I try to watch as much of the economic data flow as I can, but last week, I might have missed the most-important global turn-of-the-screw amid the deluge of high-profile US data, such as Friday’s jobs report.

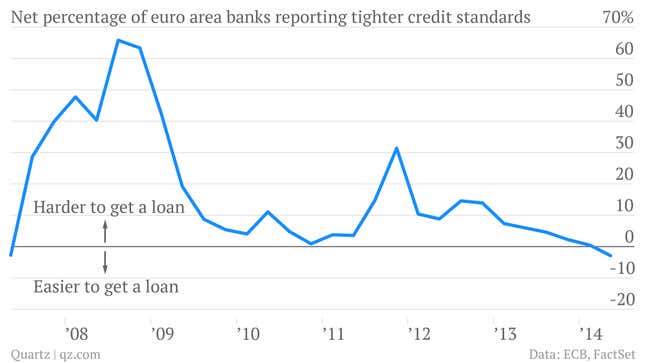

The tidbit? Banks in the euro zone made it easier to get a loan for the first time since late 2007.

Europe has been an albatross around the neck of the global economy for years. That’s largely due to a zombified financial system that’s been focused on its own survival rather than on providing the credit that serves as the lifeblood of any modern advanced economy.

That’s changed over the couple of years as Mario Draghi’s promise to do “whatever it takes” has been followed up with actual action aimed at bringing the European debt crisis under control. Prices for European government bonds have risen, bolstering the financial position of European banks that own so many of them. The financial crisis is effectively over.

But a pesky economic crisis remained, with sky-high unemployment—even higher youth unemployment—and puny growth.

Those problems won’t go away in a hurry, but the return of easier lending standards, even if they are only just a tad easier, is a very good sign. It means that the banking system is once again interested in supplying credit.

The question, however, is whether demand for credit will return. The odds are it won’t be soon. Amid the ugly economic conditions that prevail in Europe right now, households and corporations are rightly skeptical about the benefits of expansion.

That’s why levels of loans outstanding continue to decline. Credit outstanding to non-financial euro zone corporations fell 2.3% in year through the end of June, slightly better than the 2.8% decline in the year up to the previous month. It will take a lot of coaxing before borrowers return to the European banking system.

But the decline in lending standards suggest that coaxing has finally begun. And that is a very good thing.