This last week was a big one in that it showed broad-based improvement in the global economy. The US recovery seems to be gathering strength, if not picking up speed. Signs of hope emerged in Europe. And Asian markets telegraphed growing expectations that governments there will take action to kick economic expansion into a higher gear. Here are the key developments from the week that was:

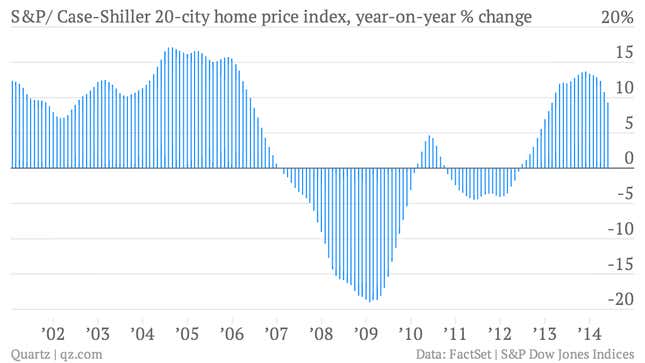

US home price gains slowed, but they still rose 9.3% in May (paywall)

US consumer confidence hit a post-crisis high

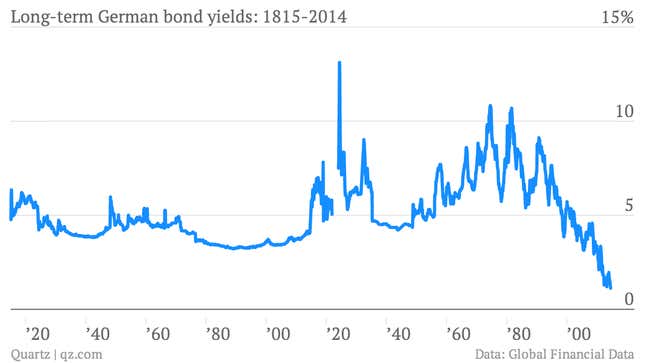

German bond yields touched all-time lows amid unrest in Ukraine

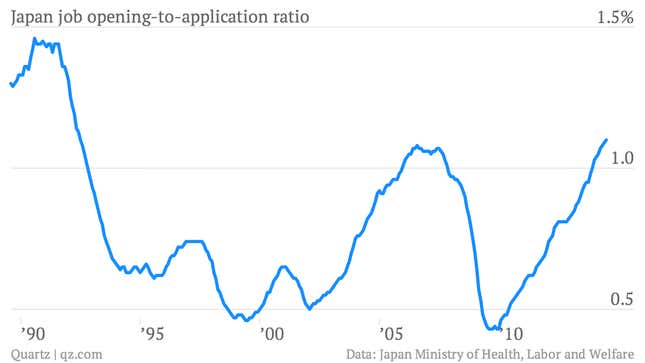

Japan reported some of the strongest labor demand in decades

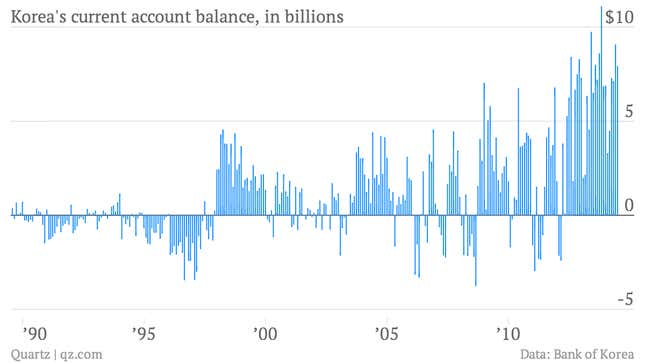

Korea posted another giant current account surplus

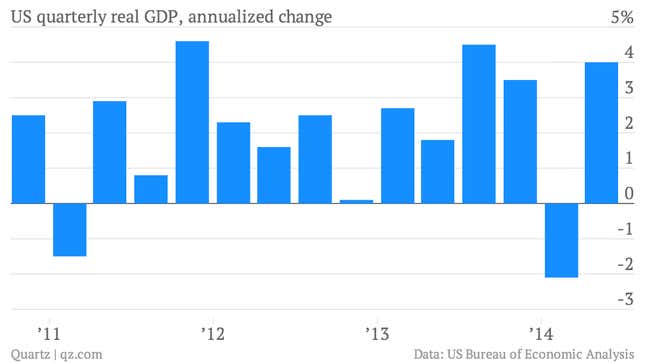

US economic growth surged in the second quarter, after hitting a first-quarter pothole

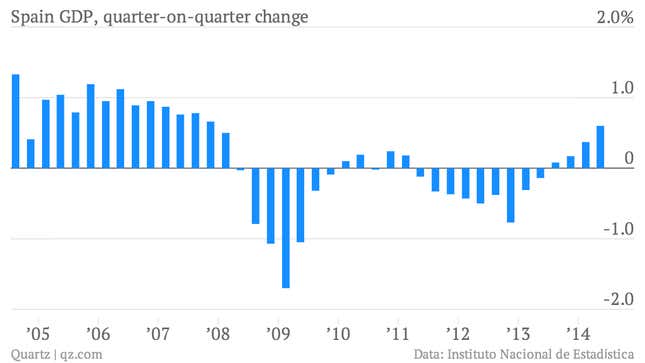

Spain, the euro zone’s fourth-largest economy, grew faster than economists expected during the second quarter

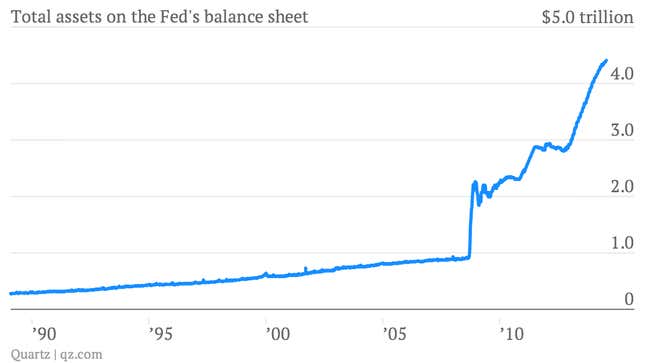

The Fed acknowledged some economic improvement, and continued tapering the bond-buying programs that have expanded its balance sheet

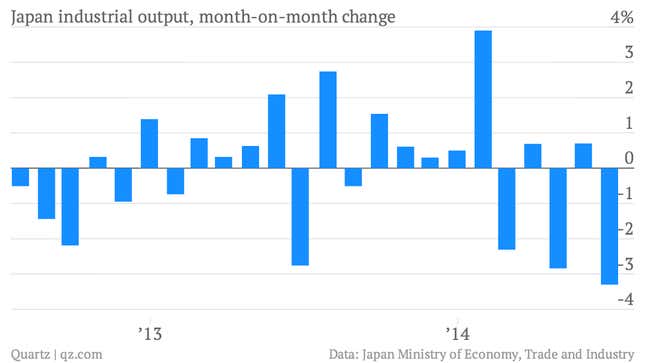

Japan’s industrial production data looked quite weak

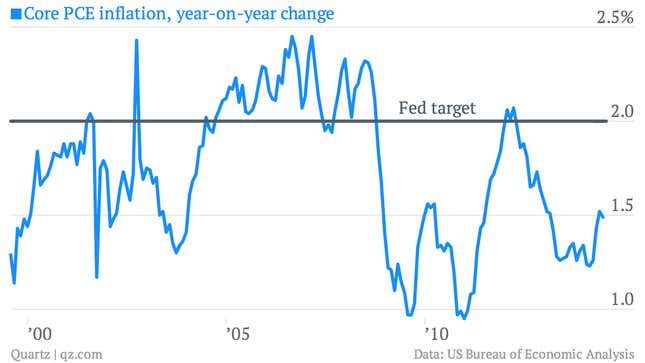

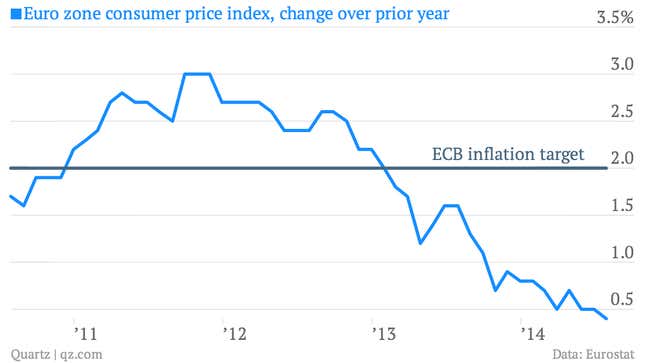

Europe continued to flirt with deflation

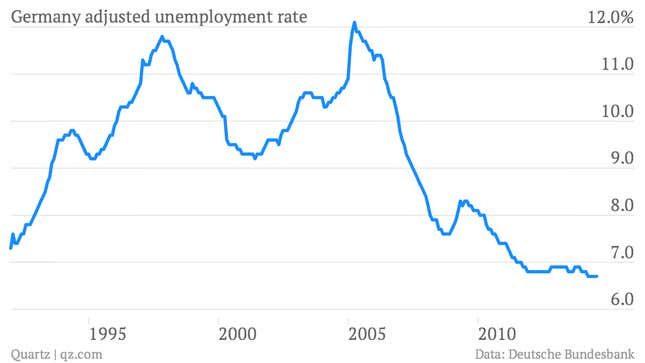

Germany’s unemployment rate remained at multi-decade lows

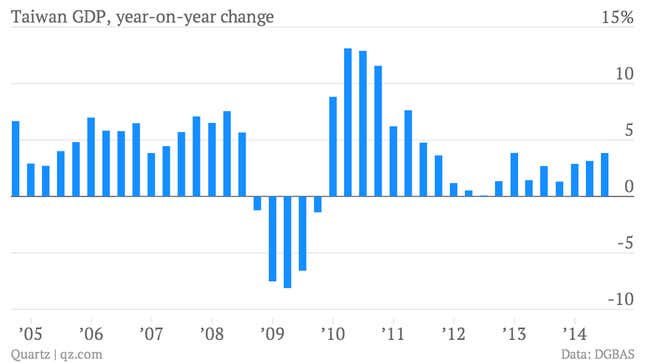

Taiwan’s economy grew faster, thanks to exports and investment

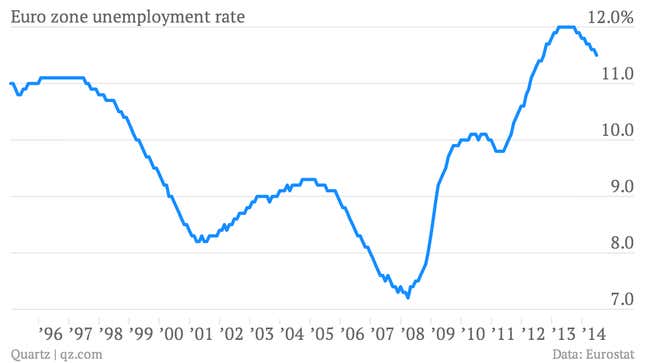

European unemployment continues to fall from historically high levels

The US job market continued improving in July, the sixth consecutive month in which more than 200,000 jobs were created

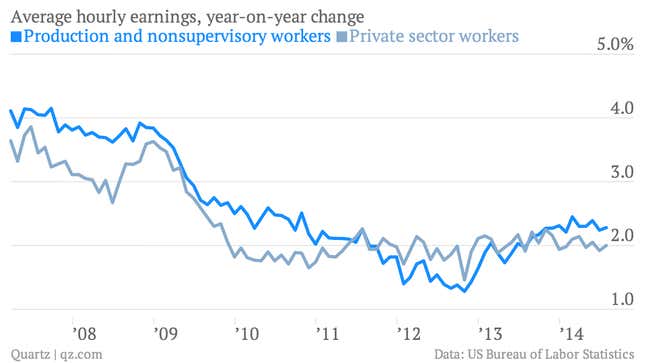

Though US wage growth remains quite muted

And there is little sign of US inflation, according to the Fed’s preferred measure