A lot of money went the wrong way on Wall Street this year, and none of it was managed by the Quartz staff. Still, we used our 20/20 hindsight to gather up six of the worst investing ideas of the year. We hope none of them have punished your portfolio too much.

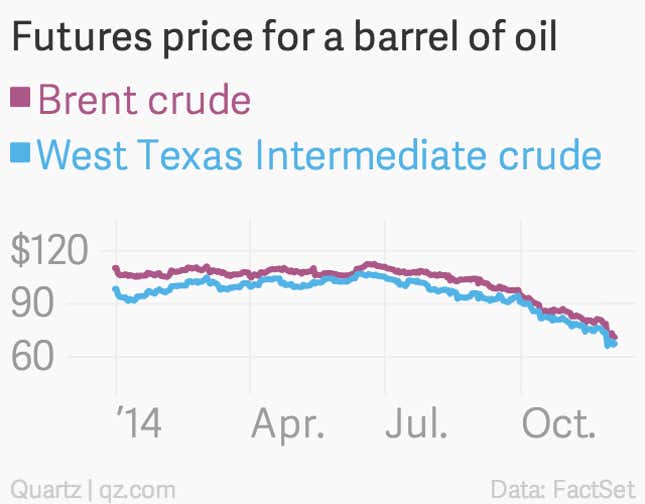

1. Oil

Analysts had expected oil prices to come down this year, but they didn’t think it would be this bad. The two main benchmarks, West Texas Intermediate and Brent crude, are down more than a third this year, hitting five-year lows.

But why is that? Lots of reasons: More US oil output, the lack of an OPEC production reduction, Middle Eastern price wars, a weakening global economy or a strong US dollar.

No matter what you’re blaming it on, oil fell big time, and Saudi Arabia says it might go even lower.

2. The Russian ruble

Russia’s currency started out the year with a brand-new symbol, and things went downhill from there.

The former Soviet seat went to repossess parts of Ukraine, which unleashed a wave of sanctions that isolated its economy. Falling energy prices added to the pile-on. After throwing a pile of foreign reserves at runaway inflation, the Bank of Russia has pretty much given up on shoring up the currency. The country’s government is now warning of an impending recession.

3. Betting against Bill Ackman

One of 2013’s hottest trades was betting against hedge fund investor Bill Ackman’s Herbalife short. Ackman had publicly decried the company as a pyramid scheme and said its stock would go to zero. But Ackman took his licks as the shares rose through 2013. (If you short a stock, you’re betting it will fall. You lose money when the shares rise.)

But 2014 was a different story. Herbalife struggled overseas, its customers dislike its new website and the company just paid a $15 million settlement for a class-action lawsuit that accused it … of being a pyramid scheme.

Herbalife’s shares have fallen by roughly half this year. One of Ackman’s biggest nemeses in his anti-Herbalife crusade, George Soros, just cut a big chunk of his holdings for a loss. And Ackman is having a terrific year, with his firm’s publicly traded fund up more than 40% in 2014.

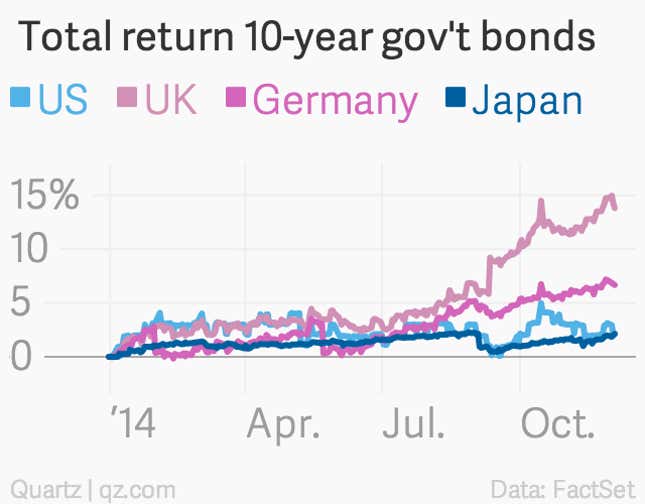

4. The Treasury Sell-Off that Never Came

The Federal Reserve’s bond-buying program ended amid healthy-ish US economic growth, so Treasury yields were supposed to rise, right? Nope.

Just as the Fed was turning off the spigot, the rest of the world opened theirs wider—save the Bank of England, which is in the same boat as the US—and yields tumbled as investors snapped up government debt. The Bank of Japan doubled down on its own easing program as it entered a recession, and the European Central Bank is struggling to get its own bond-buying program off the ground (paywall) to stave off possible deflation. And the expectations for US rate hikes that are supposed to be coming in the middle of next year? The market is keeping them in place for now, though there’s increasing pessimism that the US will be able to entirely withstand a global decline in growth and prices, which could prompt the Fed to push its first rate hike further into the future.

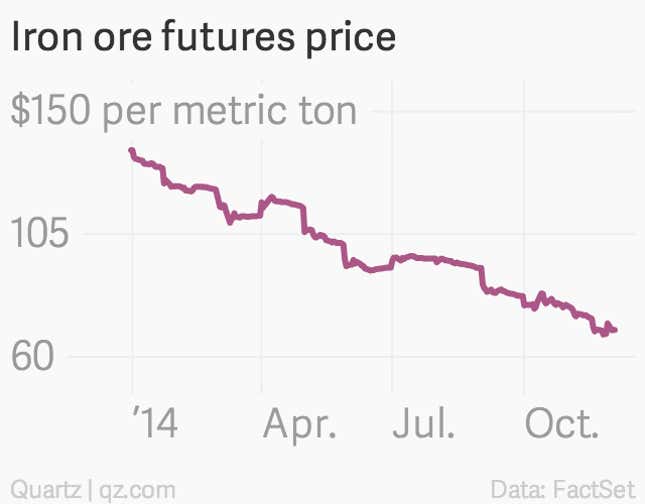

5. Ore-nery Iron

China uses almost as much steel than the rest of the world combined. And what do you need to make steel? Iron! So China’s ongoing slowdown is having a big effect on iron ore prices — steel demand there dropped there for the first time this century in September.

But economic growth isn’t the only Chinese story pushing iron prices 50% lower: Officials are trying to tamp down the country’s booming shadow banking sector, and one way of doing that is by making it harder (paywall) to use iron as loan collateral.

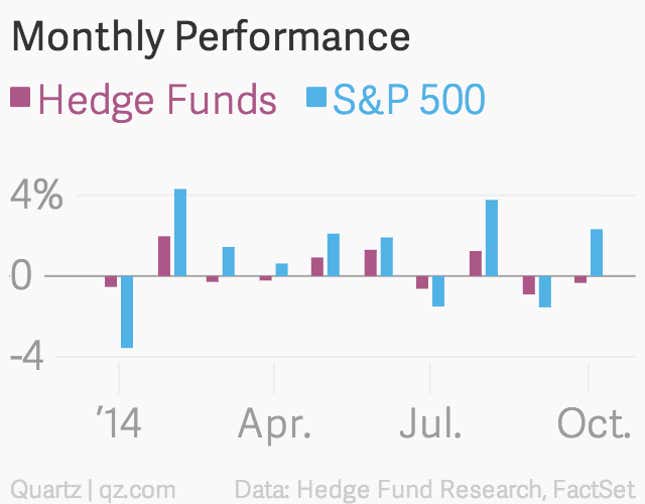

6. The hedge fund industry

Hedge funds—the exclusive and expensive investment funds catering to wealthy clients—have long been for suckers. And 2014 was no exception. According data from Hedge Fund Research, a firm does just what it’s name suggests, the industry as a whole had posted just a quarter of the S&P 500’s 10% return through October.

In fact, the HFR data shows that hedge funds haven’t beat the stock market since the end of the financial crisis. Of course, not all hedge funds and hedge fund strategies have been duds (see no. 3), just most of them. Even though giant public pension CalPERS ditched hedge funds earlier this year and the funds themselves are closing at a pace unseen since the crisis, investors aren’t convinced. HFR reports that investors poured $72 billion into the industry through the end of the third quarter, more than in all of 2013.