The great rush for smartphones and tablets in the mature markets of the western world is over.

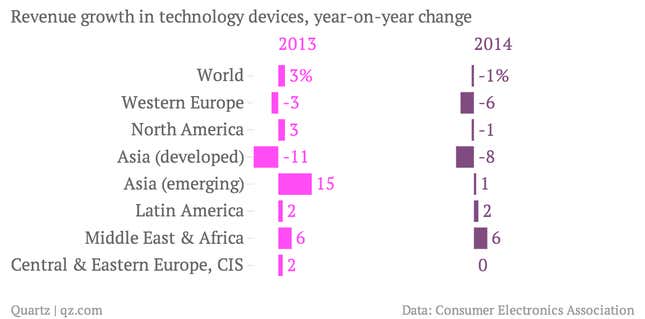

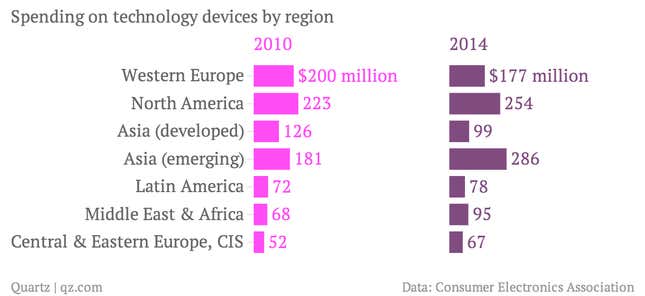

According to numbers from Steve Koenig of the Consumer Electronics Association, an industry body, global spending on technology devices such as smartphones, tablets and cameras, TVs, game consoles and the like will shrink to $1.055 trillion in 2014, down 1% from $1.068 trillion in 2013.

Smartphones and tablets alone account for 43% of that amount, with the share of everything else declining steadily since 2011. And the single largest contributor to revenues will be not North America but what the CEA calls “emerging Asia,” which includes China, India, Pakistan, Bangladesh and Indonesia, states that together contain about 3.2 billion people. The developing world will buy 70% of all smartphones in 2014, up from less than half in 2011.

Two things are responsible for this dramatic shift. The average selling price (ASP) of smartphones has dropped from $444 in 2010 to $345 in 2013 and will fall further to $297 in 2014, making the devices more affordable for ever more people. (Note that this is the average; significantly cheaper smartphones exist.) The same thing is happening with tablets. Emerging markets will buy 42% of all tablets in 2014, up from less than 30% in 2012. All of this should be intuitive; if you sell more devices at lower prices to people in poorer countries, market share as expressed in unit sales will go up.

But there is another factor responsible for the rich world’s declining contribution to tech revenues: There’s nothing new for people in Western Europe, North America, and Asia’s developed markets to buy. “We’re waiting for the next wave of innovation to help lift it [growth] again,” Koenig told the Financial Times (paywall). So as Western markets and the richer cities of the developing world come to be saturated, device makers will increasingly have to rely on cheaper phones sold in volume. That’s great news for the likes of Xiaomi and Micromax, but a challenge for the Apples and HTCs of the world.