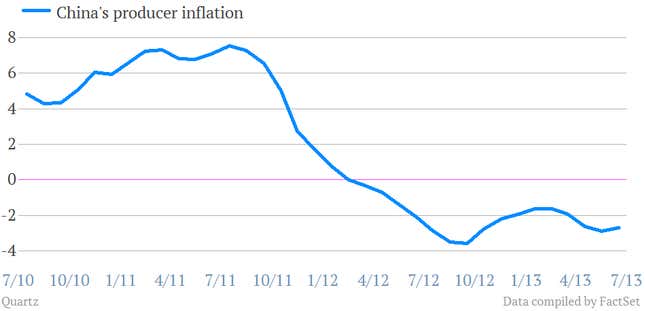

Chinese demand is slowly collapsing, as June’s produce price index (PPI) showed today. PPI slipped another 2.7% in June, compared with the same month last year. That was the 16th consecutive month of falling producer prices. Here’s a look at how that’s been going:

Sometimes PPI surges due to commodity producers passing on rising costs to Chinese buyers. But in this case, demand for commodities has been plummeting. Fuel and power prices tumbled 4.9% compared with June 2012.

Prices for ferrous metals fell 6.3% on the same period last year, even as the China Steel Association said that daily steel output is hitting historical highs (link in Chinese). That’s a sharper drop than the 5.7% decrease in the first half of 2013, suggesting that China’s bloated steel sector is rapidly running out of customers. Meanwhile, mining and quarrying prices fell 8.5%, also implying a slackening in demand for commodities.

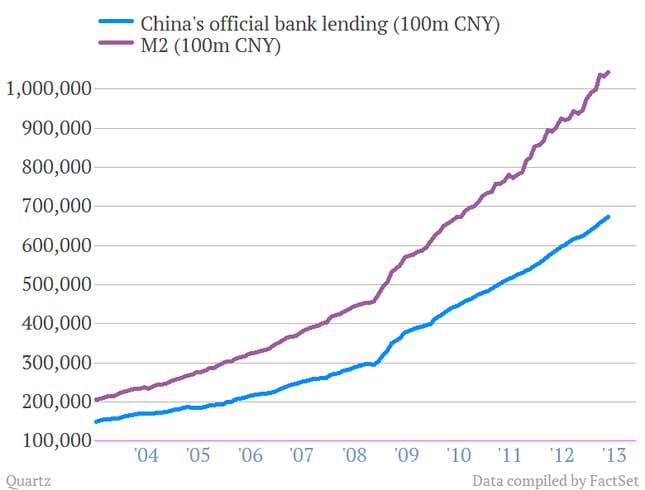

What does this all mean? The key is looking at loans and money supply, which continue to surge:

Chinese businesses have enjoyed access to easy money for projects like real estate development, infrastructure and factories, but they aren’t actually buying the stuff to build these things. It’s more evidence that companies are borrowing to boost dwindling cash flows, worsening the country’s debt crisis. The problem goes beyond local government debt. The consistent slide of producer prices implies rampant corporate debt, which is perhaps China’s biggest—and most overlooked—economic problem.

On a slightly positive note, consumer demand hasn’t faltered; producer prices for those goods stayed flat in June, compared with the same month in 2012. Too bad the government has been shifting of earnings away from households and toward wasteful investments in property, infrastructure and industry.