China is showing signs of stress this morning after the central bank issued a terse statement telling bankers to shape up and stop counting on perpetual money printing.

Chinese stocks tanked. The Shenzhen A shares fell more than 6%. The Shanghai Composite index, pictured below year-to-date, was down more than 5%, falling below 2,000.

Of course, a lot of the the worries center on the stability of China’s banking system. China’s government-controlled version of Libor still shows that conditions in the interbank lending markets are a bit tight. Still, rates have declined since last week, showing some improvement.

As the US learned during its financial crisis, it doesn’t take long for problems in the banking system to bleed into the overall economy. Copper has been something of a proxy for Chinese growth in recent years. Prices for the industrial metal tumbled to its lowest price in nearly three years.

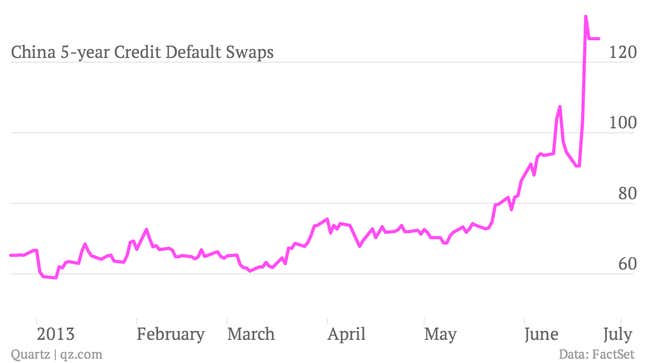

There are emerging doubts about how all this will effect the fiscal health of the world’s second largest economy. The cost of insuring against a default on Chinese government bonds has jumped over the last few days. Here’s a look at five-year credit default swaps on China.