The big drama in China right now is who will end up swallowing losses on “Credit Equals Gold #1,” a $496-million high-yield investment product tied to a coal company gone bust. The outcome will have resounding implications, and not just for shareholders in Industrial and Commercial Bank of China (ICBC), the world’s biggest bank by assets, which sold the wealth management product (WMP).

It will also set a precedent for who will bear losses on other products used to fund China’s $5-trillion shadow banking system of off-balance-sheet lending. As we approach the Jan. 31 climax, when the product matures, the plot keeps twisting:

- From the sidelines of Davos on Jan. 24, Jiang Jianqing, ICBC’s chairman, told CNBC his bank wouldn’t “rigidly [meaning ‘no matter what’] pay out the funds to investors,” saying it was a “very good opportunity to educate the investors.”

- But, wait. That same day an anonymous ICBC head told the Shanghai Securities News, the official state financial rag, that ICBC would bear some responsibility, because it was concerned for its reputation. As we argued last week, if ICBC’s reputation suffers, so will its profitability.

- Other rumors suggest ICBC might not have to. Earlier this week, China Credit Trust Co, the trust company, said it was raising funds from new investors, and that the government may let the debt-saddled coal company resume production (a move of spurious merit given collapsing coal prices).

- Rumor has it the government of Shanxi province, home of the broke coal company, may pony up half the funds to repay investors, with ICBC and the trust company potentially chipping in 25% apiece.

It’s unclear who, if anyone, will pay. But whichever option ICBC goes with, it will have a big impact on banking, finance and the economy. Jiang, after all, is right: His customers don’t assume personal responsibility for investment choices. And if ICBC covers the losses on “Credit Equals Gold #1,” all its other investors and future customers will expect the bank to pay up whenever trust products go bust.

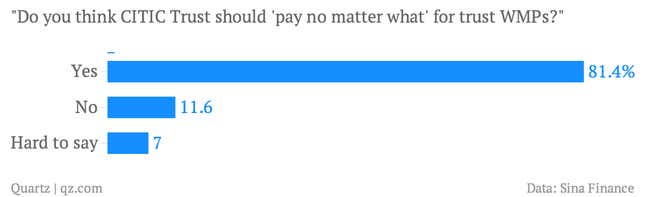

So why not hang investors out to dry? Check out the results of this recent online survey (link in Chinese):

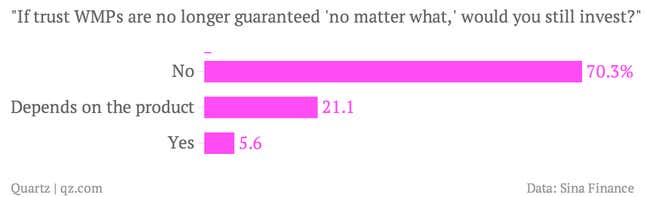

And this:

Though conducted among customers of CITIC, a competitor of ICBC’s, the conclusion still holds: Stop guaranteeing trust-linked WMPs, and investors will flee.

That’s bad news considering WMP sales are a crucial driver of bank profit growth. In Q3 2013, ICBC brought in 28.1 billion in fees including WMP sales, a 13% year-over-year increase; net interest income rose only 4.1%.

The “Credit Equals Gold #1” incident will feed a much larger problem facing China’s economy. Because banks don’t need to sock away capital against WMP-funded loans, they allow far more credit into the system than if WMPs were counted as official bank loans.

China’s financial system and its growth model are hooked on this credit. Look no further than the June 2013 cash crunch, which regulators brought on when they blocked a big source of WMP investment. An abrupt pullback from retail investors would cause something similar—and would have a much more permanent impact on the economy.