowing, as SSN reports, citing “authoritative sources.” The central government might want to send out another memo.