The time for talk is over. The European Central Bank has taken criticism for fighting to the euro zone’s economic malaise with words instead of deeds. Two years ago, ECB president Mario Draghi said that the bank would do “whatever it takes” to avert a collapse. Since then, as its counterparts in the US, UK, and Japan pumped up their economies by buying hundreds of billions of dollars worth of bonds, the ECB stuck to more conventional measures. And talk. Lots of talk.

But today Draghi ran out of conventional ammunition. The ECB cut its main interest rate to just 0.05%, from 0.15%. This is as low as Draghi is willing to go, he said. We are now in the weird and wonderful world of “unconventional” monetary policy. As economic growth falters and the euro zone flirts with deflation, Draghi’s pledge to do ”whatever it takes” will finally be tested.

The markets weren’t expecting much from the ECB today. In June, Draghi said that interest rates were unlikely to go lower—”I would say that for all the practical purposes, we have reached the lower bound.” The rate cut alone startled traders, and their jaws dropped further when Draghi later announced something that sounds like quantitative easing. As a result, the euro fell out of bed:

Next month, the ECB will start buying asset-backed securities and bonds from banks, it said. Swapping cash for collections of loans and mortgage-backed bonds will, in theory, encourage banks to lend more to the euro zone’s credit-starved economies. We don’t yet know the precise details of the program, which will be released next month.

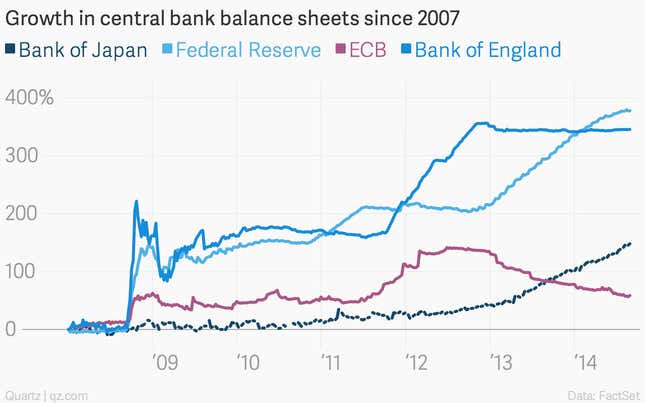

In a few weeks the ECB will also begin extending cheap emergency loans to banks, as part of an initiative first announced in June; on top of the new bond-buying program, it’s Christmas come early for the euro zone’s beleaguered banks. Not before time, the ECB’s balance sheet is about to play catch-up with its counterparts:

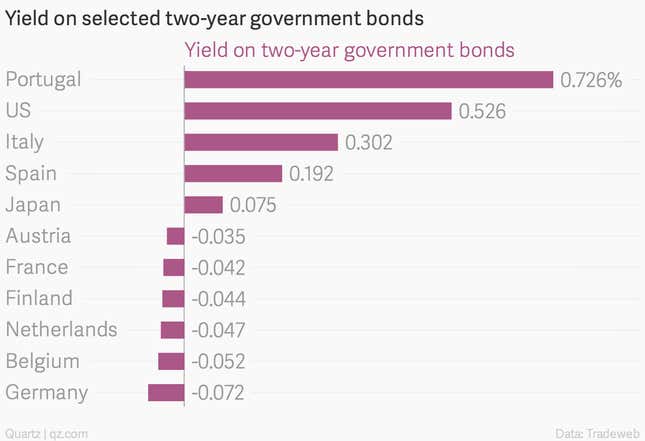

Bruegel, a think tank, reckons that the ECB needs to spend 1% of euro zone GDP to boost inflation by 0.2%. With headline inflation now running at just 0.3%, boosting it closer to the ECB’s 2% inflation target implies hundreds of billions of euros in purchases. This prospect pushed bond yields down sharply today (prices move inversely to yields)—for a host of countries, investors must now pay governments to lend them money:

Buying bonds at sufficient scale will be far from straightforward. Draghi revealed that today’s decision was not agreed unanimously by the bank’s board:

Some traders are taking this to mean that full-blown quantitative easing—that is, buying government bonds in bulk—is on the table, pushed by voices from the hardest-hit member of Europe’s “periphery.” But others note that the hawks—basically, the Germans—will be reluctant to let the ECB spend with abandon.

Whatever the case, the surprisingly aggressive moves by the ECB today sparked a rally in a broad range of assets today. The markets in Draghi’s native Italy—home to some of the euro zone’s shakiest banks–had a particularly good day.

When the ECB president delivered his famous ”whatever it takes” line, he added, “believe me, it will be enough.” We’ll soon find out.