Growth is picking up in Japan. No, really.

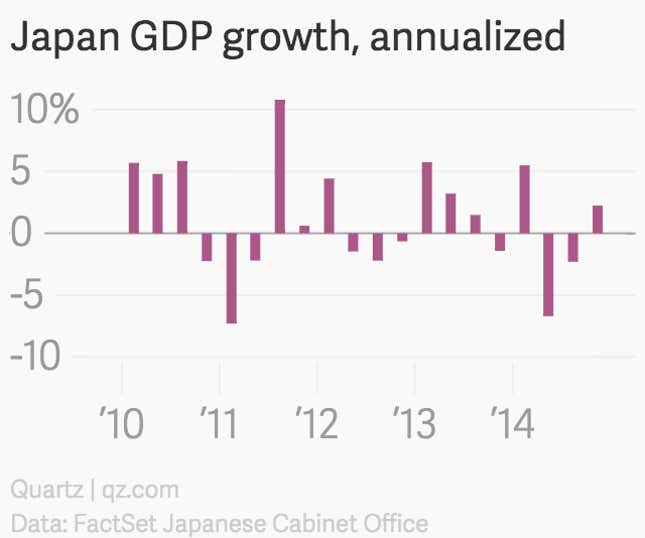

The GDP numbers out yesterday showed the world’s third-largest economy emerging from a brief recession—if you use the conventional definition of two straight quarters of contracting GDP.

True, that was a bit less than the 3.7% analysts had forecasted. But it’s a welcome development, especially given that export growth was a key driver of the quarter. The weak yen engineered by the Bank of Japan seems to be giving a fillip to Japan’s important exporting sector.

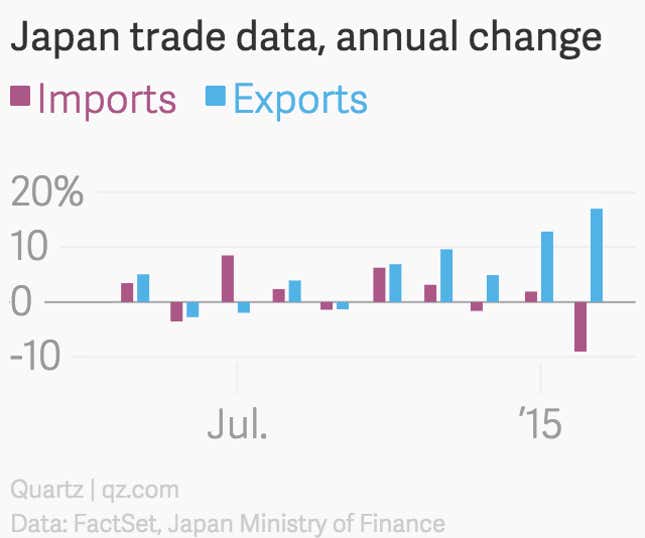

And the export boomlet seems set to continue. January trade data released today showed exports surging 17%, and imports collapsing by 9%, thanks to falling global energy prices.

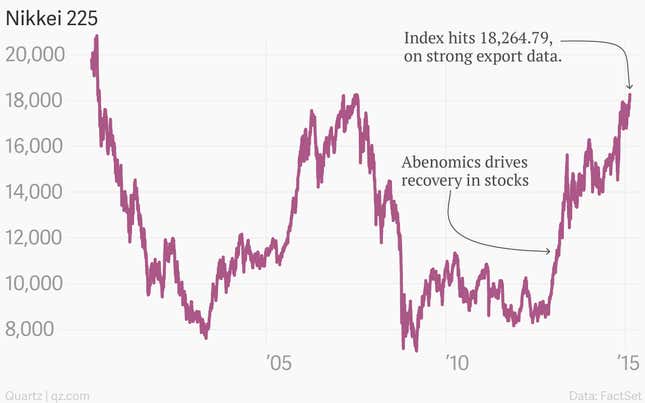

Optimism seems to be spreading, with the Nikkei 225 hitting a 15-year high Thursday.

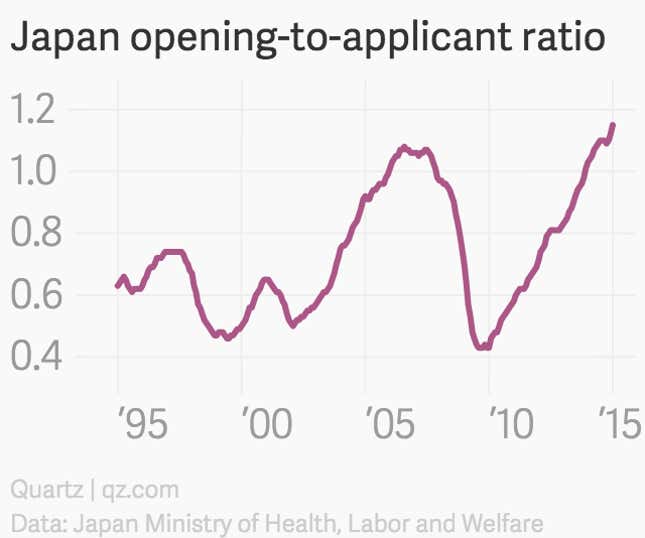

The key question for the future of Japanese growth is how consumer demand responds. Consumption accounts for roughly 60% of the Japanese economy, and the key ingredient for consumption is wage growth. For the moment, Japanese consumers—like consumers worldwide—are getting a real wage raise thanks to declining energy prices. But to create sustainable consumer growth, corporations have to be convinced to give workers a larger cut of profits.

It just might be possible. The largest employer in the US, Wal-Mart, signaled today that it was going to begin raising wages for its workforce, in a nod to both rising political pressure and tightening labor markets. Similar dynamics are in place in Japan. Prime minister Shinzo Abe has stepped up calls for wage increases. And labor conditions—best measured in a rapidly aging Japan via the job openings-to-applicants ratio—are at their tightest in more than two decades.