For those who worry that China might dump its $1.28 trillion in US government debt and wreak havoc on the US economy, the country’s $1.5 billion investment in US Treasury debt in July might seem heartening, particularly after it sold $21.5 billion in overall US debt in June. But a closer look at the data isn’t that comforting.

First off, China didn’t buy long-term Treasury debt. In fact, it sold it, unloading $6.5 billion in longer-term notes and bonds, as Moneybeat points out in this insightful post. That marks a reversal after China bought a combined $34.7 billion worth of those types of securities in May and June.

So what exactly did China buy? Shorter-term securities called bills—which mature in a year or less. The large volume of those purchases explains why China’s overall Treasury purchases hit $1.5 billion in July, despite the $6.5 billion it sold in notes and bonds.

This seems strange, given the timing. China has long bellyached about the low returns on long-term US government debt and made noise about its intention to buy other assets. But July wasn’t exactly the best time to act on those complaints given that long-term debt was unusually cheap. In fact, prices for 10-year Treasury notes hit a 23-month low on July 8. That proved inviting for everyone else; overall, foreign investors bought $31.1 billion in long-term US securities in July, after dumping $67 billion in June.

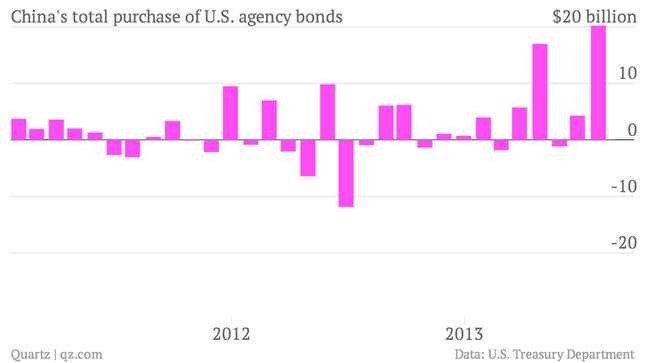

China also snapped up $20.2 billion in US agency debt (home mortgage-backed securities, as well as those sold by government-backed enterprises like Fannie Mae and Freddie Mac). That’s the most China has ever bought of that type of debt, surpassing its record $16.9 billion purchase in April. This isn’t that surprising given that these securities tend to have a much higher yield.

Though it’s too early to tell whether China’s central bank is actually pulling back from long-term US government debt, July’s data offer a reason to keep watching. China’s rush into mortgage-backed securities could help keep down US mortgage rates down, offsetting any pullback in MBS purchases from the Federal Reserve. And if the country continues to lean more on short-term debt purchases, that might be a sign that the People’s Bank of China wants to keep its assets liquid. Either could signal that China has fallen out of love with long-term US Treasurys.