Last month, China’s banking sector dodged a potential catastrophe when a mystery group stepped in at the 11th hour to pay investors in the now-infamous “Credit Equals Gold #1, a defaulted $495-million trust product. Barely two weeks have passed and now another trust product has failed to pay back investors.

This product—known as “Songhua River #77 Shanxi Opulent Blessing Project”—is unlikely to cause more than a minor scare. But episodes like Credit Equals Gold and Opulent Blessing Project are just the beginning, says Mike Werner, senior analyst at Bernstein Research, in a note today.

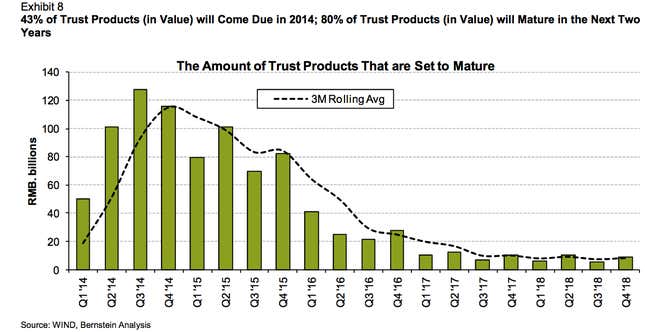

One reason is that more than 43% of the 10.9 trillion yuan ($1.8 trillion) worth of outstanding trust products come due in 2014. (Trust companies manage client investments through such products, providing an alternative credit source for companies that can’t convince commercial banks to lend to them.)

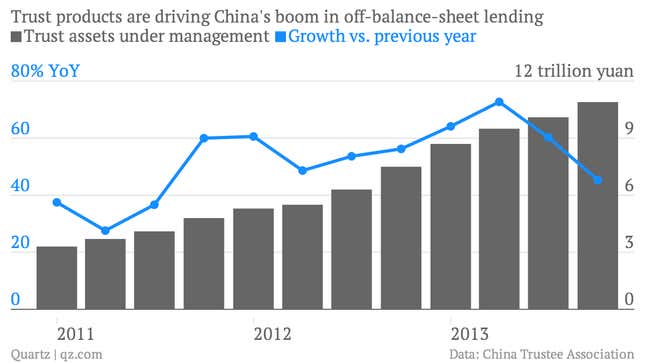

Werner argues that rising interest rates on the interbank market reflect the Chinese government’s crackdown on shadow (a.k.a. off-balance-sheet) credit and have already taken their toll on the trust industry. While assets managed by China’s trust firms are up 46% from the end of 2012, that growth is less than the 73% year-on-year growth in Q2 2013. Rising rates will make it hard for bankrupt companies to find the cash to pay back investors, he says.

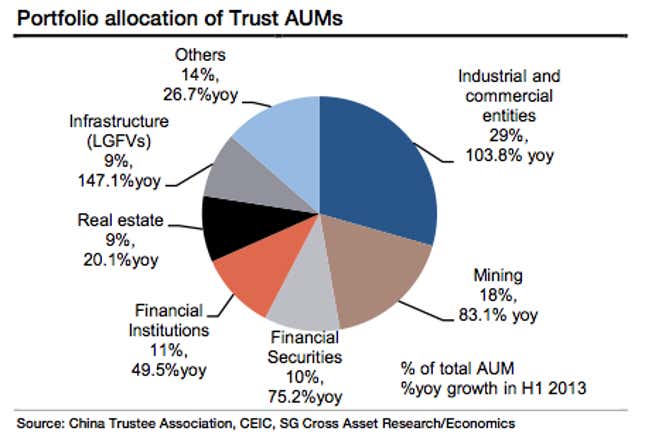

Many trust products have been able to offer yields high enough to attract well-heeled investors because they’re lending to distressed industries at high rates. It’s telling that both Credit Equals Gold and Opulent Blessing Project were invested in coal, an industry whose flabby production capacity has left scores of companies losing money for more than a year now.

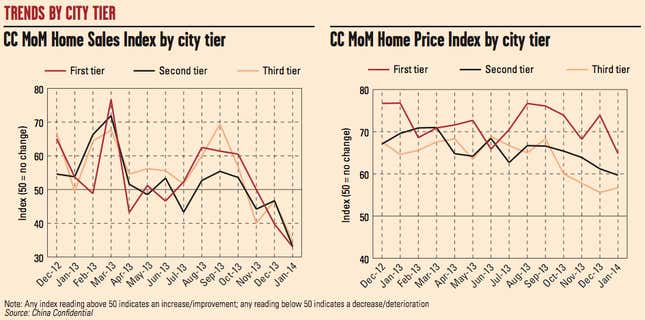

Coal isn’t the only problem sector. So is infrastructure, investments which often involve projects of little value, but that local governments use to finance themselves. And let’s not forget real estate. The lack of investment options in China has whipped up a housing investment craze such that, in some areas, home ownership may average 200%. There are signs that bubble may finally be bursting, as sales have started slumping since Dec. 2013:

Together, those sectors total around 40% of trust company investments. That puts the odds of default pretty high. Still, the real issue isn’t whether products default (of course they will). It’s whether the central and local governments allow the default. Doing so will cause some real financial drama as investors reckon with the true value of their assets. But until those defaults start happening, the desperate risk-taking will continue.