Time for a reality check.

If Ben Bernanke is talking openly about starting to ease off the economic gas pedal that is quantitative easing, it’s only because the US economy is mucho robusto.

And the economic data out this morning would seem to confirm that.

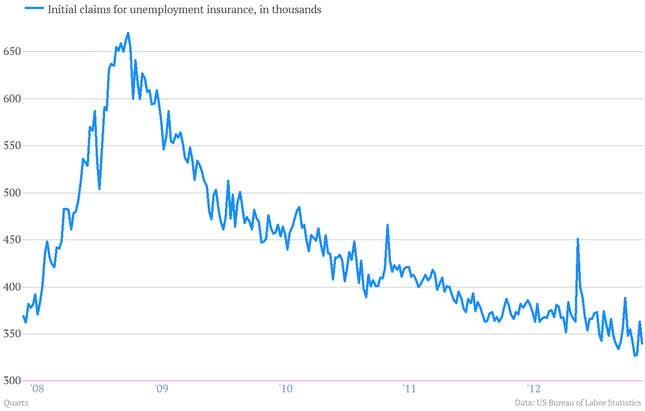

Jobless claims are falling

- Weekly claims for initial unemployment benefits, one of the best high-frequency measures of the US labor market, fell back below 350,000. That suggests the economy is still creating jobs at a healthy clip.

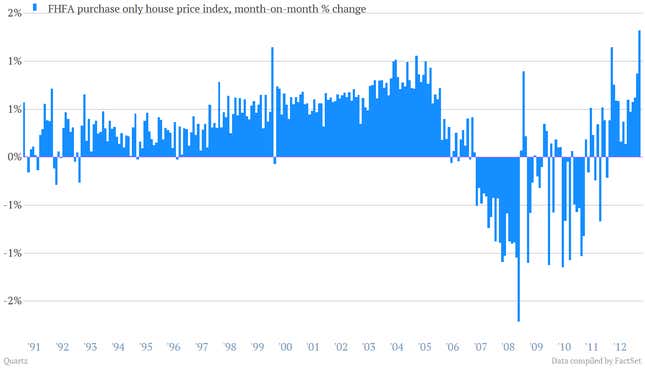

Housing is healing

- House prices are officially surging on tight supply and growing demand. One of the best measures of housing prices, the FHFA Housing Price Index, which is calculated using repeated mortgage transactions on houses with mortgages that end up in mortgage backed securities insured by government entities like Freddie Mac and Fannie Mae. (More here.) For the renters out there, it likely hurts to see housing prices again moving higher. But housing affordability still remains quite good. (If you can get a bank to give you a loan.) And rising home prices have a range of knock-on effects that are good for the economy. Check out Home Depot’s recent earnings report, for example. The FHFA posted a 1.3% jump in March—the largest month-on-month movement on record.

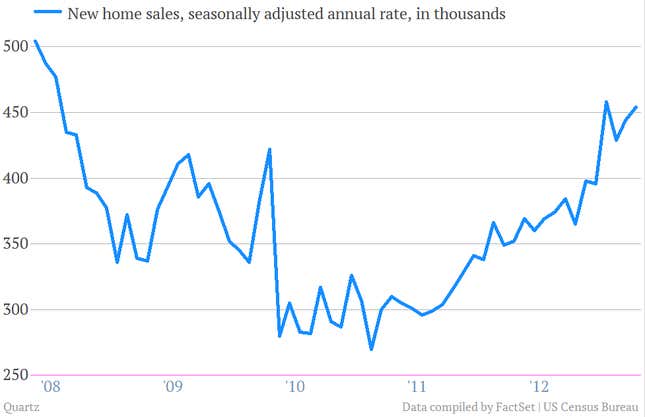

- While the FHFA index measures repeated home sale prices, overall sales of new homes are also looking pretty strong too. April numbers arrived at a better-than-expected 454,000. Also, March and February numbers were revised higher too. Sure we’re nowhere near where new home sales were before the recession. But improvement is improvement. And again, demand for houses is buoying firms, like homebuilding company Toll Brothers.

So yes, while it may take the markets a little while to get comfortable with the idea that Bernanke & Co. won’t support stocks forever, it’s worth keeping in mind that a less supportive Fed is actually a good thing, economically speaking.