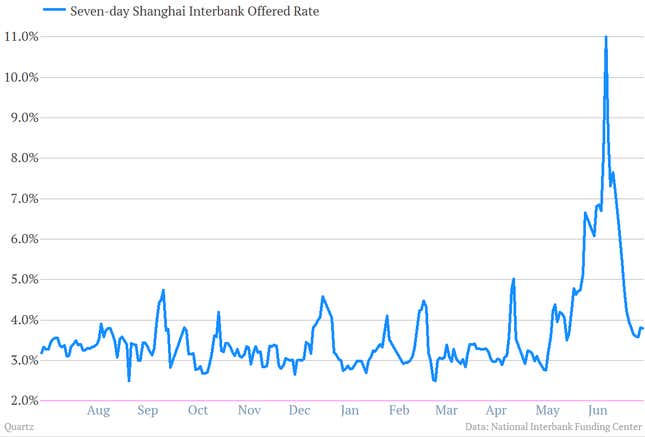

The Chinese government appears to have stopped trying to scare its banking system straight, at least for now. Interbank lending rates have moved lower after a spike that shook up the financial world a few weeks back (Paywall) and caused borrowing costs to rise.

We, along with plenty of others, found the spike in Shibor, the Shanghai interbank lending rate, reminiscent of the jump in the London interbank rate, Libor, which presaged the worst of the US financial crisis. That crisis led to a deep economic downturn and, eventually, a tax-payer funded bailout of the financial system.

Might China’s financial system be headed for a similar fate? Maybe.

But there are differences. For instance, we already know that China stands willing to bailout its largest banks. In fact, it has already done so relatively recently. Back in 2003, the Chinese government stepped in to bail out its largest banks, which where struggling under a mountain of bad loans to Chinese state-owned companies.

To do so, the government established “asset management companies” to take a lot of bad loans off the balance sheets of Chinese banks. Then the People’s Bank of China established Central Huijin Investments, a subsidiary of sovereign wealth fund China Investment Corp, in 2003 as a way to inject capital into the banking system. The State Administration of Foreign Exchange, which manages the country’s growing stockpile of foreign exchange reserves, moved those reserves into Central Huijin, which then bought equity in the banks. (It first used $45 billion worth of foreign reserves to buy equity stakes in Bank of China and China Construction Bank in 2004.) By 2012, Huijin had pumped some $156 billion into the financial system. Central Huijin still owns hefty stakes in China’s four biggest banks, among others.

So even though China has a rotten banking system, it also has a ton of money that it could use to bail it out. Using this money would be a complicated. But the government has shown very recently that it’s willing to try.

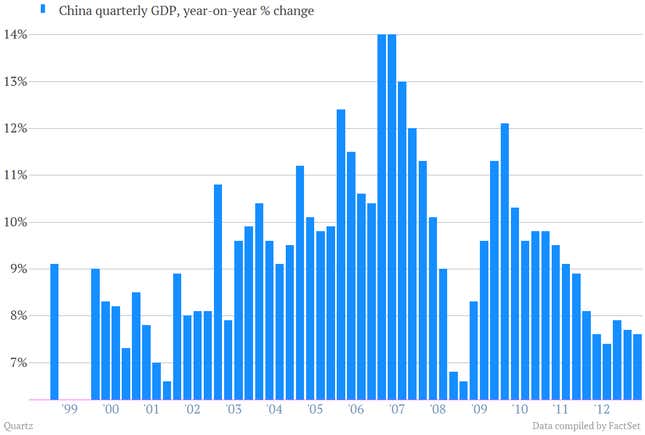

And for the record, China’s financial woes in the early part of the last decade had little noticeable effect on its economy, which continued to boom until the US financial crisis hit in 2008.