Anytime there’s drama around US fiscal and monetary policy, commentators and policymakers typecast the US and China as debtor and creditor, respectively. Those who criticize US policies worry that China, the biggest foreign buyer of US government debt, will drive up interest rates in the US as it shifts out of Treasurys. Annoyed that loose US economic policies have eroded the value of its foreign reserves, the Chinese government is only too happy to act out the part of the indignant lender.

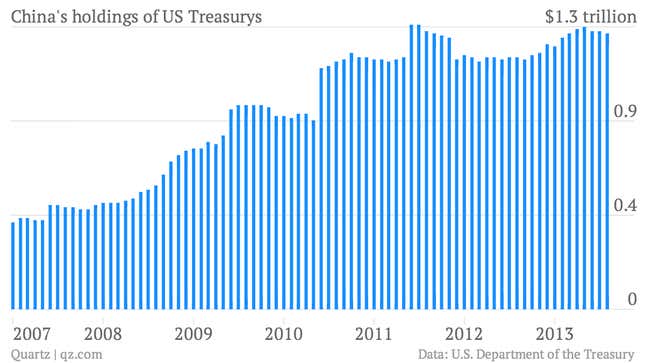

The shutdown breathed new life into that familiar drama. But it turns out China has been slashing its Treasury holdings since before the shutdown. China held $1.27 trillion in US government debt as of the end of August, a reduction of $11.2 billion and down $22.6 billion from May. It has been selling each month since then, with the exception of July. But even then, China shifted out of long-term debt in favor of agency debt, which includes things like securities of government-backed enterprises like Fannie Mae and Freddie Mac, and short-term bills, which are more liquid.

Why is it doing that? May was when the US Federal Reserve first began publicly discussing its possible winding down of bond purchases. When the Fed finally goes through with that, it will probably cause the value of US government debt to drop.

This raises some cause for concern. The flight out of Treasurys resulting from mere talk of the taper caused borrowing costs to rise “faster than the rest of the world,” as Bloomberg notes. Imagine what will happen when the Fed really does start winding things down.

But China’s role in all this is really pretty minor and part of a larger trend among foreign central banks. In August, only 48.2% of US government debt was held abroad, down from 50.4% at the end of 2012. That’s the smallest share since November 2006, says Bloomberg.

What’s more, though China’s massive cache of Treasurys means it gets a lot of attention, it hasn’t been buying US government debt in anything but small increments since mid-2011, when it held $1.32 trillion. It could sell off a chunk of those Treasurys, of course, but that would devalue the rest of its holdings. So we can probably expect China to gradually whittle down its stockpile of US debt while its sovereign wealth funds snap up higher-yielding European infrastructure assets (pdf, p.33) and the like.