Seriously, where else are you going to find good news from a major economy? China and its 7%—wink, wink, nudge, nudge, say no more—growth rate? Its spineless stock market? Or Europe, which just went through one of its periodic crises flare-ups that threaten the foundations of its post-war economic order? How about Latin America, where Brazil is increasingly looking like a basket case? (Though it’s an all-star in comparison to the monetary disasters of Venezuela and Argentina.) Japan? It’s improving thanks to life-support from its central bank, but it’s still very much a work in progress.

No, if you’re searching for a clear growth trend, you’re going to end up in the US right now. And if you’re looking at the US, you’re looking at housing, a long-time driver of consumption trends in an economy where consumption amounts to roughly two-thirds of GDP.

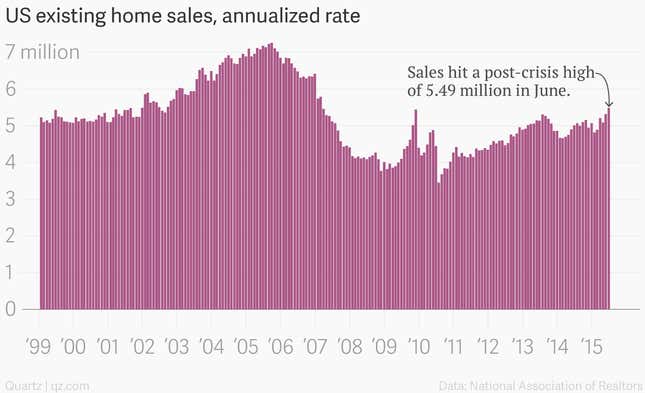

Just released data show that the annualized sales rate of previously owned homes hit a post-crisis peak of 5.49 million in June. Sales prices hit an all-time nominal high, as bidding wars break out over tight inventory.

Now some of you might remember that the US housing market was also the epicenter of a bit of unpleasantness a few years back. And it’s true, lax lending conditions coupled with a downturn in housing prices set off a global financial crisis and the deepest recession seen in the US since the Great Depression.

But that was then! This is now. Subprime lending—as it existed during the most recent housing boom years—remains pretty much dead. (Although it’s thriving in the US automotive lending market.) US household balance sheets have largely healed. Wages show tentative signs of picking up. Mortgage rates are low, as are oil prices, which should help keep gas prices down.

And indications are that the US housing rebound might have a bit further to run. Wood and lumber employment is picking up.

That could spread to the construction industry more broadly as leading indicators of building are also surging to post-crisis highs.

In short, US housing is back. And don’t bet against it, unless you’re looking to get run over.