The long-awaited popping of China’s housing bubble may finally be here. Although a slew of individual cities had seen their property markets collapse since 2012, in Q1 2014, the trend went national.

“Every property market leading indicator at the national level turned down,” writes Zhang Zhiwei, economist at Nomura, in a note. “The question is no longer ‘if’ or ‘when’ but rather ‘how much’ China’s property market will correct.”

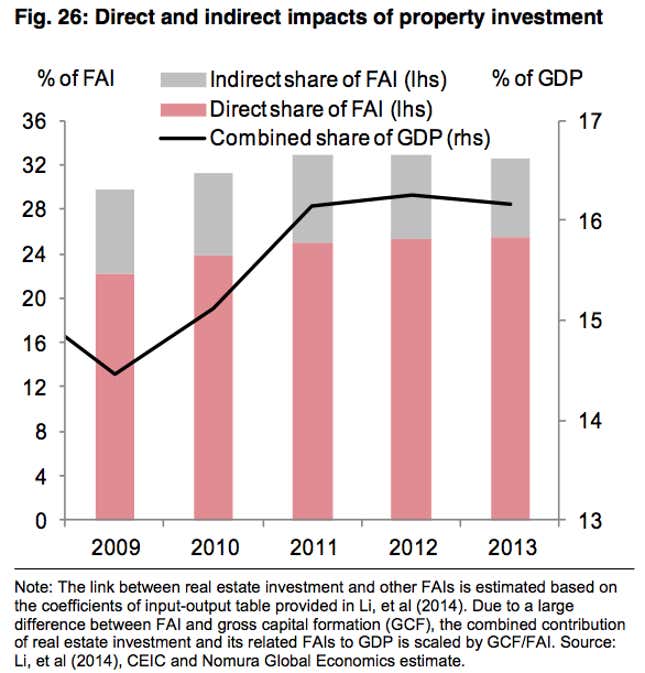

This is scary stuff. Falling sales tend to discourage property investment, which generates at least 16% of China’s GDP, says Zhang. A six-percentage-point decline in property investment translates to a 1ppt drop in GDP growth, he calculates. In other words, if property investment were to fall from 2013’s 19.8% to, say, 7.8%, China’s GDP growth would fall to around 5.8%. Nomura expects a less dramatic drop—for investment to slide to 13.8%, dragging GDP growth down to 6.7%.

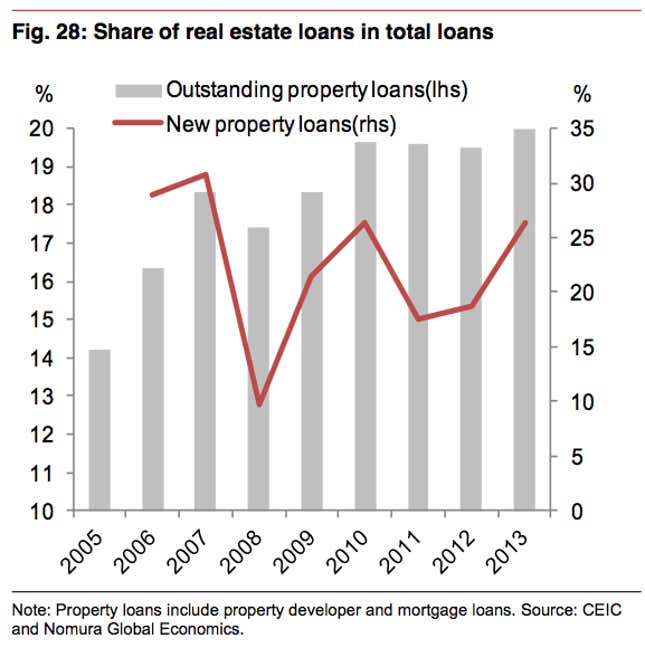

Worse, real estate is the linchpin of China financial system. One-fifth of all outstanding loans are property loans, compared with 14% in 2005, says Nomura. And those are the loans recorded on bank balance sheets; developers also borrow heavily from shadow channels. An enormous percentage of loans use property as collateral, as we explained recently, or are based on expected profits of future property sales.

Is it too late to prevent a catastrophic pop? Maybe, argues Nomura. The central government will need to launch fiscal stimulus and loosen monetary policy to encourage borrowing. Local governments will need to relax home-buying restrictions—something already underway in many cities.

Two factors—policy and demographics—might make that much harder than it seems, though.

In fact, Mao Daqing, vice chairman of prominent developer Vanke, recently alarmed the industry when his private remarks on both factors were illicitly recorded and uploaded online (link in Chinese, registration required).

Mao questioned whether the tools Nomura proposes would even be effective, according to a translation by JL Warren Capital, a research firm. The new administration, Mao said, inflated the housing bubble with its over-reliance on monetary policy to stimulate the economy. Fiscal stimulus, he added, doesn’t create actual value. Instead, the country needs private-sector expansion to boost productivity.

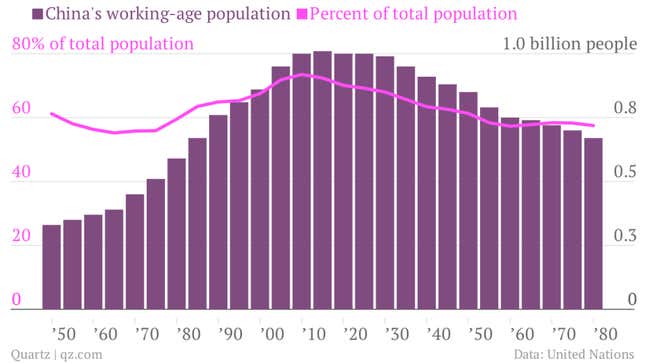

Mao also underscored the impact of demographics, a point we’ve flagged before: Rapid aging of China’s population means that future workers will have less and less disposable income to spend on housing in the next two decades.

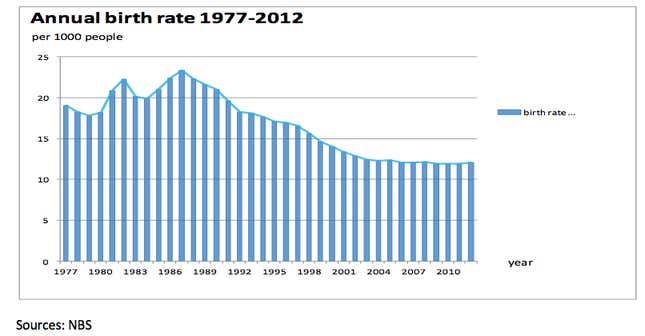

Taking his argument one step further, JL Warren demonstrates how demographics might also explain the current collapse in housing demand. China’s birth rate peaked in 1987, and since people marry approximately 25 years later, that means demand for “new household formation” homes maxed out in 2012.

This implies that things could get a lot worse as the bubble pops. With credit cheap and abundant, developers have been pumping out new housing like there’s no tomorrow. And since homes take on average 2.5 years to complete, developers will pile on excess supply for two to three years to come. But they’ll need to sell those homes to repay loans. That means they’ll have to slash prices, scaring off speculative buyers, which JL Warren assumes make up around 15% of commercial purchases, compounding the collapse.

If that’s what’s behind the current glut of housing supply, it also means there’s not much the government can do to prevent the next three years from turning very ugly indeed.