So maybe China’s not collapsing—in fact, it might be stabilizing. At least, that’s what China’s unexpectedly strong July trade data hints. Exports rose 5.1% year-on-year in July, more than analysts expected. Imports, though, were the real shocker, surging 10.9%, to hit $168 billion.

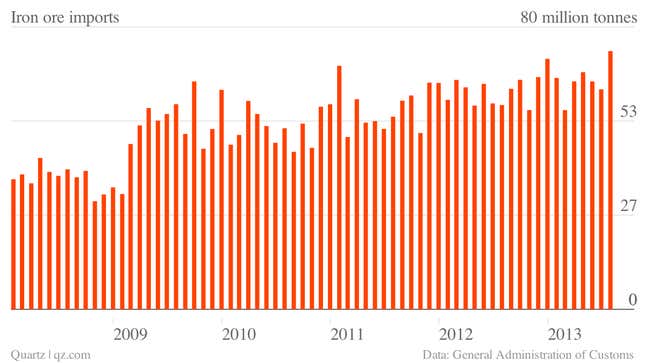

But wait—what exactly was China importing so furiously in July? Heaps of iron ore, it seems. Imports of the metal leapt to a record 73.1 million tonnes (80.5 million tons), up 26.7% on the previous year. That’s more than it imported during the many months of the infrastructure bonanza between 2009 and 2012, when the government pumped $11.2 trillion into the economy:

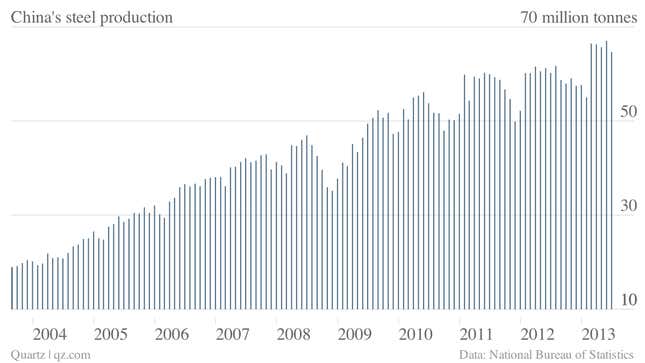

Some think this means the economy is stabilizing; “steel demand is quite strong” (paywall), Maquarie analyst Graeme Train said. But it’s weird, because China’s businesses really don’t need new steel. It’s so hard to find buyers that steel mills are now storing 225,000 tonnes of steel, up 1.8% from last year. By one estimate the industry has a fifth more production capacity than it needs. And of China’s major steel mills, 40 out of 86 operated at a loss in H1 2013.

And yet:

One answer might be that Chinese steelmakers are keeping their furnaces going not to build more skyscrapers, but quite simply as proof that they’re busy so they can keep lines of credit open with banks, as Reuters reports—probably to avoid defaulting on existing loans.

That story should sound familiar: It’s been happening in other industries all over China. The economy is slowing, crimping cash-flow and leaving companies without funds to cover bad debts taken on during the infrastructure boom. The government has told banks they must curb lending to steelmakers (link in Chinese), but this is too little, too late, given that the average debt-to-assets ratio of the 86 biggest steel companies has already climbed to 70% for H1 2013—and some companies’ are as high as 80%.

Don’t take my money, take my ore

But even this crazed pumping out of unnecessary steel may not fully explain why iron imports are so high. As Société Générale’s Wei Yao noted today, the import boom could signal “reviving [of] commodity financing as a way of coping with domestic liquidity squeezes.” In other words, the cash crunch in May and June meant steel companies started using iron ore as loan collateral once again.

Why would they do that? Because you can get a lot more credit for a pile of iron ore than the pile is actually worth, and then you can go speculate with that capital on, say, real estate. An article in Time Weekly (link in Chinese) offers a series of disquieting quotes on how this works from interviews in Shanghai, the hub of iron ore-trading:

“At present, a slew of steel trade bosses have fled. They don’t want the [iron ore] collateral—prices have now bottomed out, and since they’ve already gotten loans, they’re leaving the iron ore for the banks to handle. On top of that, we don’t know how many times a batch of the commodity has been offered up as collateral.” – a Shanghai steel trader.

Here’s how that works:

“For example, a steel company puts $1 million worth of goods in a warehouse. He then pledges this collateral to a dozen or so banks. Just like that, $1 million in goods becomes $10 million in capital. The risk to banks is obviously really high. When steel prices were up, it was hard to realize what was going on. But when they fell, companies couldn’t repay their loans and their bosses skipped town. The boss doesn’t care about the iron ore any more now that he’s turned $1 million into $10 million. So the loss all falls on the bank.” – A general manager of a steel trading company

And what the banks think about that:

“The situation is extremely pessimistic, and the risk of not getting our loans back is huge.” – a senior manager at a Jiangsu bank branch.

“About 60% of loans to steel companies are non-performing loan. At present, we haven’t received back any of the credit extended to steel companies.” – a Bank of Communications executive.

So China’s steel sector looks ugly. But bad as it is, it’s really just a microcosm of what’s wrong with China’s bank lending habits in general. Iron ore isn’t the only thing loan officers accept as collateral; copper and rubber are just another couple of examples. And those have nothing on the scale and magnitude of what’s most commonly used as collateral: property. If the steel sector can cause this much trouble for banks, imagine what will happen when real estate values start to slide.