As concerns mount about the health of China’s economy, and particularly the possibility of a property bubble bursting and a sharp rise in bad loans, everyone is wondering who is going to be left holding the bad debt.

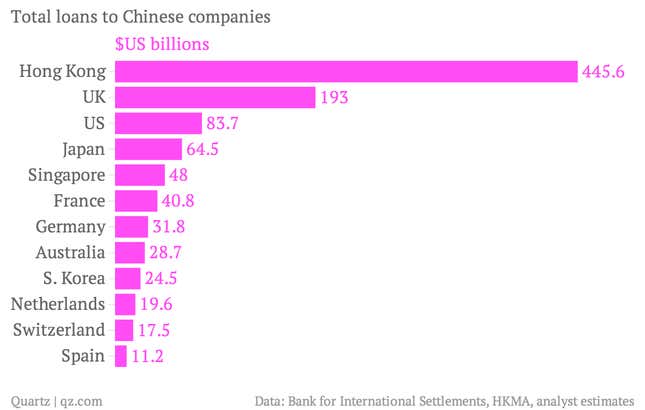

While China’s own state-run banks provide much of the liquidity for the country’s businesses, foreign banks have stepped up lending to China as well in recent years. They now have over $1 trillion in loans outstanding to China’s public and private companies, according to data from Switzerland’s Bank for International Settlements (BIS), which advises central banks. Of these, Hong Kong’s banks remain the most exposed to China, as Quartz recently reported, with about $446 billion (Table 3.11.3) in loans outstanding to Chinese companies and banks as of this month.

After Hong Kong, the UK takes the lead by far. (As a note, banks in several countries, particularly in emerging markets like Russia or Latin America, aren’t listed, because they don’t report to the Bank for International Settlements):

Some UK banks’ long historical ties with China—HSBC and Standard Chartered, in particular, have roots in Hong Kong—mean they have been lending there for decades, though in recent years, loans to Chinese companies and banks have also grown steadily. Neither will be a good thing if analysts’ worst fears about China come to pass.

Regulators in Britain are concerned, and have quietly asked these big banks to stress-test their lending portfolios, to see if they could withstand a China crash. HSBC explained in its annual report (pdf, pg 139) that one such test included a “China hard landing scenario” which was “based on a pronounced economic slowdown in mainland China and Hong Kong.”

Of the $660 billion in loans made to Chinese companies by banks in the countries that report directly to BIS, more than half, $326 billion, were made to Chinese banks. The foreign banks who report to BIS have another $146 billion in exposure to China through derivatives and “credit commitments.” In the UK’s case, on top of the $193 billion in loans, there’s another $32 billion in derivative and credit exposure to China.

The vast majority of the loans made by foreign banks to Chinese companies are probably direct or indirect trade financing, analysts believe—short-term loans that grease the wheels of global trade by giving exporters advance payment for goods. But trade financing can also be risky, at least the way it is being done in China.

Over-invoicing of export trade is a common way to commit tax fraud, for example. Another common deceptive practice is faking imports to get low-interest rate Letters of Credit (LCs) from banks, and then investing the money in a higher-return financial product.