Last year, Maker’s Mark got a 45% jump in sales after the whiskey brand announced that it would water down its bourbon to meet climbing demand, which prompted panicked customers to stock up on the unadulterated stuff. (Then Maker’s didn’t go through with the plan.) Now, the Kentucky-based Buffalo Trace distillery has announced impending bourbon “shortages,” causing a mild uproar (perhaps all bourbon drinkers can muster after being jerked around by Maker’s Mark). Meanwhile, in a case of very poor timing, low lumber stocks mean that distilleries are running low on the barrels they need for aging.

It’s hard to say if there is a true shortage, since whiskey reserves remain a trade secret. But it’s clear that we just can’t stop drinking bourbon. And apparently, we like the good stuff.

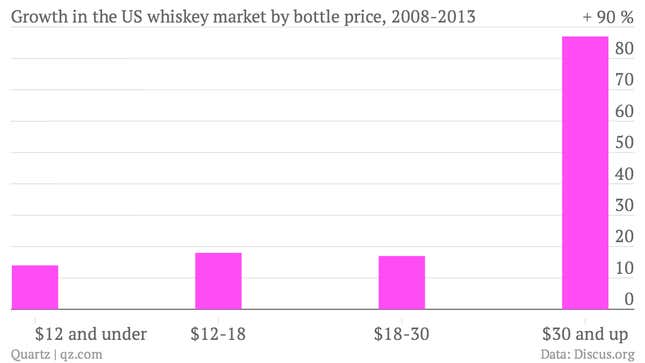

To be called bourbon, the spirit must be made in the United States, from a fermented mash of grains including at least 51% corn, and stored in new charred oak containers for at least two years. The US also remains the largest consumer of bourbon, drinking about 73 percent of the stock domestically, according to the Distilled Sprits Council of the US. The growth has been at the top end of the market; sales of pricier bottles such as Woodford Reserve, Knob Creek, and Basil Hayden’s have nearly quadrupled over the last decade.

Fine whiskey takes time (though some innovative distillers are working on changing that), which is part of the problem with a bourbon—distillers can’t ramp up production in short order. So even as consumers are willing to pay nearly a thousand dollars for a bottle of 15-year-aged Pappy Van Winkle (one of Buffalo Trace’s several bourbon labels), there are only so many of those bottles to go around.

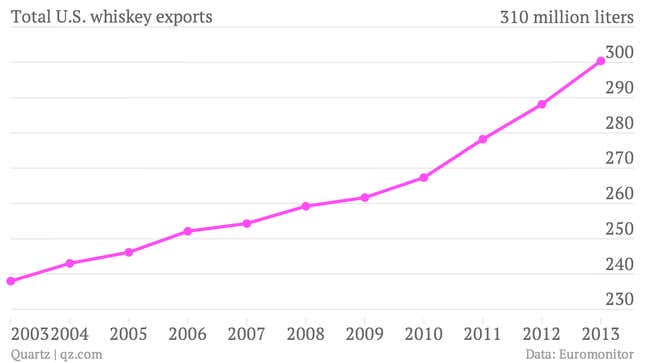

And the rest of the world has a hankering for bourbon, too. For the last five consecutive years, global exports of US whiskey—the vast majority of which is bourbon and Tennessee whiskey—have broken records. Last year, they surpassed the billion-dollar mark.

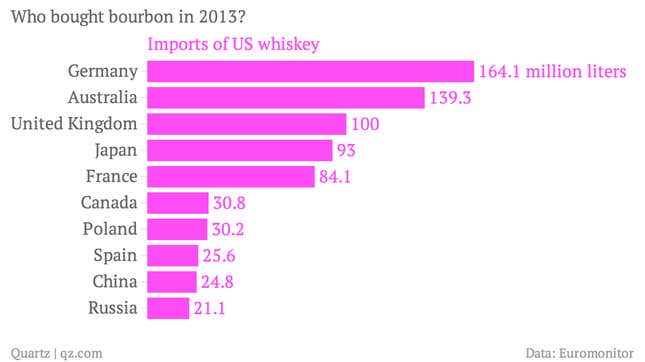

So where is it all going? Last year, Germany bought more US whiskey by volume than any other country, with Australia not far behind.

And the real emerging markets for US whiskey are, well, the emerging markets. Mexico’s imports of US whiskey have tripled by volume since 2008; Brazil’s have increased fivefold; and Turkey’s have multiplied by 10. No word yet on whether customers there have started to develop a taste for bacon-infused bourbon Manhattans.