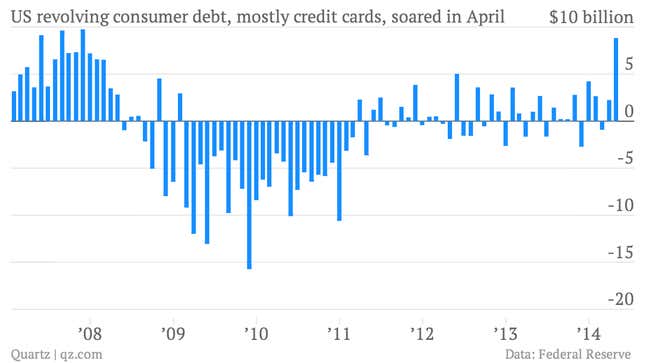

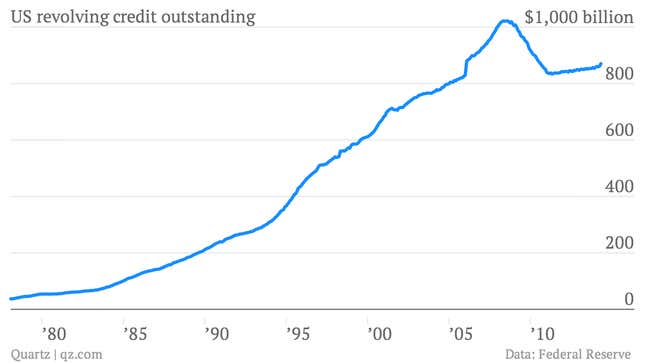

America’s addiction to credit cards is flaring up again. This is either really good news or really bad news.

As we’ve told you before, one of most unappreciated shifts in the American financial landscape since the financial crisis hit has been the downturn in credit card usage.

Why the shift? A big reason has to do with sound public policy designed to prevent predatory lending. The passage of the US Credit Card Accountability, Responsibility and Disclosure Act—the CARD Act—in 2009, and its 2010 implementation, completely reshaped the American credit card industry. Here’s some of what the CARD Act did:

- Blocked credit card companies from extending credit without assessing the customer’s ability to pay

- Implemented rules on marketing to people under the age of 21 to crack down on abuses at college campuses

- Limited a credit card company’s ability to levy penalty fees

- Restricted the circumstances in which the company could jack up interest rates

So is an increase consumer credit use good news or bad news? Well, if you’re simply rooting for GDP growth, without regard for how it occurs, you can argue that this is a great sign. Roughly 70% of US economic activity is driven by consumption. And a rise in credit card use suggests that consumers are ramping up their buying. (Other data, such as the worsening US trade balance on higher imports of consumer goods (paywall), would seem consistent with that view.)

But if you care about the long-term sustainability of US economic growth and the financial health of American households, it’s not particularly heartening to see signs of backsliding into a widespread reliance on credit cards.