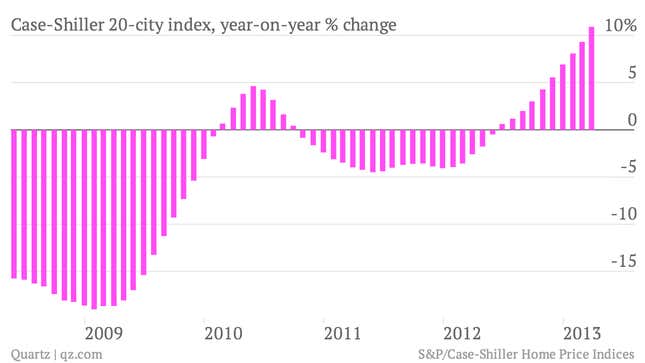

Whoa. One of the most-closely followed gauges of home price appreciation in the US, the S&P/Case-Shiller 20-city index, jumped 10.9% in March, the biggest change in seven years.

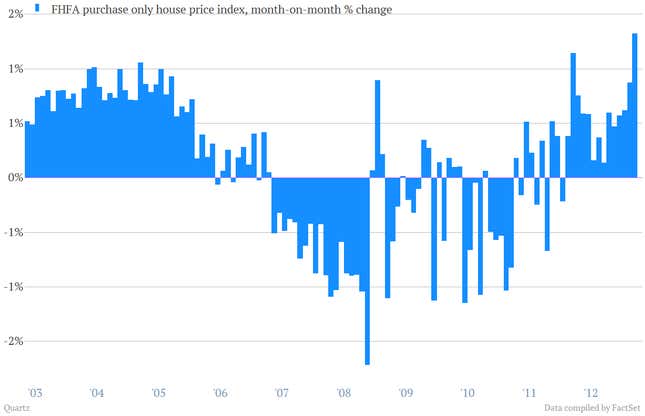

The gains in some major markets were substantial. Phoenix rose 22.5% year-on-year. Las Vegas increased 20.6%. San Francisco was up 22.2%. (New York, at 2.6%, rose the least, but it also declined a lot less during the worst years.) And don’t forget, we’ve seen similar dynamics in other gauges of home prices recently. Just last week the FHFA house price index posted its biggest-ever month-on-month increase.

For students of recent financial history, it may be somewhat disconcerting to see housing prices storming higher again. You’re already starting hearing people talk about a new US housing bubble.

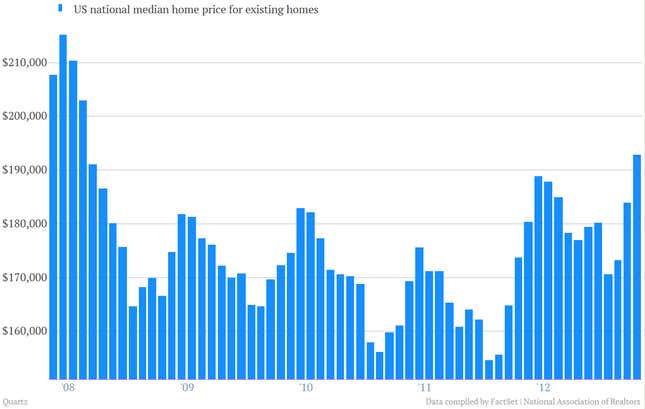

But for a bit of context, it’s worth noting that housing prices remain far away from their recent peaks. In April the national median home price for an existing home was $192,800, still down 16% from the July 2007 peak. This doesn’t, of course, definitively rule out an impending bubble, but does suggest it’s a little early to be calling one.