This post has been corrected.

Throughout 2013, China’s housing market surged. That run may finally be over.

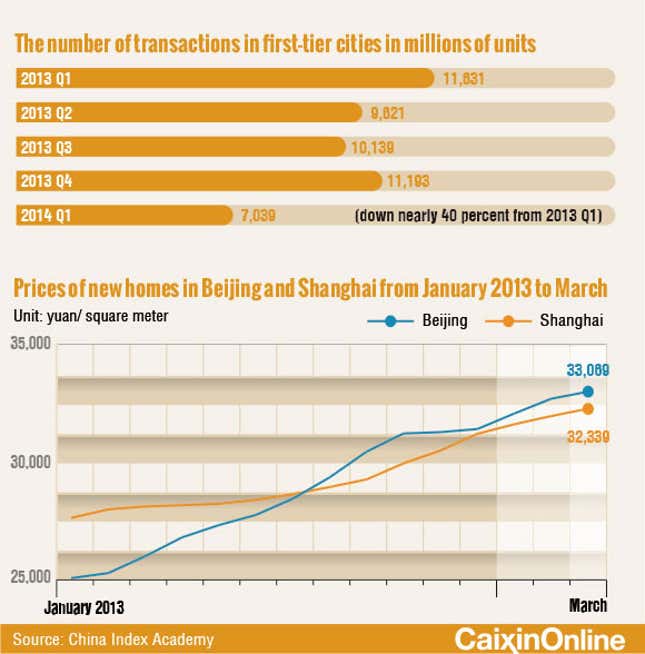

Q1 home sales in Beijing, Shanghai, Guangzhou and Shenzhen fell more than 40% from the same quarter in 2013. That’s scary. Real estate is a huge driver of China’s GDP growth. And since China’s property sector is funded by its credit boom, many fear a housing market slowdown could easily become a crash, dragging down China’s financial system along with it.

Whether or not it’s time to start the doomsday countdown depends on a question, though: Does China actually have a housing bubble? The answer depends on whether you think China’s soaring housing prices are due to speculation (which would mean a bubble) or a genuine lack of supply.

Since China first privatized the property market in 1998 (pdf, p.3), it’s gotten harder and harder for the government to keep track of housing data. After all, China has more than 160 cities with populations that exceed one million—and many hundreds the size of, say, San Francisco or Frankfurt.

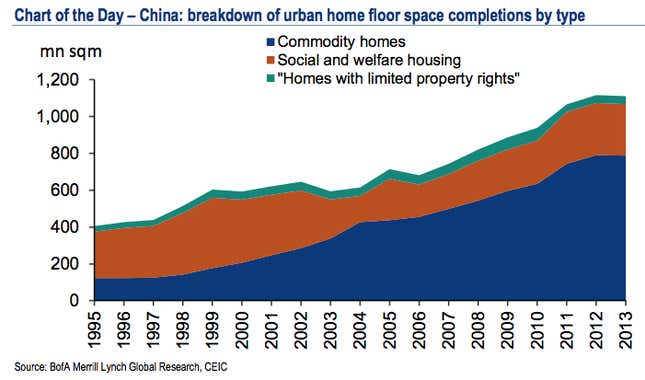

Officially, China added 787 million square meters (8.5 billion square feet) of new residential floor space in 2013, down 0.4%. Count public housing and homes that are technically rural, and Bank of America/Merrill Lynch’s Ting Lu comes up with 1.1 billion sq m of new urban home space.

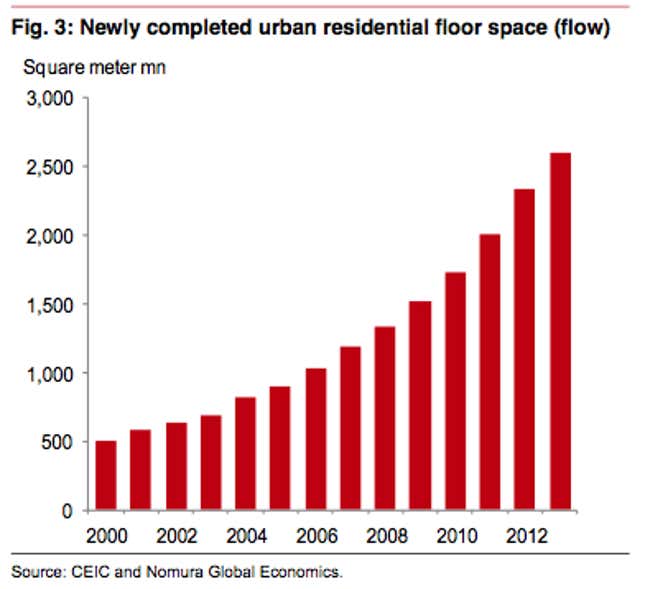

But Nomura calculates that number at closer to 2.6 billion sq m, bringing the total to 37 sq m of new residential floor space per urban resident—higher than the UK’s 33 or Japan’s 35.

Quantity is only half the story, though, says Rafael Halpin, an analyst at China Confidential. ”You could argue quite easily that there has been excessive buildout—that the current supply is sufficient—if you’re looking purely in terms of the number of houses in China,” Halpin tells Quartz. “But you have to take it a step further and say, ‘What is the quality of those houses?'”

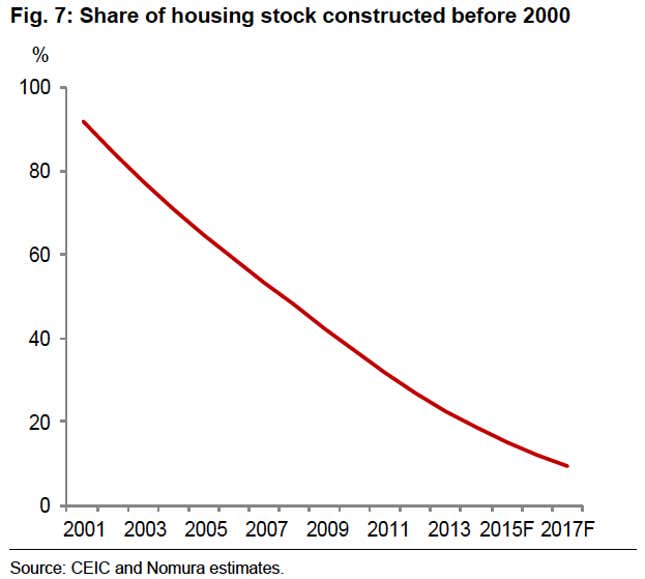

Before 2000, homes were built to be sold cheaply to poor and middle-class families. In addition to being small and spartan, these flats often included kitchens or bathrooms shared with the entire floor—no longer acceptable to today’s rising middle class.

Still, many of the sub-par homes are centrally located, so they’re convenient enough that many families still live in them, saving money to invest in posh apartments for themselves or their children. What’s more, families hang on to them when they upgrade to fancier digs, unable to sell and waiting to be bought out by developers when the land parcel sells. As of the end of 2011, around 47% of China’s overall housing stock is such “crappy legacy housing,” says Halpin. He estimates that, of housing stock used as a primary residence, only around one-third of home owners are living in “commodity houses”—i.e. those purchased and sold on the market—with the remainder either social or legacy housing.

Subtract that housing stock, then, and it turns out China might actually have a housing shortage. That’s why “you still have very strong demand for people wishing to upgrade,” says Halpin. And surging prices.

Zhang Zhiwei, head economist at Nomura, disagrees. Rapid construction in the last five or so years has dramatically changed the quality of China’s overall housing stock, he said in a recent note. While pre-2000 homes made up around 53.2% of the total in 2007, that figure had dropped to 22.4% in 2013, calculates Nomura, and will fall to just 9.1% by 2017 if developers keep building at the current rate.

China’s lousy official data make it impossible to know what’s what. On top of that, its knotty household registration system limits who can buy property where, distorting potential demand and obscuring the country’s actual urban population. That means we may need to wait and see if prices keep falling—a sign that there was a bubble—or level out as they bump up against real demand.

Correction: April 5, 2014 1:30pm (EST): This post has been corrected to reflect that China Confidential estimates that, as for 2011, about 47% of the housing stock was legacy housing (the original post quoted Rafael Halpin as saying 60-70%). The article has also been updated with China Confidential’s estimate of the percentage of commodity homes as a share of the total housing stock.