Fitbit, which makes fitness tracking hardware and software, is going public with strong sales and growth. Last year, the company sold 11 million of its activity sensor gadgets, more than double its 2013 total. Revenue and profits are looking good, too.

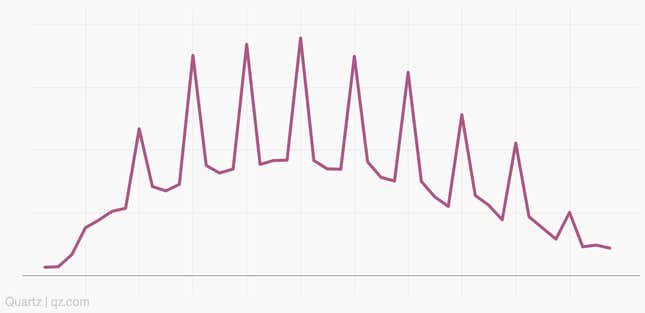

But what does the future look like? Here’s one idea:

That is, of course, the long-term sales chart for Apple’s iPod—a business that shares some key similarities with Fitbit and other single-purpose devices such as the original Amazon Kindle: Its hardware is affordable, works reasonably well, and dominates its specific market. In a filing citing the NPD Group, Fitbit boasts of a 68% share of the US fitness activity tracker market, by dollars.

But here’s the trouble. It looks like fitness tracking is on its way to becoming a feature—an app, or perhaps a few apps—on broader multitasking devices, much as “iPod” and “Kindle” became iPhone and Android apps. These gadgets include general-purpose wearable computers like the just-launched Apple Watch—which could potentially outsell the Fitbit in its first year on the market—and even smartphones.

If you study the iPod’s long-term sales curve, it wasn’t immediately superseded by the iPhone: Shipments continued to grow for a couple of years after the iPhone launch in 2007, especially during the holiday quarter. (Inexpensive Fitbits, too, will likely be popular Christmas presents for years to come.) But it wasn’t long before the iPod began its permanent decline. (Amazon doesn’t report Kindle shipments.)

One key question, then, is whether Fitbit can build enough of a following and platform—software, services, and hardware—to continue growing if its users replace their current Fitbit wearables with Apple Watches and similar devices. Apple, of course, followed up with the iPhone, and Amazon with its series of Kindle apps and more elaborate Kindle Fire tablets. But they were also much larger companies with more diversified businesses.

Fitbit, to its credit, acknowledges this risk prominently and extensively in its IPO prospectus, noting an “evolving and competitive” market:

The connected health and fitness devices market has a multitude of participants, including specialized consumer electronics companies, such as Garmin, Jawbone, and Misfit, and traditional health and fitness companies, such as adidas and Under Armour.

In addition, many large, broad-based consumer electronics companies either compete in our market or adjacent markets or have announced plans to do so, including Apple, Google, LG, Microsoft, and Samsung. For example, Apple has recently introduced the Apple Watch smartwatch, with broad-based functionalities, including some health and fitness tracking capabilities.

We also compete with a wide range of stand-alone health and fitness-related mobile apps that can be purchased or downloaded through mobile app stores.

We believe many of our competitors and potential competitors have significant competitive advantages, including longer operating histories, ability to leverage their sales efforts and marketing expenditures across a broader portfolio of products and services, larger and broader customer bases, more established relationships with a larger number of suppliers, contract manufacturers, and channel partners, greater brand recognition, ability to leverage app stores which they may operate, and greater financial, research and development, marketing, distribution, and other resources than we do.