If you watch the Russian ruble with any regularity, you are at risk of getting whiplash. Violent daily moves in the currency—both up and down, but mainly down—have become the norm.

Jitters over the country’s deteriorating economy, Western sanctions, and the falling oil price have battered the currency—it’s down around 40% so far this year. The Russian central bank stopped automatically supporting the ruble last month, after burning through billions of dollars in reserves with very little to show for it. The bank said it would intervene to prop up the currency only when its movements threatened financial stability.

We now know how the central bank defines instability. A huge drop against the dollar at the beginning of the week triggered $700 million worth of intervention, according to data released today. But the slide quickly resumed, with new all-time record lows against the dollar set both yesterday and today. A sudden rally in the ruble around midday in Moscow suggests that the central bank is at it again.

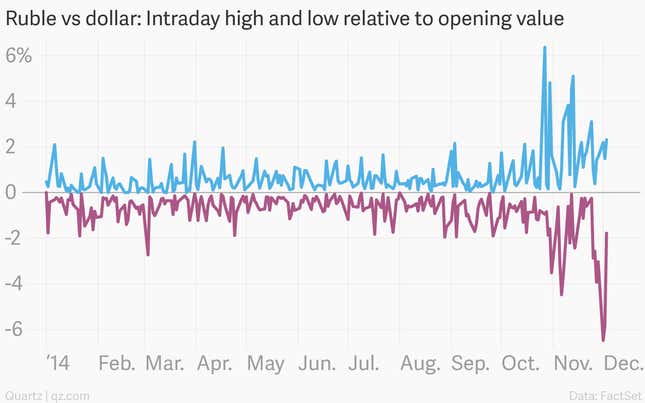

These days, it’s not unusual for the ruble’s daily trading range against the dollar to swing by 5% or more:

These are huge moves for a currency. They represents a major headache for any person or business who trades or transfers goods and money abroad. The volatility has also driven rumors that the government could impose capital controls to calm things down, which it denies.

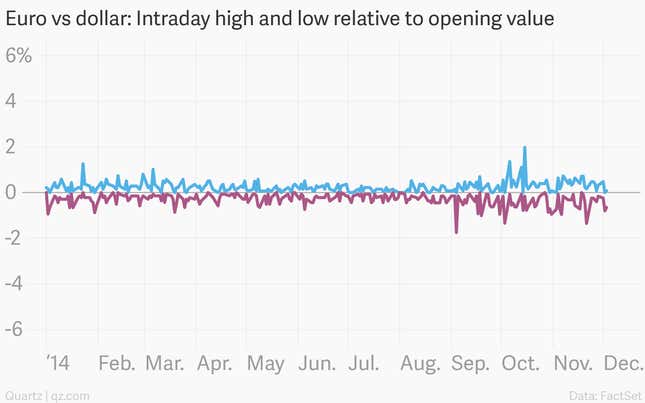

For some perspective on how haywire the trading in the ruble has become, take a look at the same chart, on the same scale, for the world’s busiest currency pair, the euro-dollar. Although the euro has lost around 10% of its value against the dollar so far this year, the slide has been quite orderly by comparison:

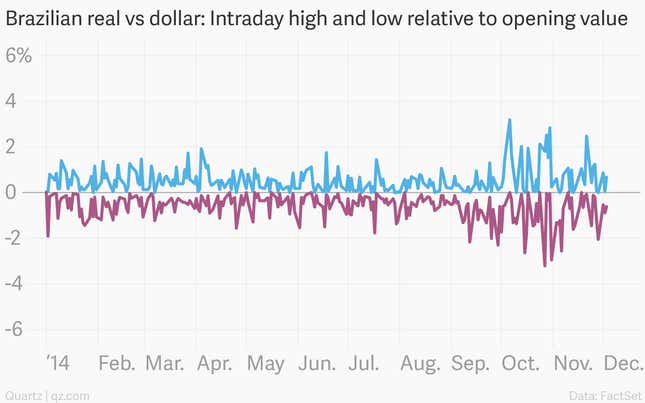

Now, it isn’t exactly fair to compare ruble trading with the world’s deepest and most liquid currency pair. So here’s the chart for the Brazilian real, a fellow petroleum-producing BRIC member with a floating currency. Although things have gotten a bit noisier for the real since oil prices started to tumble in recent months, the ruble remains in league of its own when it comes to currency volatility among major countries: